Our firm’s structure, where every colleague is an equity owner, breeds accountability—to our clients, to our colleagues, to our community and to our culture. This interconnectedness imbues our work with meaning, inspires us to outperform—for our clients and each other—and drives us to raise the future.

Holding ourselves and each other accountable is central to our DNA. Given our ownership mindset, it is baked into the decisions we make and the care we take—of our clients and of each other.

We are focused on creating a world-class environment for our colleagues to thrive over the long term because we believe this is the only way to deliver the highest level of performance, advice and service to our clients. It is on all of us to strive continually to make Brown Advisory a place that attracts and retains the best and brightest professionals—colleagues who contribute to sustaining our collaborative culture and challenge each other to get better.

Kellie Zesch Weir, CFA, Portfolio Manager and Head of Austin Office; Ken Stuzin, CFA, Portfolio Manager, Large-Cap Growth Strategy

Independent Board of Directors

When we established our firm 25 years ago, we elected to engage an outside board of directors, even though there was no regulation or even convention for a private firm to do so. Today, we are even more passionate about the accountability and benefits that an outside board provides—for all of our stakeholders. Our directors share diverse perspectives on strategic issues, question our assumptions and challenge us to be the best.

Sarah Penne, Internal Audit Supervisor; Linda Tan, Head of Internal Audit; Uche Ogbuokiri, Internal Audit Supervisor

Underscoring Accountability

To ensure absolute accountability and to underscore the importance of independence in protecting our clients, our Internal Audit function reports directly to the Audit Committee of the Board of Directors.

In addition to the directors of Brown Advisory Incorporated, who are listed above and govern our entire business, we have boards that oversee specific areas, including boards of directors for Brown Advisory Limited (our international business), Brown Advisory Funds (our U.S. mutual fund business), Brown Advisory Funds plc (our UCITS business), Brown Advisory Trust Company of Delaware, Brown Investment Advisory & Trust Company, Brown Advisory (Bermuda) Limited and Brown Advisory (Ireland) Limited; and advisory boards for our Sustainable Investing and International Businesses.

While only some of these boards are regulatory in nature, they all share our firm’s commitment to maximizing accountability and transparency for the benefit of our clients.

"The Board has been a pillar of our independence for 25 years—they have been invaluable in holding us accountable to our clients’ best interests."

DAVE CHURCHILL

CFO, COO

Our DNA

Brown Advisory’s DNA is not just one thing; it is the culture created by our 800+ colleagues working together to raise the future.

- Part of our DNA is our client-first culture—our mission is to make a material, positive difference in the lives of our clients—and we are focused on putting clients first, always.

- Part of it is our ownership structure and ownership mindset—every one of our full-time colleagues is an equity owner, and no colleague owns more than 5% of the firm.

- Part of it is our appreciation of humility—knowing that we don’t have all the answers, listening more than talking, searching for new and better solutions, celebrating learning and curiosity—because we believe this produces the best results for client.

- Part of it is our leadership in sustainable investing—which has been an important focus for more than 12 years.

- Part of it is our commitment to diversity, equity and inclusion (DEI)—we simply cannot be an innovative firm without a pronounced dedication to and investment in DEI.

"The Four Cs"

We use “the Four Cs”—clients, colleagues, community and culture—as a framework to reflect our DNA. We focus on clients, always. We take care of each other. We find material ways to help our communities thrive. And we strive to invest in, nurture and cultivate a culture that can support a special focus on the first three Cs.

-

CLIENT FIRST

Helping clients get “there” defines our mission.

-

COLLEAGUE DRIVEN

Uncompromising commitment to integrity, excellence and inclusivity guides our way.

-

COMMUNITY FOCUSED

Recognition of our responsibility for the future inspires our purpose.

-

CULTURE LED

Shared passion and beliefs translate to our clients’ success.

Morning Meeting Mindset

Four days a week, the entire firm gathers to listen to our investment teams discuss topics that are influencing their investment thinking—from macro issues, such as asset allocation and consumer trends, to deep dives into private investment opportunities and engagement with management teams around sustainable business practices. These meetings bring us together physically—each office gathers in person, and we are all connected via video—as well as intellectually and emotionally, and keep us accountable to each other.

Information Security and Technology

Ensuring the security and privacy of our clients’ information has never been more important—or more in focus.

We invest heavily in security architecture, while continuing to ask: Are our current tools and partners supporting us effectively? Are there any areas that we need to reinforce? Are we keeping pace with emerging threats? We implemented 31 security projects in 2022 and have more than 40 planned for 2023. As a private and independent firm, we have the ability to answer “yes, always,” when we are considering the deployment of a new security project.

Meanwhile, our technology team is laser-focused on making sure that our clients and colleagues are supported by best-in-class technology across our businesses. In addition to rolling out a new client relationship management system so that we can communicate optimally with clients, the tech team deployed more than 125 projects last year across private investments, equity research, fixed income, sustainable investing, legal and human resources.

Left to right: Tayo Okunseinde, Director, Application Development and Support; Charles Severn, Director, Application Integration and Support; Gus de Los Reyes, Chief Information Security Officer; Teresa Pollet, Senior Project Manager; Brian Cobb, Chief Technology Officer

"Brown Advisory is an intense place. We work hard to deliver results for our clients. But being in it together means that while we are challenging each other, we are also looking out for each other. We’re a team—we have each other’s backs."

BRIEN WHITE

Chief Operating Officer of U.S. Private Client, Endowments and Foundations Business

Rebecca Sugarman, Chief Human Resources Officer

Investing in Human Capital

In many ways, we are in the human capital business. We cannot achieve our mission—to make a material, positive difference for our clients—without recruiting, investing in, nurturing, challenging and elevating a world-class team of thoughtful, collaborative and inclusive colleagues. In 2022, we focused on two key efforts—finding, developing and retaining top talent; and remaining steadfast in protecting our culture.

A hallmark of Brown Advisory is investing in, developing and promoting our own talent. We believe in challenging our colleagues with new opportunities and, with proper support, have seen time and again that they bring fresh perspectives and insightful approaches that benefit our clients. Many of the innovations described in these pages have been created, launched and led by colleagues who joined the firm as recent college graduates in entry-level positions. Driven by entrepreneurial spirit and nurtured by mentors, they continue to seek out new and better ways to serve clients. They hold us accountable for ensuring the continued evolution of the firm.

We launched our first firmwide engagement survey, administered by a third party, to ensure that we remain accountable for our colleagues’ experiences. It allowed us to assess how we compare to our peers and translate survey results into actionable business goals. We learned some things that made us feel pretty good—89% of colleagues said Brown Advisory was a great place to work, and 88% believe “the firm shows care and concern for colleagues.”

From an absolute perspective, these are strong marks, and they are well above our industry’s average.

At the same time, we learned plenty about where we need to improve, which includes but is not limited to: training for colleagues and visibility for colleagues into their future pathways at the firm. We plan to conduct this survey each year over the near term to measure our progress.

An important part of the engagement survey was continuing our firmwide DEI assessments that we began in 2018. Our commitment to creating an environment where all colleagues feel they belong is stronger than ever. We know that diverse experiences, backgrounds and thinking are essential to serving our clients and to helping all of our stakeholders raise the future.

DEI is now embedded in our business goals and across all levels of recruiting. Using data from the engagement survey, each group head is accountable for achieving specific objectives.

Under the leadership of Mia Contreras, Director of DEI and Learning & Development, we broadened our partnerships to source the best and brightest talent, working with Historically Black Colleges and Universities (HBCUs) and other community partners such as Invest in Girls, Modern Guild, Association of Latino Professionals For America (ALPFA), The Mom Project, Hiring Our Heroes, the Ron Brown Scholar Program, Girls Are INvestors (GAIN), YearUp and Black Women in Asset Management. In addition to expanding our external talent acquisition network, we strengthened our internal network, integrating an anti-bias framework into our Principal and Partner promotion process. For the third year in a row, we earned a perfect score of 100 on the Human Rights Campaign’s Corporate Equality Index, the national benchmark for corporate policies and practices to support LGBTQ+ colleagues.

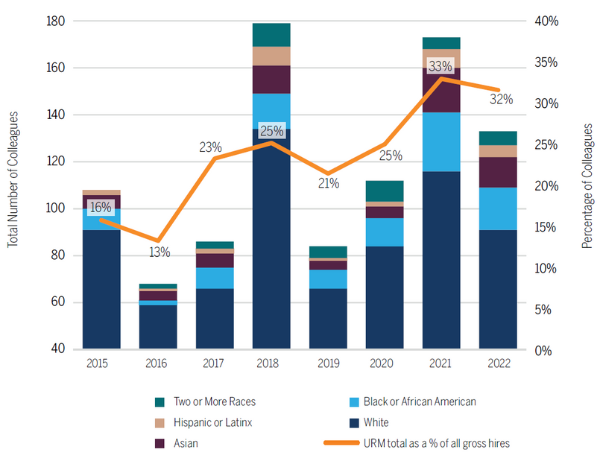

In 2022, 32% of new hires were underrepresented minorities, compared with 21% in 2019 and 13% in 2016. While we have work to do at the partner level, in 2022, 15% of partners were underrepresented minorities, compared with 9% in 2020—and over 70% of new partner hires in 2021 and 2022 were underrepresented minorities.

Mia Contreras, Director of DEI and Learning & Development

NEW HIRE DIVERSITY:

Race and Ethnicity

Colleague data is self-reported and as of 12/31/2022

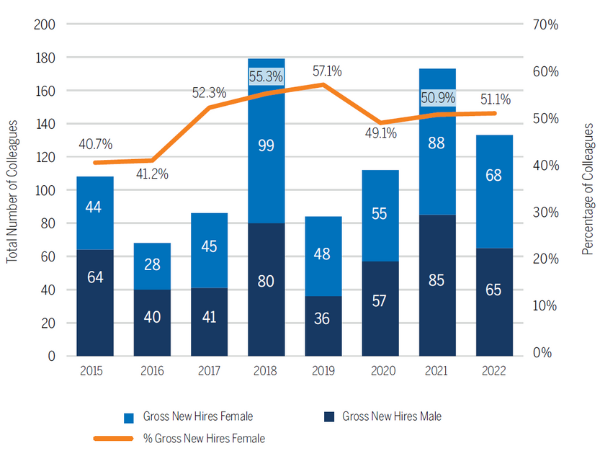

NEW HIRE DIVERSITY:

Gender Expression

Colleague data is self-reported and as of 12/31/2022

Nature Sacred works with communities to create public green spaces—called Sacred Spaces—that are designed to improve mental health, unify communities and engender peace.

Our Communities

We recognize that we are accountable for the current and future health of our communities. Our responsibility takes numerous forms: climate stewardship, catalyzing local mission-driven businesses, providing nonprofit leadership and volunteer service, and charitable giving.

You will often hear colleagues share that our community focus attracted them to Brown Advisory. Indeed, demonstrated leadership in the community is one of the criteria for promotion to Principal and Partner. Across our offices, you will find colleagues contributing financially, intellectually and through hands-on partnership to local organizations of their choice—all of which are encouraged and supported by the firm.

Charitable Giving

In 2022, Brown Advisory contributed more than $2 million to a range of nonprofits and charities across the communities where we live and work. Our focus is supporting local organizations that are important to our clients and colleagues, in addition to our strategic giving areas: the environment, gender equity and justice. We are pleased to share a few of these organizations that are working to raise the future.

Girls are INvestors (GAIN) inspires and prepares young women for careers in the investment management industry.

Environment:

The nonprofits and charities with which we partner strive to solve the complex environmental challenges threatening our world, such as climate change, water scarcity and quality, biodiversity, sustainable agriculture, and environmental justice. We believe that these issues are interconnected with their social and systemic counterparts, and that addressing them requires a holistic approach to balance urgency with long-term solutions.

Baltimore Healthy Harbor Project | Chesapeake Bay Foundation | The Nature Conservancy | Nature Sacred | Royal Botanic Gardens, Kew

Gender Equity:

We partner with organizations dedicated to helping and empowering women and girls, especially those in underrepresented groups. Their work focuses on inclusion, education, health and social services, and includes closing the gender gap in business and government, mentoring, furthering and supporting women’s rights, preventing abuse, and providing direct services to people in need.

Girls Are INvestors (GAIN) | HM Treasury’s Women in Finance Charter | Him For Her | Invest in Girls

Justice:

We support charitable organizations that address social injustice and racial inequity. These organizations provide support and services to underrepresented and economically disadvantaged groups, work to dismantle systemic barriers to racial equity, and build deliberate systems to achieve and sustain racial equity.

10,000 Black Interns | Anti-Defamation League | Bard Prison Initiative | Roca | Ron Brown Scholar Program

Bard Prison Initiative

For the past two years, the firm has had the privilege of supporting the Bard Prison Initiative (BPI) through our charitable foundation. For more than 20 years, BPI has created groundbreaking opportunities within America’s prison systems.

These college programs mitigate the negative impacts of incarceration and create transformative access to high-quality liberal arts education.

Brown Advisory’s relationship with BPI is emblematic of our broader entrepreneurial mindset. Two colleagues from New York—Rima Parikh and Katie Kelley—met the BPI team and were convinced of the alignment between our two organizations. They facilitated the New York team’s and then the broader firm’s introduction to BPI and continue to shepherd our multiple touchpoints and connections. After a recent Lunch and Learn with the BPI leadership team, Dyjuan Tatro, BPI ‘18, said, “the level of engagement from across your firm was truly a marvel.”

Carey Buxton, Head of Sustainable Investing Business

Climate

The four Cs—our clients, colleagues, community and culture—guide all our activities, including our work on climate. As a business, we believe we have a responsibility to understand our climate impact.

As an investment firm, we view climate decisions through the lens of our fiduciary duty to generate attractive investment returns that help our clients achieve their goals over the long term. This long-term lens, we believe, requires an appreciation of how climate and other sustainability challenges will strengthen or weaken an investment case. Given our role as investment advisor, we have a responsibility to identify all data—which include climate-related risks, costs and opportunities—relevant to driving investment performance.

Operational Carbon Footprint

From an operational perspective, our focus is on monitoring and reducing emissions and contributing financially to climate-positive projects that can help offset emissions that are unavoidable in the course of serving our clients. All of our newly developed office space must meet the highest levels of LEED and BREEAM certifications.

Our operational carbon emissions in 2022 were approximately 4,750 metric tons of CO2e. This number is attributed to about 1,150 mt CO2e of Scope 2 emissions related to electricity in our offices and 3,600 mt CO2e of Scope 3 coming from air travel to connect with clients and colleagues. Consistent with prior years, we purchased Renewable Energy Certificates (RECs) to match electricity use for the year related to Scope 2 emissions and offset projects to address Scope 3 emissions.

In an effort to offset our emissions, we strive for a diversified portfolio of high-quality projects that are backed by rigorous science and monitoring and incorporate secondary benefits such as biodiversity and human health.

This year, we invested in the following climate-positive projects:

Seeing the Forest for the Trees:

This project mitigates forest exploitation in Mexico. All members of the community within the project area are involved in the effort to sustainably manage and increase the carbon stocks in the forests—conserving forests, increasing biodiversity, and providing education and jobs to local residents.

Doo Doo Does More:

This project installs biodigesters in rural Indian homes that convert cow dung into clean methane gas for cooking. The biodigesters replace inefficient wood-burning stoves—preventing the depletion of already-scarce local forest resources and reducing emissions from methane, a greenhouse gas that would otherwise be released into the air from decaying cow dung.

The Giving Trees:

This project supports reforestation and sustainable development among small groups of farmers in Kenya, Uganda, Tanzania and India. The trees help break the cycle of deforestation, drought and famine. The profits earned through the sale of carbon offsets provide capital for tree planting, as well as leadership opportunities for women, and income to address agricultural and nutritional deficiencies, HIV/AIDS, clean cooking, and fuel availability.

What's next?

CONTENTS | DOWNLOAD THE REPORT | REQUEST A HARD COPY | ABOUT BROWN ADVISORY | CONTACT US