There’s no guarantee that a given ETF will rise in value, as any number of market factors could lead to a decline. But whatever the market environment, it is crucial that the ETF is performing its role correctly. Investors should look at the key risk metrics for a given fund to see whether the ETF is truly “doing its job.” That can help determine whether it’s a hold, or if it’s time to sell and move on to a product more likely to meet their objective.

Beta

Beta is a measure of an ETF’s volatility relative to the market. By definition, the overall market’s Beta is 1.00. An ETF with a Beta greater than 1.00 has exhibited more volatility than the market over a specified period of time. In contrast, an ETF with a Beta less than 1.00 has been less volatile than the overall market.

Beta is also a function of correlation: An ETF with a positive Beta (greater than 0) is positively correlated with the overall market, whereas an ETF with a negative Beta (less than 0) is inversely correlated to the overall market. Most passive ETFs will have a positive Beta, while most active ETFs will have a negative Beta. Sectors that tend to exhibit high levels of volatility will have a positive Beta greater than 1, and more defensive sector ETFs will have a Beta that is positive but less than 1.

Examples of passive ETFs that may, depending on the market environment, have a negative Beta, include inverse ETFs (exchange traded funds that use derivatives to achieve the opposite returns of a specified benchmark), and government bond ETFs.

Standard Deviation

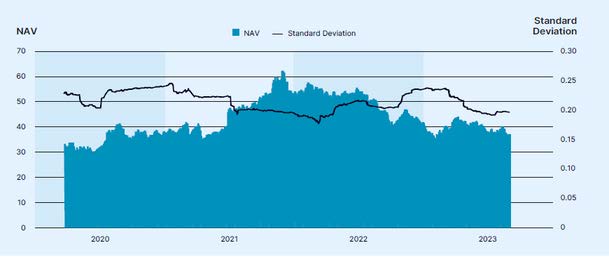

Standard Deviation compares the long-term average return of an investment to the shorter-term returns it achieved along the way. It’s common to look at the historical average returns of an investment when deciding if it’s a good opportunity. But average returns don’t tell the whole story. Suppose two ETFs both average a 7% return over the past 10 years. But when looking at individual years, one returned 7% every year while the other had some years with double-digit performance, and others with low single digit returns. Clearly, the ETF that rose 7% each year displayed lower volatility than its counterpart— and likely took less risk to achieve the same long-term return.

It’s crucial to note that Standard Deviation includes both upside and downside volatility. So, a high number could indicate increasing returns, decreasing returns, or a combination of both.

This graph is for illustrative purposes only and does not represent any specific investment

Alpha

A measure of how an ETF performs relative to a particular index or benchmark over a specified period of time, after adjusting for volatility. Alpha offers a window into the ‘active’ performance of an ETF, allowing investors to see whether a fund is outperforming or underperforming a passive benchmark. This measure is expressed as a percentage. For instance, an ETF with an Alpha of 3% will have exceeded its benchmark by this amount, after taking into account the volatility of the fund’s portfolio.

Sharpe Ratio

The Sharpe Ratio is a measure of an ETF’s excess returns relative to its volatility. The Sharpe Ratio indicates how much excess return is generated per unit of risk taken, and a higher number implies that an investor is being compensated for taking on extra risk with relatively outsized returns. The Sharpe Ratio gives investors a sense of whether an active ETF fund is taking a substantial amount of risk in order to generate outperformance. Ideally, an ETF is delivering above-average returns with low volatility. The Sharpe Ratio is also expressed numerically (the higher the better), with anything above 1 considered to be good.