Independence orients us toward the future—on a course that lifts our clients, colleagues and communities. For sure, we have not always gotten it right. Yet, we think that the practice of asking where we need to be in five and 10 years pushes us to be better investors and stewards of our clients’ capital. Twenty-five years on, our firm still has a start-up mindset. We are a collection of entrepreneurs, continually asking ourselves, “How can we get better?” We know that we must evolve to reflect our clients’ expanding needs and the rapidly changing world in which we invest.

Evolution

Being independent provides the financial flexibility to invest in areas that we believe will bear fruit for our clients—but whose positive impact they may not feel for years.

Since 1998, when we established Brown Advisory as a private, independent firm, the financial markets have certainly increased in complexity, and our clients’ need for sophisticated financial solutions has grown substantially. To meet these needs, we have significantly expanded our investment capabilities and global reach. When we think about the growth of our firm, it is expressly driven by listening to our clients’ needs rather than our own.

For example, we recently enhanced our presence in Asia with the opening of our Tokyo office to expand our existing partnerships with local asset managers.

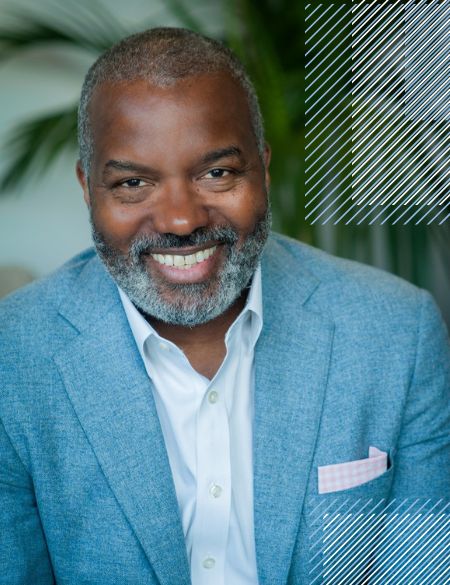

We are thrilled to welcome Toshiyuki (Toshi) Murasawa, who will lead our Japan-based business. Additionally, Serena Sim, an experienced investment professional, joined Walter Beckett in our Singapore office, to deepen existing relationships and serve clients across Southeast Asia. We now oversee more than $1 billion in assets from clients in the Asia Pacific region, who invest in the firm's U.S. and global equity and fixed income strategies and who are particularly interested in our sustainable investing expertise.

Toshi Murasawa, Head of the Tokyo Office

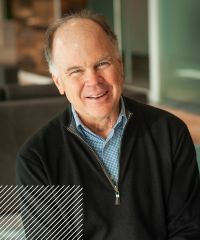

Tom Curtis, Head of the Nashville Office

In the U.S., we opened an office in Nashville to support our growing client base in Tennessee and beyond. Tom Curtis, an experienced portfolio manager who has deep roots in the local business and nonprofit communities, joined to lead our Nashville effort, with the support of Jon Price and Craig Martin. To say that we are “careful” when we make hires to lead important initiatives is an understatement; when we find someone—like Tom—who embraces integrity, excellence and inclusivity at levels to which we aspire, we are genuinely elated to welcome them to the Brown Advisory team.

Developing an Independent Investment Perspective

Looking back on our 25 years as an independent firm, we have the opportunity to reflect on lots of decisions—some certainly ill-advised or mistimed, but plenty that laid the groundwork for the firm we are today. Our decision to build an equity research team falls into the latter camp.

Back in the late 1990s, with assets of about $3 billion and fewer than 80 colleagues, deciding to invest in a team of equity analysts who could cover the full gamut of industry sectors was a lofty aspiration. Not to be deterred, Paul Chew—now our Chief Investment Officer, but then a young technology analyst—was elevated to Director of Equity Research to take on the task. Paul reflects: "We were committed to developing independent thought processes and to eliminating bias as much as we possibly could. We felt that building our own intellectual investment engine, one that could collect and evaluate multiple external and internal perspectives, was the only way to make the best long-term decisions for clients."

The practices that the fledgling equity research team developed are still important parts of our investment processes. According to Paul, "we felt if we could build the right frameworks from the beginning, we could make fewer emotional decisions and minimize the impact of our mistakes." Those frameworks—including our upside-downside and risk-reward analyses—are central now not only to our equity decision-making but also to the way we assess fixed income, asset allocation, external managers and private investments.

Thinking back to those early days, Paul remembers telling research team members that they had to be the nicest, most respectful partners to everyone they encountered—from management teams to sell-side firms to third-party data providers. “We were so small that the only way we could get access was to be genuinely nice. I think that’s just part of our DNA today.”

Likewise, when we launch new investment strategies, we are responding to what our clients tell us they need. Our newest institutional strategy, Large-Cap Sustainable Value, is a case in point. A number of clients asked us to provide a high-quality solution in an asset class where there were few options. Managed by Mike Poggi, the Large-Cap Sustainable Value strategy builds on the firm’s history in large-cap investing, value-investing, ESG research and sustainable investing, and seeks to invest in companies with Sustainable Cash Flow Advantages (SCFA) that have been overlooked by the market. The strategy is supported by a team of sector and ESG specialists including Director of Equity ESG Research and Strategy, Katherine Kroll.

Here too, our independence and ownership mindset play a meaningful role. Alongside some very supportive clients, many Brown Advisory partners helped seed the Large-Cap Sustainable Value strategy with their own capital based on their conviction in its tenets and in the portfolio management team. From our beginnings, our colleagues have invested alongside our clients—because this keeps us aligned with our clients and demonstrates our belief in the long-term performance opportunities of our investment strategies.

"When we think about opening an office to support local clients, we are very careful to wait until we find people with trusted local networks, with a deep understanding of our business and the respective region, and whose DNA will contribute to our culture."

LOGIE FITZWILLIAMS

Head of International Business and Global Head of Sales

CrossBoundary

We invested in CrossBoundary, our frontier markets partner, to help us understand the opportunities for private investment capital in historically underserved markets.

Today, CrossBoundary—with 23 offices on five continents—co-locates in our London office, which has allowed us to find new ways to collaborate and increase our mutual understanding of global investment opportunities—from sovereign bonds to nature-based finance to solar-powered mini grids.

CrossBoundary provided support for Norrsken2—an Africa-focused technology growth fund—for its investment in Autochek, a used-car platform that is building digital infrastructure for Africa’s automotive industry. The investment will help scale long-term economic growth by enabling Autochek to increase the number of used cars sold through its platform, increase access to financing solutions to facilitate affordability, and enhance its suite of value-added services.

The Anchor Investor Network

Private investments often play an important role in driving long-term investment results. At the same time, compelling direct private investments can be challenging from a timing and process standpoint. We developed a solution that would respond to client demand for access to attractive direct investment opportunities in growth-stage private companies, which are often fast-moving and capacity-constrained.

The Anchor Investor Network is the result—offering first-mover investors priority allocations to oversubscribed deals. Investors “pledge” a capital commitment per vetted deal—an “anchor commitment”—in exchange for a priority allocation. Investors can opt out or (where capacity permits) double down on specific opportunities to retain deal-by-deal decision-making. One such investment was Thrive Earlier Detection Corp., founded by cancer research pioneers at Johns Hopkins.

Thrive Earlier Detection Corp. was launched at the Science and Technology Park at Johns Hopkins, the home of Johns Hopkins Technology Ventures, one of our private investment partners.

James Harding, Editor and Co-Founder, Tortoise Media; and The Rt Hon George Osborne, Partner, Robey Warshaw LLP and Former Chancellor of the Exchequer; in conversation at the Responsible Investment Forum/strong>

Responsible Investment Forum

We are proud to be the founding partner of the Responsible Investment Forum, hosted by the Rothschild Foundation and Tortoise Media. The Forum convened for the first time at Waddesdon Manor in Aylesbury, England, last October, bringing together some of the most thoughtful and innovative business leaders, academics and investors for thought-provoking debate, respectful disagreement and mutual learning. Karina Funk, Brown Advisory's Chair of Sustainable Investing and Co-Portfolio Manager of the Large-Cap Sustainable Growth Strategy, serves as an advisory board member. We view the Forum as a new kind of venue to discuss the role of finance and investment capital in solving our sustainability challenges—in a way that will genuinely make a difference.

ARIS

We developed our proprietary ARIS (Alignment, Risk, Impact and Sustainability) analysis and reporting tool to provide visibility into a portfolio’s exposure to a range of factors—including climate risk, corporate diversity, corporate governance, religious values and certain business practices, as well as positive impact. ARIS enables clients to understand their portfolio exposure at a granular level and supports substantive discussions around sustainability risks, opportunity for impact and progress over time.

Rebecka Markland, Sustainable Investing Business Intelligence Specialist, Angelina Choi, Portfolio Analyst, and Colin Chandler, Associate Portfolio Manager.

Brigid Peterson, Head of Endowments and Foundations (right), speaks at Mission Investors Exchange

We had the privilege of participating in and guiding the 2022 Mission Investors Exchange (MIE) National Conference, which was held in Baltimore.

MIE is one of the most important gatherings for investors in the foundation and philanthropy arena. Brigid Peterson, Head of Endowments and Foundations, spoke on a panel entitled “Making the Case: Starting or Growing an Impact Investing Program,” and Elise Liberto, Private Equity Portfolio Manager, moderated “Equitech and Beyond: Building through Incubators, Inclusion and Impact Investing.”

"Our start-up mindset keeps us pushing ourselves to focus on continual growth—asking what our clients will need in three, five, eight years and how we will need to evolve as an organization to support them."

BRIAN COBB

Chief Technology Officer

Jeff Cherry, Founder and CEO of Conscious Venture Labs, leads the early-stage accelerator from B.Innovative in Baltimore—developing companies and leaders who embrace capitalism as a catalyst for positive impact on society.

B. Innovative

B.Innovative is our “in-house” program for purpose-driven startups, investors and ecosystem-builders to catalyze entrepreneurial activity and thought leadership across underserved stakeholders.

We provide collaborative workspace and wraparound services to help our resident innovators raise the future. Located in our Baltimore and Austin offices—so far—B.Innovative enables us to invest in our communities and, equally importantly, brings our colleagues into the flow of new ideas, fresh thinking and diverse perspectives.

Jeff Cherry, Founder and CEO of Conscious Venture Labs, leads the early-stage accelerator from B.Innovative in Baltimore—developing companies and leaders who embrace capitalism as a catalyst for positive impact on society.

We value the opportunity to convene innovators.

In Baltimore, TechStars Equitech uses our space for demo days and other events. In Austin, we support the local start-up ecosystem with events during SXSW and throughout the year.

Left: 2023 Techstars Equitech class with Mac Conwell, Founder and Managing Partner, RareBreed Ventures (fourth from right). Right: Preston James, CEO, DivInc (third from right), and DivInc team members

What's next?

CONTENTS | DOWNLOAD THE REPORT | REQUEST A HARD COPY | ABOUT BROWN ADVISORY | CONTACT US