Annual Report

We usually think of mountains as the Earth’s surface rising abruptly toward the sky, but with a broader perspective, we find their likeness in the challenges that we face as investors and advisors for our clients, as teammates of our colleagues and as citizens in our communities. No matter the shape of the mountain, our climb is fueled by deep curiosity, incisive questions and critical listening. At the other end of any challenge is the opportunity to turn our energy into solutions for our clients, to deepen relationships with each other and to strengthen the communities in which we work and live.

In this annual report, we ascend these mountains in partnership with each of our stakeholders. In Mission, you will read about our relationship with clients and the outcomes that we are helping them create. Performance describes our investment activity. Impact focuses on our communities and the value that we strive to create beyond our revenue-generating business. DNA is about what connects us as colleagues and who we aspire to be. Together, this annual report attempts to highlight the people, places and things that motivate our purpose:

To raise the future.

We are privileged to serve an inspiring group of individuals, families, nonprofits, charities, institutions and financial intermediaries around the world. For each, we work to deliver first-rate investment performance, thoughtful strategic advice and the highest level of service in order to help them get to wherever it is they want to go.

For private clients—individuals and families with all different types of financial complexity—we assemble a team of portfolio managers, strategic advisors and client service professionals to build relationships around clients’ long-term goals. Everything we do stems from listening closely to the values, aspirations, interests and family circumstances of our clients so that we can best invest and plan for their collective futures.

For family offices, we draw on our experience working with multigenerational families to design creative strategies that can range from a specific area of investment expertise to comprehensive financial oversight. Whether families need help streamlining their financial lives for peace of mind or have a professional family office already in place, we know that a customized approach is the only way to help them reach their goals.

For foundations, charities and other nonprofits, we provide investment solutions, strategic advice, policy consultation and guidance on mission-aligned investing in order to help them fulfill their organizational missions. Whether they are seeking a specific investment solution or a fully outsourced chief investment officer (OCIO), our teams partner with organizations’ management and investment committees to execute their investment objectives, navigate their fiduciary challenges and consult with their many stakeholders.

For institutions, banks and advisors who are investing for others, we offer a broad range of global, international and U.S.-focused equity and fixed income investment solutions rooted in our bottom-up, fundamental research process. We manage concentrated portfolios focused on long-term compounding and preservation of capital to provide other professional investors with compelling and reliable investment results.

We are pleased to share a few examples of the clients with whom we work and how together, we are striving to raise the future.

Body

Dear Clients, Shareholders, Colleagues and Friends,

It has been a long two years since we shared our last report on Brown Advisory. At any moment, if I were to have sat down to write this letter, my mind would likely have been focused on events that none of us would have projected back in 2019, from the COVID-19 pandemic and the shutting down of life as we knew it to the Russian invasion of Ukraine. If we had shared the concerns on our minds at the beginning of 2020, none of these would have ranked very highly, if at all.

We now live in a world, however, where we know that the unthinkable can and may occur. Yet, we have found the capacity to adapt and learn how to move on. Always in our minds will be the countless lives lost or forever changed. At the same time, we appreciate the incredible science behind the vaccines and care of COVID-19 patients. These have given us a sense of relief and hope. We are also inspired by the courage, determination and ability of the Ukrainian people and are actively looking for ways to help them.

These forces have required us to think through the consequences of investing in an environment where lockdowns, quarantines, travel restrictions and government support have taken traditional pressure points in an economy to levels we have never experienced. The combination of deficit spending, expansion of central bank balance sheets, supply chain disruptions, sustained low or zero interest rates, increased savings rates, low unemployment, energy volatility and inflationary pressures have produced challenges and opportunities many businesses and management teams have never before experienced. Global conflict, millions of new refugees, sanctions and the ever-present threat of nuclear war have accelerated a reversal of globalism.

As an employer, we have also had to wrestle with a changing level of trust in institutions and the fear that still unfortunately exists in Black, Asian, Latinx, LGBTQ+ and other marginalized communities. We have had to think creatively and carefully about how to build a working environment that allows us to stay connected without posing undue health risks. And, in a business that depends on human capital, we have had to think in new ways about how best to retain and recruit the talent we need to succeed for clients.

Throughout it all, most of us at Brown Advisory have been far more fortunate and insulated from these pressures than many people around the world. This is both an acknowledgment and responsibility that we feel very deeply across the firm. We believe that Brown Advisory has performed well, and we recognize how lucky we are to be in such a position.

We ended 2021 at a level of client assets—nearly $148 billion— that is truly humbling. We are privileged to work with people and organizations located in over 40 countries around the world. Most importantly to us, our clients continue to deepen and expand our partnership with them—our trailing 10-year client retention across the entire business is 98.2%. At the top line, this translated into a run-rate revenue of $578 million. As a private company, we are able to reinvest a significant portion of that amount in strategic initiatives for the future. If you would like more information on our financial results or position, please reach out to me at any time.

The reasons behind these results are clear to us. It starts and ends with our focus on putting clients first, always. I feel confident in saying that we will never, ever hedge on that commitment. “Client first” is our focus on generating first-rate investment performance— the ultimate results we produce for clients will determine our credibility. “Client first” is our focus to provide thoughtful, creative and strategic advice beyond traditional tax, trust and estate matters. “Client first” is our focus to deliver the highest levels of client service—the recognition of several of our client service advisors as Partners during our most recent promotion cycle underlines our commitment to our pillar of service. Finally, “Client first” is our focus on remaining a private, independent and largely colleague-owned firm. Our ownership structure enables everything mentioned above—there is no better model to allow a firm like ours to truly be client first.

However, there is nothing genuinely unique about our focus—these things aren’t “moats” by any means, and there is certainly nothing stopping any other firm from operating under similar principles and competing for our clients. So, what is it that we are doing that has built deep trust with clients and propelled so many others to join us along the way? A year ago, a good friend challenged me with this idea by asking what I thought our business flywheel was—in the Jim Collins sense. Collins describes the flywheel effect in his book Good to Great to reflect how the process of business transformation “resembles relentlessly pushing a giant, heavy flywheel, turn upon turn, building momentum until a point of breakthrough, and beyond.” And as I tried to collate the work of our more than 800 colleagues in an effort to answer this seemingly simple question, one thing stood above the rest. If you talk to people throughout our firm—across Partners, Principals and all colleagues—more often than not, you will hear them talking about their teammates.

The “team thing” is something that is on our minds every day. There are lots of reasons for it, but it starts with the fact that we care deeply about each other. We look out for each other. We have fun with each other. We all share a keen focus on our clients, staying private and doing whatever we have to do to meet our performance, advice and service responsibilities to our clients. The team thing is why we pushed so hard to get back into the office during the pandemic, standing up a lot of new processes and procedures so that we could be together in a safe way. The connectedness, as we like to call it, that we are able to achieve when we are side by side allows us to solve problems for clients in ways that just are not possible in a remote setting. Together, a connected team is the flywheel that makes Brown Advisory such an exciting place to work.

Our belief in the power of the team is also evidenced by our ability to recruit new colleagues. Since the start of 2020, we have hired 337 new colleagues in markets across the United States, U.K. and Europe. Our summer analyst program continues to attract high-level talent from top global colleges and universities. During the past two summers, we worked with 41 analysts across the firm, and we look forward to welcoming 29 new summer analysts for 2022. The resounding reason for folks joining the Brown Advisory team is an attraction to the client-, colleague- and community-focused culture.

Without a doubt, though, we have challenges to overcome if we are going to be the firm we want to be. Recently, we framed and organized our challenges in the form of five questions:

1. What are the threats to our team-based, client-first culture?

2. What are the threats to our ability to deliver excellent results for clients?

3. What are the threats to staying private and independent?

4. Do we have the advisors, leaders and managers to fight these threats?

5. Are we committed to innovate beyond the status quo, even if it’s still “working?”

Our financial performance, our continuing commitment to being a private company and our belief in the value of teams allow us to meet the questions and challenges before us, head on.

As we grow larger, however, we recognize that the number of threats we face and the number of people who ask us to address them are only going to increase, which makes the last question, rooted in our aspiration to be an innovation organization, absolutely critical to our future. As you will see and read in the pages to come, our team has been very active in reinvesting in the business to create new ways to help clients achieve their goals. This reinvestment of time, capital and resources for the future remains focused on four things: enhancing our investment capabilities, deepening and broadening our advisory expertise, enriching the client experience and protecting our clients and firm from unintended outcomes and cyber-based risks.

There are many exciting things to report from investment, expertise and client experience perspectives, some of which we started years ago and some brand-new.

Our now 12-year commitment to sustainable investing continues to be welcomed enthusiastically by investors and has resulted in significant inflows of new assets. Our Large-Cap Sustainable Growth (LCSG) team, led by Karina Funk and David Powell and supported by a deep and experienced team of analysts, managed $17.7 billion at the end of 2021. In February, the strategy was recognized by Bloomberg for its performance and size relative to its very few peers that have zero exposure to fossil fuels. In March, Karina was once again named to Barron’s list of the 100 Most Influential Women in U.S. Finance. The hallmark of LCSG’s investment approach is to identify companies with a “Sustainable Business “Advantage”—the factor by which we believe a company can drive attractive, long-term performance and risk protection through revenue growth, cost improvements and enhanced franchise value.

The performance success of our team has led the firm to make a much broader commitment under the umbrella of sustainable investing. We now have 11 institutionally distributed sustainable strategies, including the newly launched Global Sustainable Total Return Bond and Sustainable International Leaders strategies. The Global Sustainable Fixed Income strategy is led by Ryan Myerberg, Colby Stilson and Chris Diaz, who joined the firm in 2021 to help expand our sustainable fixed income efforts globally. Sustainable International Leaders is managed by Priyanka Agnihotri, who has been with the firm since 2015 and has made outstanding investment contributions working with Mick Dillon and Bertie Thomson on the global equity team.

In late 2021, we also made the decision to sign on to the Net Zero Asset Managers initiative (NZAMi). We know that it is up to clients to decide how their assets are used and counted, and whether they want certain issues to be taken into account in the management of their portfolios. Our responsibility is clear—to protect client interests, make decisions that we believe can enhance future returns and encourage the companies, bond issuers and managers with whom we invest to act in a way that has the potential to reduce risk and maximize opportunities. We view climate change entirely from this perspective, and we believe that NZAMi is aligned with this approach. As the world embraces sustainable and environmental, social and governance (ESG) investing more broadly, our experience has allowed Brown Advisory to take a leadership role globally.

As we did when we charted out a course with sustainable investing, we are thinking about where we need to invest today so that we can serve our clients well in the future. Over the past year-plus, we have been building teams around a number of exciting opportunities.

We now have a group focused exclusively on creating and delivering solutions for entrepreneurs, founders and those building game-changing businesses but whose investable liquidity might be years down the road. The value we can provide in these situations relies on a heavy dose of what we call strategic advice. In fact, we are concurrently and meaningfully expanding the capacity of our strategic advisory team so that we can more deeply advise in areas that are increasing in relevance to our clients, namely impact advisory, blockchain technology (think crypto, Web3 and NFTs) and banking/lending/financing.

We have (or soon will have) opened new offices in San Francisco, Frankfurt, Nashville and Southern California, and brand-new space in Austin, London and Washington, D.C. We have expanded our capacity to serve endowments and foundations in meaningful ways. We have built new relationships across Europe, Asia and Australia. We raised the 10th edition of our Private Equity Partners (PEP) program and launched a new direct investing platform called the Anchor Investor Network. The firm received ISO 27001 certification by an independent audit as a means to reflect the rigor of our information security management system. These are just a few examples of our engagement to improve our ability to invest for, advise and serve our clients—you will see plenty more examples of this focus throughout this report.

To close, I want to reflect on and thank our colleagues. I am so very proud of the leadership of the firm, at all levels and functions. We have a tremendous bench of people who have done an incredible job serving clients, helping each other and making decisions in a very difficult environment. Coping with the pandemic has been demanding and exhausting for many, and most acutely for our client service, human resources and technology teams. If we have learned anything since the onset of COVID-19, however, it is that Brown Advisory is stronger together and that we will do absolutely everything we can to ensure our colleagues can safely execute on our mission to put our clients first. We understand the toll that COVID-19 has had on the social-emotional well-being of our colleagues and their families—our path forward will continue to support the needs of each. Our COVID-19 “success” has been possible only because of our team’s collective adherence to the protocols that have been developed to keep all of us safe and healthy. If we find that today’s protocols are not meeting those standards, then we will do what we have done all along—we will pivot and modify as needed.

Our long-term commitment to invest in our colleagues is also evidenced in our belief in diversity, equity and inclusion. We believe that bringing diverse experiences, backgrounds and thinking is critical to serving our clients and making a material and positive difference in their lives. We also believe that it is the right thing to do. At its core, it is about each and every one of us considering what it feels like to be in someone else’s shoes and asking ourselves the questions: Are they comfortable working in the Brown Advisory environment? Are they treated fairly and with respect? How can I help?

In the pages that follow, we reflect on our mission, performance, impact and DNA through both an internal and external lens. Internally, you will read about the themes and people that provide our client-first foundation. Externally, you will find stories and profiles of several clients who we think are making a distinct and indelible impact on the world. We hope that, together, they provide a better understanding of our focus—past, present and future.

As always, I invite you to reach out to me or anyone on the team to provide your thoughts, questions or feedback at any time—we are always looking for ways to improve, and your input is a big part of doing just that. Thank you again for your support.

Sincerely,

Body

MISSION

At Brown Advisory, our mission is to make a positive and material difference in the lives of our clients. In everything we do, we are guided by asking: What do our clients need? How can we help them get there? These questions propel our aspiration to be team oriented, generational, holistic, sustainable, personal and connected.

Team Oriented

Perhaps no characteristic distinguishes Brown Advisory more than our team approach. We have a remarkable group of professionals who serve our clients—and by working as a team, we can bring to bear the power of our collective experience, insights and service. Our culture of teamwork is supported by our firm’s structure. As partners and collective owners of the firm, we are well-positioned and incentivized to challenge each other to achieve better outcomes for clients. It is also much easier to listen for the nuance of a certain client situation when you have eight ears tuned in rather than two. Collaboration, whether focused on investment research, tax planning or creating an impact in the community, allows us to ask the right questions, formulate thoughtful strategies and fine-tune solutions. It may not always be the easiest way to operate or the quickest approach to a result, but we know that teams deliver the best solutions and outcomes for our clients. We believe we can credit our unusually high client retention rate of 98% for the past 10 years to this approach.

Generational

When thinking, planning and investing for both our clients and our firm, we think in terms of generations and value the long term over the short. As a private and independent firm, we have a patient, supportive and aligned group of shareholders (most of whom are colleagues). They have enabled us to develop multigenerational relationships with clients, build institutional portfolios that beat their benchmarks over decades, and seed new, innovative strategies and services that likely won’t “reward” shareholders for many years.

Our clients rely on us to realize their investment objectives. We believe that achieving compelling investment results starts and ends with an ability to weather the tough times (which are always shorter than they feel) so that capital can compound. This philosophy applies whether we are investing on behalf of individuals, families, family offices, nonprofits and charities, pension plans, or financial institutions and is underpinned by rigorous research, repeatable processes, collaborative teamwork and high-conviction ideas.

When we oversee and manage a majority (if not the entirety) of an overall investment portfolio, we use our “three-bucket” framework to help protect a long-term focus. The first bucket, or operating account, provides liquidity and stability; the second bucket, or core portfolio, combines growth and stability assets designed to pursue long-term growth; and the third bucket, or opportunistic allocation, enables timely investments that capitalize on time-sensitive opportunities. Over the 10-plus years that we have used this three-bucket approach, we have found that it not only serves as a useful structure to survive down markets but also allows our clients to thrive in them—the confidence of adequate liquidity frees up capital to take advantage of opportunities in times of market dislocation.

When we manage individual portfolios for clients, we also take the long view, relying on concentration to drive the long-term orientation of the given strategy. Concentration forces, among other things, high conviction and a ruthless search for the best ideas. Coupling conviction with the possibility that selling a position from a concentrated portfolio can lead to adverse tax outcomes, our institutional portfolio managers and analysts have a fundamental incentive to invest in securities that they intend to hold for, at the very least, three to five years.

As an example of our long-term approach, the Global Leaders strategy, led by Mick Dillon and Bertie Thomson, has outperformed for clients by integrating fundamental and sustainable research to evaluate and invest in a portfolio of companies that they believe combine consistently high returns on invested capital while delivering exceptional customer outcomes. Mick and Bertie are true long-term investors, asking, “Will I care about this issue in three, four or five years’ time?”— so as not to get distracted by short-term market moves.

Holistic

We built our firm around the idea that an investment program is most helpful when integrated with broader strategic advice. In many ways, our strategic advisory team— which typically plays a central role in client relationships—epitomizes our long-term approach. Team members often have decades long relationships across generations, with the goal of helping clients make good decisions as they confront investment and financial challenges throughout their lives. The firm’s strategic advisors bring together experience across many fields, including law, taxation, investing, business, philanthropy and family dynamics, to act as a sounding board and thinking partner for clients.

Among the many types of clients who find strategic advisors’ specialized knowledge helpful are startup founders and leaders. Brown Advisory was founded to help entrepreneurs involved in newly public companies invest their capital. Today, we continue to work with entrepreneurs across the stages of their companies’ life cycles—helping them address all forms of capital (human, intellectual, social and financial), business succession, philanthropy, and generational, estate and tax planning. For example, we often help startup executives navigate the complexities around restricted stock units and taxation, such as understanding the nuances of qualified small business stock exclusions.

Sustainable

Sustainability means a lot of things to different people. For us, it is at the heart of our generational focus and our questions about goals, values and risk tolerance.

For some of our clients, particularly nonprofits, charities and families, we construct multiasset, mission-aligned portfolios that seek to deploy capital to achieve both financial objectives and positive impact in the world. Just as we do not build portfolios based on models, we do not make assumptions about what sustainability means to a client. Again, we start by listening and investigating which issues are most important before we begin to discuss how to express any idea through a client’s investment portfolio. For many of our family clients, discussions about sustainability serve as valuable tools to connect multiple generations, as we help them articulate the impact they want to create and then work with them to help realize their vision through investments and philanthropy.

For our nonprofit and charity clients, we often craft an investment portfolio that serves as an extension of their mission. We were particularly gratified that several of our new nonprofit and charity clients selected Brown Advisory to oversee their sizable endowments not only because of our investment capabilities but also because of our firm’s purpose-driven commitment. At year-end, we oversaw more than $12 billion of endowment and foundation assets.

Personal

Everything about our structure—being private and independent, our team orientation, and our completely customized approach—is designed to help us build deep and personal relationships with our clients. As our firm evolved, we added capabilities based on what our clients told us they needed. We recently opened an office in Frankfurt to bring us closer to our clients in Germany, Austria and Switzerland. Over the years, client needs led us to open our office in Singapore and our Delaware trust company, expand access for clients to private equity opportunities, and launch customized equity and fixed income strategies. As an organization, we place enormous value on learning and innovation— trusted, personal relationships with clients allow for challenges to become opportunities to develop new solutions.

One such an example was launching the Social Inclusion equity strategy for one of our long-standing financial intermediary clients. The firm came to us to help build a public equity portfolio focused on manifesting positive social impact when its team couldn’t find anything truly compelling or authentic in the market. The strategy seeks to generate attractive, risk-adjusted returns by investing in companies that offer inclusive products and services, create economic opportunities for underrepresented populations, address systemic drivers of inequity, and exemplify diverse, equitable and inclusive corporate cultures—which we believe will lead to enhanced franchise value over time.

Our U.S.-connected clients living in the U.K. have specialized cross-border investment, financial and tax needs that require highly personalized solutions. Having worked with these clients for many years, our portfolio management, strategic advisory and client service teams understand the intricacies and interactions of the two respective financial systems. Frankly, we embrace the complexity and the opportunity to develop tailored investment solutions that address tax compliance, trusts, philanthropy and currency risk while striving to meet clients’ individual risk and return objectives.

Connected

Our client service teams across the firm play a pivotal role in fulfilling our mission. They are a group of individuals who make it their business to understand the intricacies of each client relationship. Client service teams include professionals with MBAs, CFAs, CAIAs, Masters of Taxation, Masters of Trust and Wealth Management, Certified Financial Planners, Certified Trust and Fiduciary Advisors, and attorneys. They combine technical expertise—in investments, fiduciary oversight, trust management, estate administration, tax compliance, charitable giving, portfolio analysis and more—with the detailed execution that clients need and deserve. They typically are clients’ first call when they have a question, concern or news to share. Our client service team members are critical guides in helping our clients climb their individual mountains, and we recognized several of our client service colleagues at the highest levels last year, promoting Megan Brune, Kathryn McManus and Greta Meytin to Partner.

Body

Body

PERFORMANCE

Thoughtful investing is a dedication to rigorous, fundamental research to gain a deep understanding of the businesses, issuers and managers in which we invest our clients’ capital. It is the patience to allow the quality of strategies, companies and allocators to compound our clients’ capital over time. It is the humility needed to make objective, unbiased decisions—even under pressure—and to learn from our mistakes. It is an appreciation of context so that ideas can be kept in proper perspective. It is a focus on sustainability as a means to outperform. Thoughtful investing is the belief that teams—through diversity, collaboration and a willingness to challenge one another—best deliver the first-rate performance that we promise to each and every client.

Investing for Private Clients, Endowments and Foundations

We measure our private client, endowment and foundation portfolios against the customized performance objectives that we set with each and every client—we do not use “models” to build multiasset portfolios. At the same time, it can be helpful to aggregate similar portfolios to gain a sense of general performance.

Institutional Investment Management

In our actively managed, single-strategy equity and fixed income portfolios, we strive to generate outperformance through rigorous, bottom-up research; high-conviction ideas; and a repeatable investment process that is focused on long-term, risk-adjusted returns.

Funds and Strategies

We use a disciplined, bottom-up, fundamental research approach to build low-turnover, concentrated portfolios with the potential to drive attractive performance results over time. We have a culture and firm equity ownership structure that help us attract and retain professionals who share these beliefs, and we follow a repeatable investment process that helps us stay true to our philosophy. ESG research is fully integrated into the process behind our dedicated sustainable investing strategies and considered across our entire research platform to identify risks.

To respond to clients’ needs and provide specific solutions for each client’s considerations and goals, we have expanded our platform, adding investment strategies, making significant new hires and promoting professionals from within our research ranks.

In fixed income, we built a global sustainable platform, recruiting and reuniting the experienced global team of Chris Diaz, Ryan Myerberg and Colby Stilson. The team has worked closely with our broader research team to develop a fully integrated and truly global fixed income platform that includes a research and evaluation process for sovereign and supranational issuers. Our new Global Sustainable Fixed Income strategy offers investors access to an attractive income stream and risk-adjusted returns while producing positive global environmental and social impact.

We launched our Sustainable International Leaders equity strategy in 2021 to respond to client demand. Managed by Priyanka Agnihotri, the portfolio leverages the investment process developed by our Global Leaders team, of which Priyanka remains a key member. Clients wanted an ex-U.S. strategy to pair with U.S.-focused equity strategies.

Our Sustainable Small-Cap Core strategy builds on our history of small-cap equity investing and ESG research. This strategy has been a separately managed account option for our clients since 2017, generating notable performance since inception, and in 2021, we launched the strategy as a U.S. mutual fund. Our Sustainable Income strategy, launched in 2021 and co-managed by Emily Dwyer and Brian Graney, seeks to deliver returns through a portfolio of companies with meaningful sustainable advantages that can drive compelling growth and dividend income for clients.

Multiasset Portfolio Solutions

Our Investment Solutions Group guides asset allocation and manager research recommendations for our private client and our endowment and foundation portfolios, conducting deep and rigorous due diligence across asset classes to provide access to both leading and emerging managers. As our client base has grown and as the capital markets become ever more complex, we have expanded our external manager platform and continue to add highly specialized, best-in-class managers—so that we can customize portfolios to maximize opportunities and account for risk and liquidity preferences. As part of our responsibility to clients, we continue to mine opportunities among managers in public and private markets that can add value to portfolios.

Private markets are much larger than they were even a few years ago, and companies are staying private longer—so helping clients gain exposure to those markets is more important than ever. Now in its 10th year, our Private Equity Partners (PEP) program provides a highly effective way for investors to access private equity opportunities through a diversified portfolio of both “namebrand” and emerging managers across buyout, venture capital and growth equity. This portfolio approach offers clients access to world-class managers in which we have high conviction but which typically have limited capacity and are generally available only to very large investors.

We continue to challenge ourselves to find ways to add meaningful performance in client portfolios. To provide clients access to growth stage private companies that are raising funds through increasingly competitive, often capacity constrained deals, we created the Anchor Investor Network in 2021. Clients can pledge to make an “anchor commitment,” thereby gaining priority allocations to deals that are vetted by our investment committee. The program aims to combine our work to source opportunities in the venture community with the robust due diligence capabilities of our private equity team and sector research specialists.

Sustainable Investing

For us, sustainability is an essential part of thoughtful investing. We see incorporating a broad range of risks and opportunities into our research process as an important tool to generate long-term performance— including how a company is managing its products, services and solutions in the face of climate change and other long-term societal forces.

Nowhere is our belief that there does not have to be a trade-off between strong performance and responsible business practices more evident than our flagship Large- Cap Sustainable Growth strategy. Led for the past 10 years by Karina Funk and David Powell, the strategy, with more than $17 billion in assets under management as of year-end, has performed well for clients and is widely recognized by investors and leading financial publications as a leader in the industry. As another example of the proprietary research on which we rely to produce positive outcomes for clients, David and Karina developed the concept of Sustainable Business Advantages (SBAs) more than 10 years ago to determine how sustainability can drive a company’s revenue growth, cost savings or enhanced franchise value and lead, ultimately, to advancing shareholder value.

Engagement with management teams is an essential part of our fundamental due diligence. As fiduciaries and stewards of client capital, we have a responsibility to maintain consistent dialogue with the companies and issuers in which we invest. Engaging at a strategic level with management teams also enables us to advocate for progress on specific impact topics.

In our work with individuals, families, endowments and foundations, aligning their investment portfolios with their values is often a natural part of the conversation. Here too, we believe that we do not have to sacrifice performance, thanks to a range of rigorously vetted investment opportunities across asset classes.

The firm’s proprietary ARIS (Alignment, Risk, Impact and Sustainability) reporting tool provides detailed analyses of individual client portfolios’ exposure to a range of factors. With dashboards that monitor exposure to climate risk, corporate diversity, corporate governance, religious values, exposure to controversies and exposure to positive impact, ARIS enables clients to understand their portfolio exposure at a granular level and supports substantive discussions around sustainability risks, opportunity for impact and progress over time.

ARIS is an example of our belief in the importance of proprietary due diligence, especially in the sustainability space, where the data sets are notoriously incomplete and “greenwashing” is prevalent. Primary research helps us assess where financial and nonfinancial risks intersect for a given investment and, importantly, evaluate the opportunities to create “sustainable alpha”— where an investment stands to generate outsized performance thanks to its sustainable strategies or characteristics. Ultimately, we believe sustainable investing offers clients the means to achieve superior financial returns by allocating capital to companies, issuers and funds that are being thoughtful about the future.

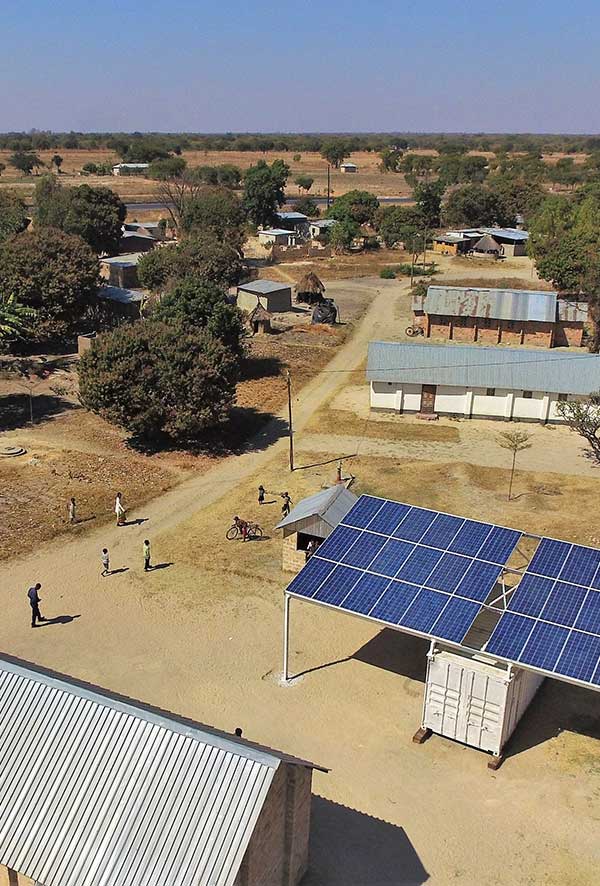

CrossBoundary Energy Access aims to connect rural homes and businesses in Africa to mini-grids to bring electricity to 170,000 people. Pictured is a mini-grid project in Tanzania that is being developed by PowerGen Renewable Energy. This project will build 60 grids, connecting 7,000 homes and businesses, and over 34,000 people to electricity.

Our investment “engine” is powered by teamwork. We combine multiple perspectives with the humility of knowing that a single point of view is often flawed and that listening is more important than speaking. We know that to help clients reach their long-term financial goals, we must bring humility to the investing process, continually asking: What can we do better? What other perspectives would be helpful to consider? What are we missing?

One way we put this into practice is through building intentionally diverse portfolios that incorporate multifaceted perspectives. For our balanced portfolios—in both public and private markets—in response to our clients’ wishes and to invest in high-performing opportunities, we partner with “name-brand” and emerging firms owned by women and people of color. Less than 2% of the $82 trillion of assets managed in the U.S. is overseen by diverse managers. Allocating capital has consequences; we choose to maximize outcomes for our clients and elevate groups that have been overlooked. When investing sustainably and with diverse managers, we strongly feel that there need be no trade-off between performance and impact.

Body

Body

IMPACT

Creating impact—real impact—for the communities in which we live and work has been an essential part of Brown Advisory’s DNA since our beginnings.

As we strive to make a positive and material difference for all of our stakeholders, we are cognizant of our responsibilities to our communities—we believe we have an obligation to contribute to and enhance the lives of others through financial, intellectual and hands-on partnership.

We think about “making an impact” broadly— you will see us use the term “raise the future” to refer to how we view our purpose for our clients, colleagues and communities. As investors, we invest in sustainable companies and issuers. As advisors, we help clients articulate what matters most to them in order to best incorporate philanthropy, community engagement, sustainability and impact-driven investments within their portfolios. As a business, we partner with for-profit and nonprofit purpose driven organizations. As a firm, we contribute our charitable dollars strategically and offset our emissions to achieve carbon neutrality. As a collection of colleagues, we donate time—and funds—to support the communities that support us and our families.

We intentionally recruit and elevate colleagues who share these values. Indeed, one of our criteria for promotion to Principal and Partner is a demonstrated energy and leadership in the community. At last count, Brown Advisory colleagues served over 400 nonprofits and charities across the U.S. and U.K.

Climate

We are committed to addressing climate change from both an investment and operational lens. With respect to operational emissions, our focus remains first on reducing and monitoring emissions, and then on contributing funds to climate-positive projects around the world to compensate for unavoidable emissions.

Our operational carbon emissions in 2021 were approximately 3,500 metric tons, with the bulk of our impact stemming from a mix of Scope 1 and 2 emissions (heating and powering our physical office spaces) and Scope 3 emissions (emissions from air travel). Our corporate real estate team is supporting multiyear reduction efforts for Scope 1 emissions with a requirement for new buildings where we procure office space to meet the highest levels of LEED and BREEAM certifications. Our development of office spaces is also aligned with these standards.

Each year, we “offset” the aforementioned emissions through a combination of renewable energy certificates and contributions to climate-positive projects. Several of these recent investments include:

- The Giving Trees plants trees in Kenya and Uganda to help small communities create a nature-based carbon removal system that helps train leaders, supports women’s smallholder farms and pulls families out of poverty. The project is verified by Verra (verra.org) and the Cool Effect Foundation (cooleffect.org), our purchasing partner.

- Cooking with Gas builds biogas digestors for families in China that capture methane emissions from waste and convert them to renewable energy. It is verified by Gold Standard CDM and the Cool Effect Foundation.

Our operational carbon footprint is important to us, but we believe that we can have a far greater impact on climate change through our investments: by working with clients to implement sustainable investment strategies, monitoring and managing the climate risk within the portfolios we manage, and engaging with our portfolio holdings and their stakeholders. We think that every business should be clear about the direct and indirect climate impacts of their activities. Nearly all of our firm’s impact on the global climate stems from our investments, not our operations. In 2021, our firm’s listed equity holdings—totaling $101.1 billion as of December 31, 2021—had a carbon footprint approximately 500 times greater than the footprint of our operational operations.

We are tackling this opportunity for impact in multiple ways. The first is through our firm’s sustainable investing strategies, whose philosophies and processes have consistently led to portfolios with substantially lower carbon intensity (a measure of a portfolio’s carbon emissions, scaled by its proportional ownership of the underlying holdings) than their benchmarks. Perhaps more importantly, many of our sustainable strategies seek to invest in companies that are trying to solve climate challenges for the rest of the world. Second is through our ESG research team’s engagement work. The team had full engagements with 148 different companies, bond issuers and other stakeholders in 2021, and 91 of those had to do with asking those entities, either on our own or as part of coalitions, such as the Science-Based Target Initiative and the Task Force on Climate-Related Financial Disclosures, to make additional progress on their emissions reduction strategies.

The Given Trees project empowers small communities and creates nature-based carbon removal solutions.

Third is through our initial steps as part of the Net Zero Asset Managers initiative (NZAMi). NZAMi supports a goal of net-zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5° C. Our decision to participate was the result of several months’ evaluation of the initiative’s goals as well as its alignment with our sustainable investment philosophy. Further, and most importantly for our clients, NZAMi respects that we, as the signatory, are not an asset owner. Exactly if, how, when and where our commitment is reflected in portfolios will be the result of conversations and support from clients—the asset owners—themselves.

All of this work has one common thread running through it: our belief that sustainable investing is smart investing and that ESG information helps us make better investment decisions. We are often frustrated when sustainable investing is framed as an “either/or” proposition—performance or impact, but not both. For over 12 years, we have been committed to the belief that you can have it both ways, and we believe that our track record in sustainable investing is largely attributable to delivering performance and impact to clients, and not sacrificing one for the other.

Giving

In 2021, Brown Advisory contributed more than $1.75 million to a range of nonprofits and charities across the communities where we live and work. In addition to supporting organizations that are important to our clients and colleagues, we focus our giving in three strategic areas: justice, the environment and gender equity. We are pleased to share a few examples of charitable organizations in which we are investing.

Justice

We support charitable organizations that address social injustice and racial inequity. These organizations provide support and services to underrepresented and economically disadvantaged groups, work to dismantle systemic barriers to racial equity, and build deliberate systems to achieve and sustain racial equity.

Bard Prison Initiative | Roca | Ron Brown Scholar Program | B-360 | 10,000 Black Interns

The Bard Prison Initiative provides a rigorous liberal arts education to inmates, along with career development and specialized support,

to disrupt the cycle of poverty, mass incarceration and systemic inequities.

Environment

The nonprofits and charities with which we partner strive to solve for the complex environmental challenges that threaten our world, such as climate change, water scarcity and quality, biodiversity, sustainable agriculture and environmental justice. We believe that these issues are interconnected with their social and systemic counterparts, and that addressing them requires a holistic approach to balance urgency with long-term solutions.

Nature Sacred | Conservation Fund | Royal Botanic Gardens, Kew

Royal Botanic Gardens, Kew, with one of the largest and most diverse botanical collections in the world, is dedicated to protecting biodiversity, motivating environmental advocacy, inspiring the next generation of scientists, and creating a world where nature is valued and managed sustainably.

Gender Equity

We partner with organizations dedicated to helping and empowering women and girls, especially those in underrepresented groups. Their work focuses on inclusion, education, health and social services, and includes closing the gender gap in business and government, mentoring, furthering and supporting women’s rights, preventing abuse, and providing direct services to people in need.

Invest in Girls | Him For Her | International Women’s Forum | U.K. Treasury’s Women in Finance Charter | Girls Are INvestors (GAIN)

Community Investment

At Brown Advisory, we catalyze innovation in mission-driven businesses and initiatives that are designed to materially enhance opportunities in our communities. These strategic investments take the form of capital, resources, and collaboration with change-agents who promote opportunity, equity, and inclusion in the ecosystems in which we work. Examples of these investments include:

UpSurge

UpSurge is building an engine to propel Baltimore into the top tier of U.S. innovation cities, while striving to be the country’s first “Equitech City.” UpSurge works with founders to launch, support, and grow high-impact startups, and develops strategies to attract new companies, talent, and capital.

Learn more

DivInc

DivInc’s mission is to generate social and economic equity through entrepreneurship by equipping underrepresented founders with access to the critical resources they need to build investable companies. Based in Austin, TX with a second location in Houston, DivInc offers a 12-week accelerator for early-stage startups and builds partnerships with public and private institutions to drive systemic change.

Learn more

B.Innovative

B.Innovative is our collaborative workspace program for purpose-driven startups and investors that seeks to catalyze entrepreneurial activity and thought leadership across underserved stakeholders. Beginning in Baltimore and now launching in Austin, B.Innovative embodies our dedication to provide physical and human capital resources to change-makers, and to help unlock new ways to create value and results for people and organizations that are working to raise the future.

Learn more

Body

Body

DNA

We use “the Four Cs”—clients, colleagues, community and culture—as a framework to reflect our DNA. We focus on clients, always. We take care of each other. We find material ways to help our communities thrive. And we strive to invest in, nurture and cultivate a culture that can support a special focus on the first three.

Fundamental to Brown Advisory’s DNA is our ownership structure and our independence. Every one of our full-time colleagues is an equity owner of the firm. This “ownership mindset” could not be more essential to our culture. As owners, we are responsible for building a firm that will navigate and raise the future. It’s on us. Each of us. And this makes for an exciting, challenging and empowering environment in which we are privileged to work.

Beyond our ownership structure, there are certain “genetic markers” that we think add substantially to the Brown Advisory experience. In the next few pages, we are pleased to share how some of these markers bring our DNA to life.

Connectedness

We were quick to ask colleagues to work remotely at the beginning of the pandemic and early to determine that we could safely come back to the office with proper testing and safeguards in place. We continue to believe that physical connectedness is important—to enable our responsibilities to clients and, especially, to sustain our very special culture and support the mental health of our colleagues. Throughout the pandemic, we learned that we can operate seamlessly from home. Frankly, however, we missed each other. We built the Brown Advisory culture in our offices, and we know that we belong together; it’s where we can best look after our clients and care for each other.

Morning Meeting Mindset

Perhaps no single activity embodies our connectedness more than our morning research meeting. Four days a week, the entire firm gathers to listen to our investment teams discuss topics that are influencing their investment thinking—from macro issues, such as asset allocation and consumer trends, to deep dives into private real estate investment opportunities and engagement with management teams around sustainable business practices. These meetings bring us together physically—each office gathers in person, and we are all connected via video—and also emotionally and intellectually.

Gathering for the morning meeting

In addition to sharing investment insights, the morning meeting provides an opportunity for Colleague Resource Groups (CRGs) to make announcements about upcoming events, to celebrate birthdays and anniversaries, and for colleagues to hear from members of the firm’s leadership about what’s on their minds, including strategic updates, financial results, colleague wellness and future opportunities. Especially in tough and trying times, we feel the significance of starting each week shoulder to shoulder at the morning meeting. This team orientation continues throughout our day and week, as we work together within and across teams to deliver for our clients.

Culture of Learning

Extending far beyond the morning meeting, our culture of learning means learning from each other. It means listening more than talking when we meet with clients. We place enormous value on curiosity and continuous learning. This value is ubiquitous across the firm and shows up in big and small ways: book clubs hosted by our Global Leaders equity team and our Women’s CRG, behavioral coaching to challenge and support our investment team’s process, firm-funded education, “lunch and learns” to meet with community leaders and explore the work nonprofits and charities are doing, and our speaker series for colleagues to learn from experts about the history of racial injustice.

To ensure that we are able to support clients across all aspects of sustainable investing, we launched SISME (Sustainable Investing Subject-Matter Expert) in 2018. Since then, more than 250 colleagues have graduated from the four-month training program, and our goal is for 100% of our colleagues to complete the course. The robust SISME curriculum—which we continue to develop and refine—incorporates 35 learning modules in a combination of on-demand video classes taught by our investment professionals, online discussions and live workshops.

A brainstorming session at a recent off-site, led by Doug Godine, Head of Private Client Business Development

We launched our Navigating Our World (NOW) podcast in April 2020 when we could not host our flagship client conference due to COVID-19. The conference—and podcast—reflect our belief in embracing outside, diverse viewpoints and in learning from experts about the pressing, long-term issues that will impact our investment decisions, our lives and our communities. While not a substitute for gathering in person, the NOW podcast continues to provide an opportunity for shared learning and a valuable means to connect with our network. Podcast guests have included CEOs, such as Dan Schulman (PayPal), Alan Jope (Unilever), Josh Silverman (Etsy) and Dr. M. Sanjayan (Conservation International); climate expert Kate Gordon; Librarian of Congress Dr. Carla Hayden; and global energy authority Dr. Daniel Yergin.

The “Team Thing”

As we have said elsewhere, at Brown Advisory, we “team” well.

Are teams always the most efficient approach to completing a task? Maybe not. Are they the surest way to think through complex challenges, develop creative solutions and deliver optimal outcomes? We think so.

We support our clients with teams—incorporating portfolio managers, strategic advisors and client service team members. We include senior and junior colleagues on teams, and we ask everyone to share their points of view and to listen to others’ points of view. We don’t put titles on business cards because seniority doesn’t connote greater importance. We make decisions—for clients and for our business—as teams. We incubate and launch new strategies in teams. We hold two strategic planning sessions a year—often including more than 100 colleagues—because we want to include as many voices as possible. Our days begin with the morning meeting, together with the whole Brown Advisory team. Each of our teams matters, whether they are evaluating stocks in equity research, processing trades, reviewing trust documents, helping colleagues understand benefits or deploying a new technology application. All of our teams contribute in meaningful ways to our clients’ success. The “team thing” is simply the Brown Advisory way.

Investing in Human Capital

Sometimes, as the saying goes, it is better to be lucky than smart. We think we were perhaps a bit of both when we hired Rebecca Sugarman as our Chief Human Resources Officer in the third quarter of 2019, before the word “pandemic” became ubiquitous. Rebecca and the human resources team have built and provided extraordinary COVID-19 protocols and policies, a testing and tracing program, and mental-health support systems—all the while professionalizing our commitment to diversity, equity and inclusion (DEI); recruiting to support our remarkable level of hiring; overhauling our benefits; establishing a business partner structure to support our managers and each of our colleagues; and deploying a new HR technology platform.

A hallmark of Brown Advisory is investing in, developing and promoting our own talent. We believe in challenging our colleagues with new opportunities and, with proper support, have seen time and again that they bring fresh perspectives and insightful approaches that benefit our clients. Many of the innovations described in these pages have been created, launched and led by colleagues who joined the firm as recent college graduates in entry-level positions. Driven by entrepreneurial spirit and nurtured by mentors, they continue to seek out new and better ways to serve clients and to help us all raise the future.

An important piece of our commitment to colleagues is diversity, equity and inclusion. We simply cannot be an innovative firm without a pronounced dedication to and investment in DEI.

After serving clients as part of our private client team, David Hodnett assumed the role of Director of Diversity, Equity and Inclusion. Led by David and Rebecca, we are building the infrastructure to deepen DEI across all aspects of our work with clients, colleagues and communities. We were thrilled to add Mia Contreras, Senior DEI Talent Acquisition Advisor, to our recruiting team as we continue to search for exceptional colleagues and strive to be the employer of choice for candidates, including those from underrepresented groups. For the third year in a row, we earned a perfect score of 100 on the Human Rights Campaign’s Corporate Equality Index, the national benchmark for corporate policies and practices to support LGBTQ+ colleagues. As we further embed DEI across the firm, all of our group heads have diversity and inclusion as part of their annual goals, to which their compensation is tied.

In the summer of 2020, in the wake of George Floyd’s murder and the continuing racial reckoning in the United States and beyond, we formed our Justice Task Force. While violence and injustice against Black and African American people have been perpetrated for centuries, we knew that this was a moment to bring renewed firmwide energy and focus to this critical issue through highly specific action. The task force set objectives across five areas: clients, community, colleague leadership development and retention, colleague recruiting, and training and assessment. It catalyzed progress across the firm, including building out our diverse manager solutions for clients, hiring Mia, recruiting a summer analyst class where approximately 40% identified as underrepresented minorities, conducting a pay equity review, organizing colleague focus groups to understand how we can drive an ever more inclusive culture and incorporating DEI into the promotions process, which resulted in the most diverse promotions class yet.

The firm’s Colleague Resource Groups play an instrumental role in the Brown Advisory colleague experience. The seven CRGs are energetically led by colleagues across the firm whose commitment to these “volunteer” roles continues to inspire. The CRGs provide important opportunities for colleagues to connect with each other. For example, leaders of the Black, Hispanic, and Asian and Pacific Islander CRGs co-led town halls about racial injustice and targeted violence. The town halls crystallized many of the characteristics that sustain our culture: participation, inspiration, honesty, humility, trust and profound caring. Our CRGs support colleagues and allies who identify as: Asian and Pacific Islander, Black and African American, Hispanic and Latinx, LGBTQ+, Military and First Responders, Parents and Caregivers, and Women.

Making a New Professional Home

Reena Thadhani, a strategic advisor based in Boston, wasn’t looking for a new job. Her role as leading partner and trust and estates attorney at Mintz Levin for more than 25 years was fulfilling. She loved her clients, her colleagues and her pro bono work.

Reena is driven by the question: Where can I make the biggest impact? She believes this aspiration emanates from her parents’ experience as immigrants. Her father marched with Gandhi in India, then moved to Nigeria, Hong Kong, Hawaii and ultimately Guam, where Reena grew up, to find the best place to support his family.

In the midst of the pandemic, Reena wondered if there might be a way for her to make an impact beyond her legal career. She knew the team at Brown Advisory well, given many shared clients and the caliber of service that she had seen them receive. So, her interest was piqued when she started having conversations with Craig Standish, Head of the Boston office, about the possibility of joining the firm.

Says Reena: “I had a professional home for 25 years, and I was only going to leave for a place with an exceptional culture. I firmly believe that culture starts at the top, and the Brown Advisory leadership had very honest discussions with me and kept their word at every point throughout the recruiting process.”

Getty Melaku spent the first two decades of his career at Fortune 100 companies. He would say these experiences were educational and fulfilling, and he had a chance to work around the world. Yet, he had always been curious about smaller, entrepreneurial firms. When he thought about making a career change, he wanted to explore what that might look like for him.

When evaluating companies and opportunities, Getty asked himself four questions: Does the firm have integrity? Is it a good cultural fit? Is the firm making an impact for its clients, its communities? Is it wellmanaged and focused on the long term? As Getty says, “Brown Advisory checked all those boxes.”

Since joining Brown Advisory as Head of Corporate Finance in January 2021, he believes he has found a place that enables him to work on consequential projects in a collaborative environment. Getty says: “This is a place where everyone is rowing in the same direction. The culture is all about asking what’s right for the client instead of what’s right for me.”

He has been particularly impressed by the nimble decision-making and the genuineness with which colleagues across the firm try to be helpful. Getty recalls one of his early interactions when he reached out to a colleague in a different part of the firm to help solve a problem. The colleague’s response was, “Of course, I’ll give you as much time as you need; we are all shareholders.”

Colleague of the Year

We are proud to announce that Bryan Carney and Ally Smith, were voted 2022 Colleague of the Year. Bryan and Ally both win the esteemed Hopkins Cup, which is named for David Hopkins, Brown Advisory’s first President and CEO. Rebecka Markland was awarded 2021 Colleague of the Year and Kristin Grady Olinyk 2020 Colleague of the Year.

The COVID Challenge

Taking care of our colleagues took on new meaning during the pandemic. Many of our colleagues experienced significant personal loss and sadness. We have all been through collective challenges, and our mental wellness has been tested. More than ever, we know that we need to ask every one of our colleagues, regularly: Are you okay? Colleagues across the firm stepped up in extraordinary ways to support our clients and each other. We are grateful for this remarkable Brown Advisory team.

Body

Component Image

Header Text

Dr. Elizabeth Lindsey: Polynesian Explorer

Header Text

Featured Text

“Women are always stronger and braver together. As a community, we are unstoppable, and we must model that for young women.” - Dr. Elizabeth Lindsey

Component Image

Header Text

Saxo Bank: Innovation at He(art)

Header Text

Featured Text

“Saxo Bank is a very different bank, and we want our environment to reflect that. The T-Rex that hangs in the canteen reminds us that we need to remain agile and be on the leading edge of technology developments so that we can continue to help our clients and partners navigate the global markets. In other words, we cannot become dinosaurs.” - Kim Fournais, CEO and Founder, Saxo Bank

Component Image

Header Text

Winthrop Rockefeller Foundation: Multiplier Effect

Header Text

Featured Text

Advancing equity in Arkansas will have a profound effect on the state’s families and communities, with the potential to drive significant economic growth. All of us—community leaders, employers, policymakers and others—have a stake in addressing the opportunity gaps and unequal access that hold back our entire society.” - Dr. Sherece Y. West-Scantlebury, CEO, Winthrop Rockefeller Foundation

Component Image

Header Text

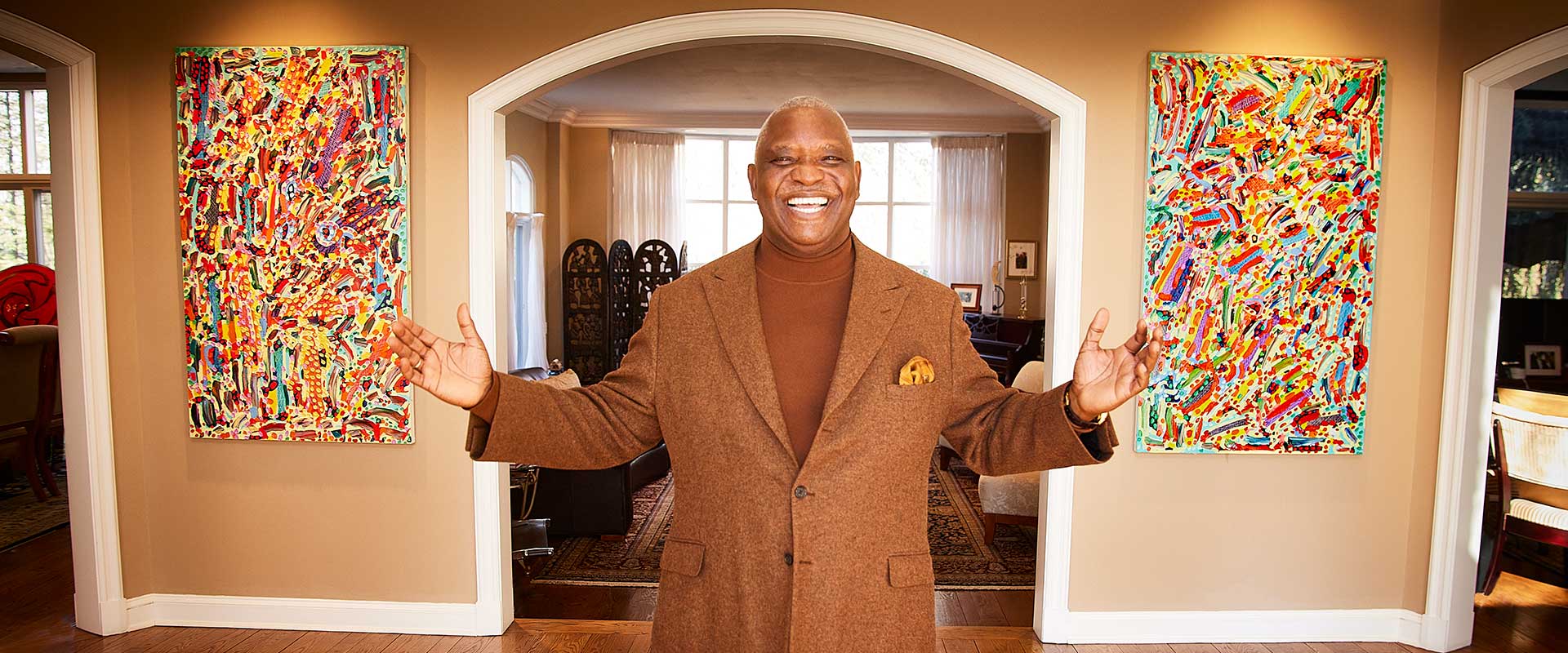

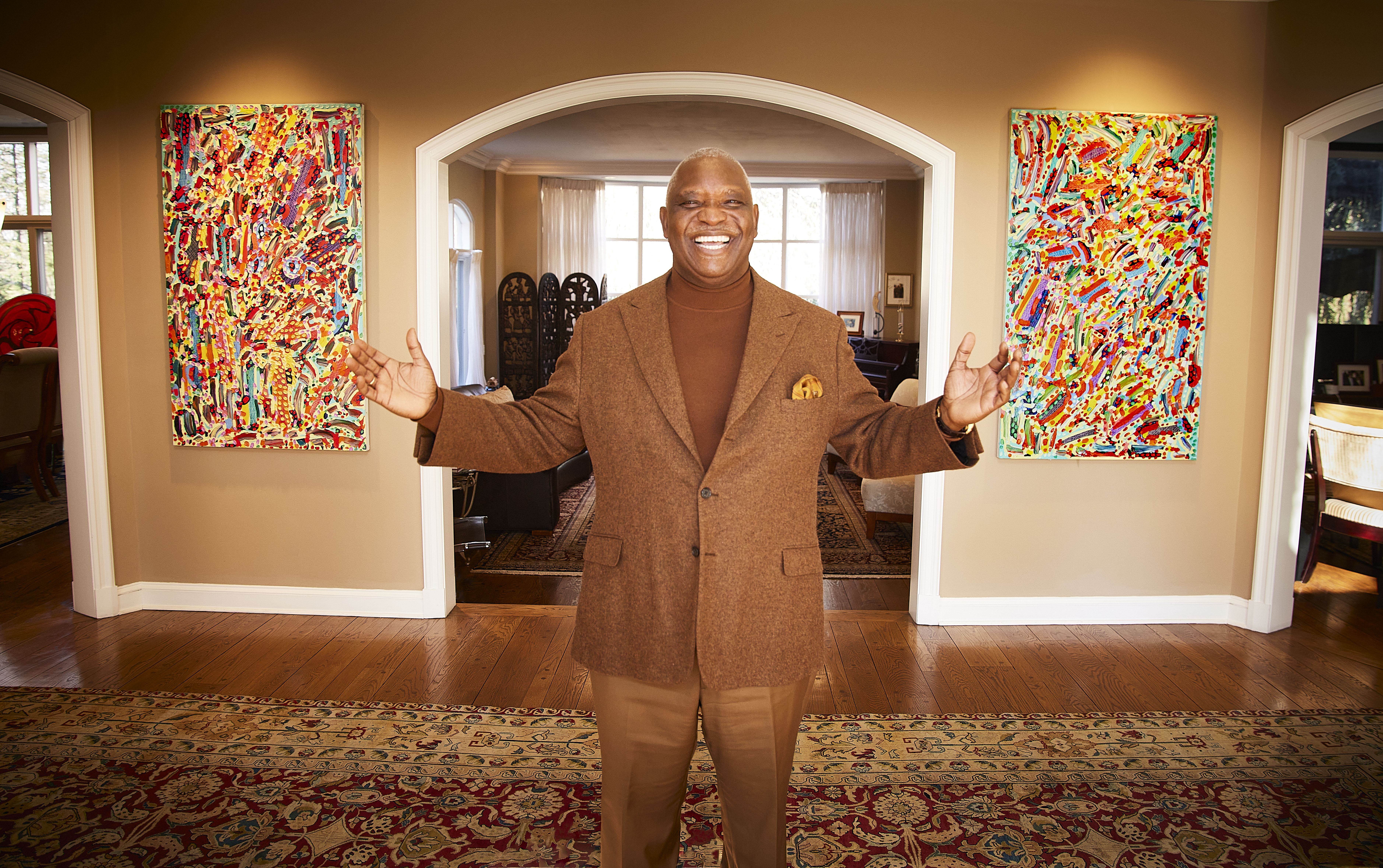

Osagie Imasogie: P.A.T.C.O.L.

Header Text

Featured Text

“People are the currency of life.” - Osagie Imasogie

Component Image

Header Text

Phipps Conservatory: A Natural Leader

Header Text

Featured Text

“Our purpose is to reconnect communities with the power and the value of nature—for the future of our collective wellbeing and the health of our planet.” - Richard Piacentini, President and CEO, Phipps Conservatory

Body

Component Text

Read the Full Report