Private credit has experienced a post-recession boom, but with rates rising steadily and default risk possibly increasing as well, some view the asset class with caution. We think differently about private credit. We believe that the “big tent” of private credit has something to offer investors at nearly all phases of the credit cycle.

Since the credit crisis in 2008-2009, the private credit space has experienced robust growth. Dry powder for private debt funds (i.e., cash raised by funds but not yet invested) has grown from about $70 billion in 2006 to a record $235 billion earlier this year, according to Preqin.

The post-crisis era has been somewhat of a perfect storm for private credit. Low interest rates made the premium yields of many private credit investments relatively attractive. And when banks broadly scaled back lending activity in the wake of Dodd-Frank and Basel III lending restrictions, private credit stepped in to fill the void.

But time marches on, and in late 2018, some see today’s environment as more challenging for private credit. Rates are rising steadily, and as the economic recovery ages, default risk becomes more of a concern. Does the asset class still make sense in this environment?

We believe the answer is yes. In fact, we think private credit can play a permanent and effective role in many portfolios, and we prefer not to view it as a temporary opportunity to be embraced and shunned alternately based on market conditions. The market today offers investors a wide range of private credit options, and we believe that a “portfolio approach” to investing in private credit—in other words, building a diverse portfolio for all phases of the credit cycle—is a better way to balance risk and opportunity than trying to time the market.

Today’s Private Credit Market

The Alternative Credit Council pegged the private credit space at nearly $1 trillion in value in October 2017. It is a vast opportunity set with many different kinds of investments; we break down this universe into three main categories: Core / “Core-Plus” Credit, Specialty Finance, and Distressed Credit.

Core / “Core-Plus” Credit: This category includes corporate loans, often secured by the company’s assets and cash flows; as one might infer from the name, these loans tend to be on the lower end of the risk spectrum for the asset class. In most cases, the focus of lenders/managers is on preserving capital and earning the majority of return from current income. Use of leverage in these funds is typically modest, and the overall return profile involves few losses and even fewer unexpected gains.

Core credit opportunities primarily consist of corporate loans to middle-market companies. Senior corporate direct loans are the bread and butter of core credit, generally offering attractive current income and low losses and volatility. “Unitranche” debt is slightly higher on the risk/reward spectrum—this is a hybrid loan structure that combines senior and subordinated debt into a single secured debt instrument. These credit opportunities often can perform well throughout the credit cycle.

All-Weather Performance

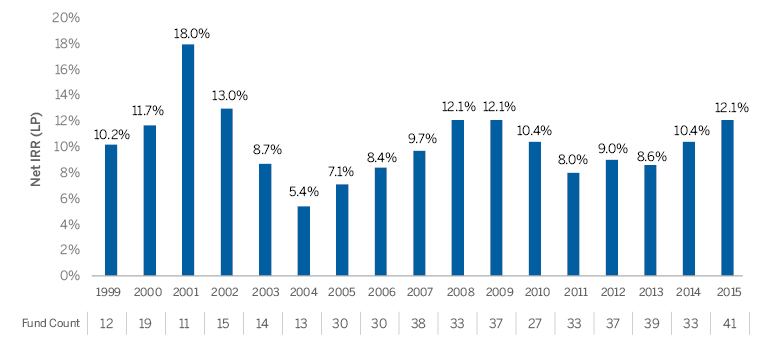

Private credit investments are not immune to the credit cycle or interest-rate risk, but the asset class has nonetheless generated consistently attractive returns for the past several decades. The chart below shows that the internal rate of return (IRR) of the private credit universe across various vintage years has ranged between 7% and 13% since 1999, with a few exceptions marginally above or below that range. (Note that this data includes distressed debt funds, a higher-risk private credit subclass; when excluding those funds from the analysis, results over time are even more consistent.)

Median Net IRR to Limited Partners (LP), Private Credit Fund Universe*

1999–2015 Vintage Years

Source: Thomson Reuters Datastream.

*Fund universe consists of 580 funds in the Cambridge Associates private debt investment universe, comprising all senior direct lending, subordinated debt, credit opportunities and illiquid distressed debt funds of vintage year 1986 or later. Number of funds from each vintage year is displayed in the chart.

"Core-plus” credit offers investors higher potential return through greater leverage (such as structured CLO instruments) or subordination risk (such as mezzanine debt). Think of “core-plus” as a middle ground in private credit—these investments carry greater risk and greater potential return than core senior loans, but less risk/reward than, say, distressed credit opportunities. “Core-plus” often performs best early in the cycle, when the economy is expanding but lending conditions are still fairly constrained.

Distressed Credit: On the other end of the risk spectrum lies distressed credit opportunities. Lending to distressed firms and investing in non-performing loan portfolios is quite risky. Many distressed investors are called “pull to par” investors because they rely on uncertain catalysts like possible refinancing or a change in business prospects, hoping that these events will improve or “pull” asset prices closer to par value. But with good managers and the right deal terms, this category offers investors high potential returns (primarily in the form of capital appreciation).

Specific distressed opportunities include “distressed-for-control” investments (e.g., convertible debt, convertible preferred, debt with warrants, etc.) that are structured with the intent of gaining control of a company on favorable terms, non-performing loan (NPL) portfolios (either in default or close to it) that can be purchased at deep discounts, and rescue financing or other special situations. Distressed debt often performs best when initiated after the credit cycle “breaks” and the economy is contracting; some level of widespread financial distress is needed to expand the distressed credit opportunity set.

Specialty Finance: This is a broad category that includes a variety of niche assets—consumer loan portfolios, loans to VC-backed companies, asset-backed instruments backed by varied assets (such as aircraft, ships, railcars or royalty streams), contingent litigation financing, and many others. As that description suggests, specialty finance managers usually target a small industry and apply their particular expertise to identify and close attractive deals. These funds tend to offer a blend of income and potential capital appreciation, and returns tend to have low correlation to traditional asset classes. As such, specialty finance on the whole has the potential to perform during all phases of the credit cycle.

The specialty finance arena is currently experiencing notable growth and innovation. One reason is that the direct private lending space is getting more crowded, and many firms are seeking opportunity elsewhere. (For example, in October, The Carlyle Group announced its purchase of Apollo Aviation Group, an aviation leasing fund manager of about $5.6 billion of capital. The acquisition seems very much in step with some of the broader thinking in the private credit space.)

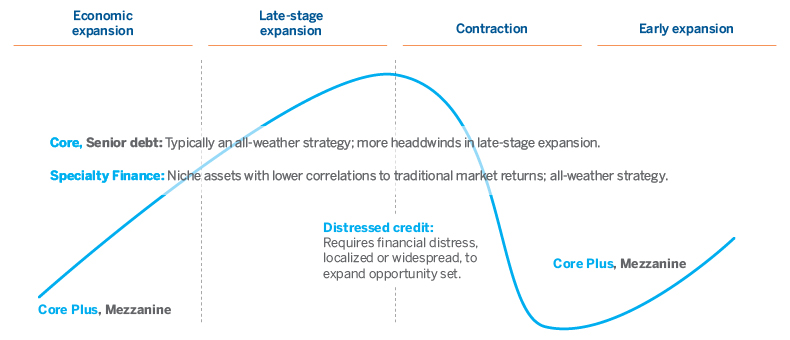

Universal Credit Application

Private credit includes a fairly broad universe of investments, from core direct corporate lending and distressed debt investments to asset-backed and other specialty finance opportunities. Each type of investment has the potential to outperform during different phases of the credit cycle.

Source: Brown Advisory analysis.

An “All-Weather” Approach to Private Credit

Private credit encompasses many different investment categories, each of which tends to shine at different points in the credit cycle. Mezzanine debt and other “core-plus” lending funds often do well during expansionary periods, while distressed debt investors can often get the most favorable terms during contractions and recessions when borrowers are starved for capital and lending activity is broadly depressed.

So, while it is true that rates are rising and credit markets are in danger of being squeezed, we don’t think it makes sense to respond by simply avoiding private credit altogether. Rather, we believe in a portfolio approach to private investing: We seek to invest consistently in each vintage year, across a diverse set of core, distressed and specialty funds. In so doing, we hope to build a robust portfolio that offers a favorable balance of risk and reward under a wide range of market scenarios. This diversification helps us counter the concentration and cycle risks that many perceive to be endemic to private credit.

Perhaps most importantly, this is a humble approach—we accept and embrace the fact that we can’t predict the short-term turns and shifts in the credit cycle. With that as a given, we believe our best option is almost always to invest with discipline, moderation and diversification in a private credit space that has consistently offered investors attractive returns and income over time.

For qualified purchasers and accredited investors.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or asset classes mentioned. It should not be assumed that investments in such securities or asset classes have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

© 2017 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. Thomson Reuters and the Kinesis logo are trademarks of Thomson Reuters and its affiliated companies.