With the holidays now upon us, there is no better time to reflect on the past year. And nothing is as joyously reflective as…Spotify? In early December, the streaming service provided its 700+ million monthly users with a personalized summary of their listening preferences over the prior year. This year Spotify Wrapped introduced a new feature that calculates people’s “listening age” based on the generation of music they enjoy most. Having just come to terms with chronologically reaching the half-century mark, my trusted musical companion added insult to injury by hypothesizing my listening age at 62. Not surprisingly, my New Year’s resolution is now firmly set around rediscovering youthfulness.

I can assure you the Equity Beat version of “2025 Wrapped” will not attempt to predict your age nor bring to light any perceived peccadillos. In collaboration with several colleagues, this piece will look back on 2025 market surprises and offer some bold predictions for the year ahead.

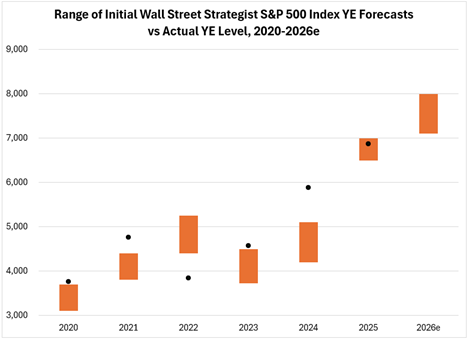

Surprise #1: Wall Street Strategists Got It Right!

For the first time this decade, a range of Wall Street strategist forecasts for year-end S&P 500® Index levels has properly bracketed the outcome (as of December 5th). The current level of 6,875 is comfortably within the forecasted range of 6,500 to 7,000, and less than 4% above the average forecast. In past years, this publication has pointed out the challenges of offering a point estimate to predict something as complex as a broad market index over a 12-month period. As Portfolio Manager Bertie Thomson says, “The future is inherently unknowable over short-time periods.”

Note: Wall Street firms included in the estimates are Bank of America, Deutsche Bank, Goldman Sachs, JP Morgan, Morgan Stanley and UBS. Data as of December 5, 2025.

Source: FactSet and Bloomberg

2025 has been no less complex a year than others to forecast, driven by the shock of Liberation Day tariff announcements, followed by start-and-stop negotiations by country and the response of corporations. Jordan Wruble, Head of the Investment Solutions Group shares, “Tariff/trade policy was less detrimental to the market than I would have otherwise expected. If not for the acceleration of AI early in the year, we’d have a very different economy and market today.” Similarly, Co-CIO of Private Client Endowments & Foundations Erika Pagel comments, “Given the magnitude of the initial tariff announcement, I’ve been surprised by the relatively low impact thus far on companies.”

Yet, the 2025 S&P 500 Index total return has reached the high teens in percentage terms, following 20+% returns in both 2023 and 2024. Should the current level hold through year-end, it would mark the first time since the late 1990s that the S&P 500 Index has risen by more than 15% in three consecutive years. Let’s give the Wall Street strategists their due – they got it right in 2025.

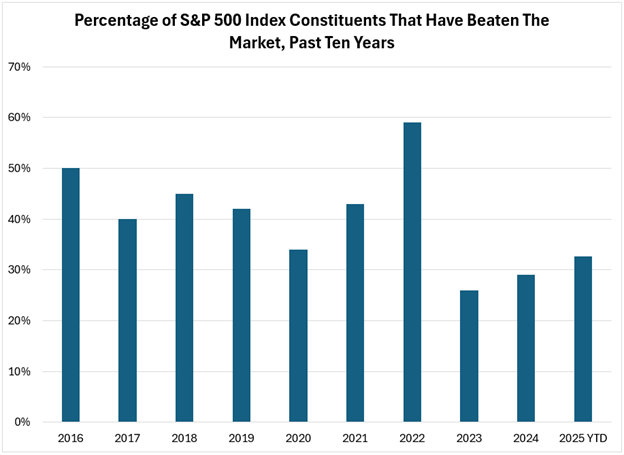

Surprise #2: Another Year of Narrow AI Market Leadership, But No Longer “Magnificent”

2025 is the third consecutive year where fewer than one-third of S&P 500 Index constituents have beaten the Index. These are the three narrowest years of market leadership over the past decade. The overriding commonality across the market’s best performers is once again exposure to the Generative AI theme, with 12 of the top 14 performers in the S&P 500 Index benefitting from the related chip demand and data center build-out. However, unlike 2023 and 2024, the Magnificent Seven1 have not collectively demonstrated leadership. Among this group, only Alphabet Inc. (GOOG) and NVIDIA Corporation (NVDA) have outperformed the S&P 500 Index this year.

Note: Data as of December 5, 2025.

Source: Morningstar, Bloomberg and FactSet

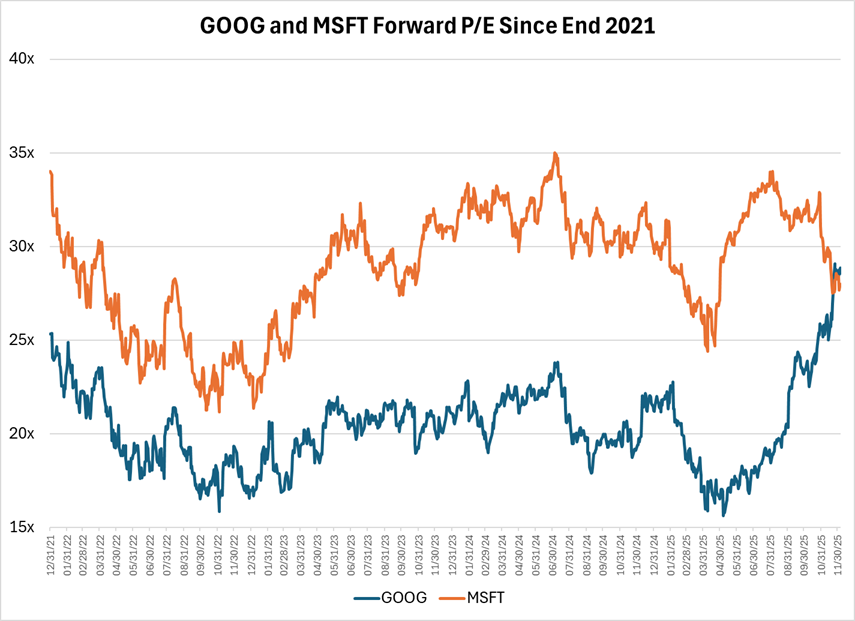

Surprise #3: GOOG’s Valuation Rebound

GOOG’s forward P/E multiple has climbed nearly 50% since early September when a U.S. District Court issued limited penalties against the company after it was convicted of violating anti-trust laws in its Search business. Portfolio Manager David Powell states, “Investor sentiment in GOOG has turned on a dime. In retrospect, we should have given more credit to the non-Search businesses. Still, we consider OpenAI as a major risk to Google but are uncertain of the timing.” Supported by recent momentum in its cloud and custom chip businesses, GOOG now trades on par with Microsoft (MSFT) on forward P/E for the first time in many years.

Note: Data as of December 5, 2025.

Source: FactSet

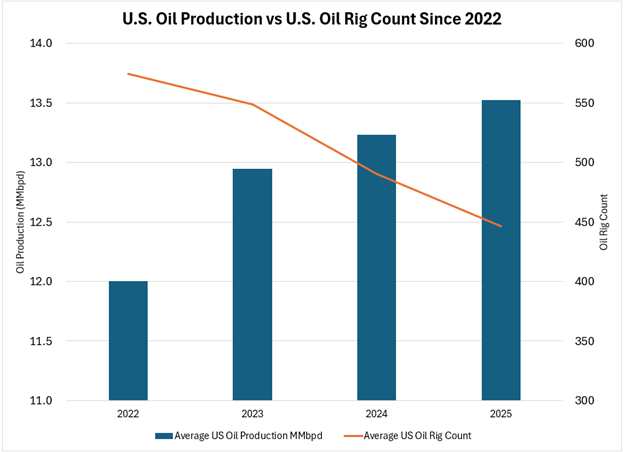

Surprise #4: US Oil Production Resilience

Elizabeth Hiss, Equity Research Analyst: “I continue to be surprised by the prolific efficiency gains of the U.S. oil sector. Despite another year of declining rig count, domestic oil output reached its highest level ever in September. Production recovery methods using technology like AI-driven reservoir modeling and longer laterals (up to five-miles!) are the primary factors.”

Note: Data as of December 5, 2025.

Source: EIA and Baker Hughes

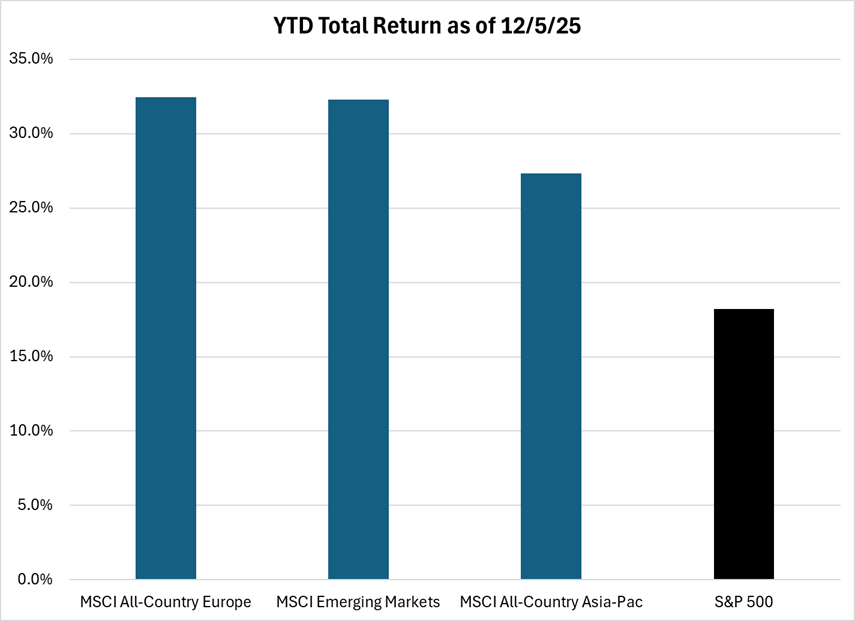

Surprise #5: International Equity Market Strength

Nick Kirrage, Portfolio Manager: “The ongoing surprise for me has been how consistently investors underestimate the strength of international markets relative to the U.S. It’s fashionable to frame this as just a 2025 story, but the trend has been building for years. The MSCI EAFE Value Index has delivered roughly the same total return as the S&P 500 Index for the past five years, an extraordinary fact on its own, and even more so given how little attention it receives.”

Priyanka Agnihotri, Portfolio Manager: “The significant outperformance of European banks this year really surprised me. They had underperformed for years, and some re-rated significantly this year.”

Note: Data as of December 5, 2025.

Source: FactSet

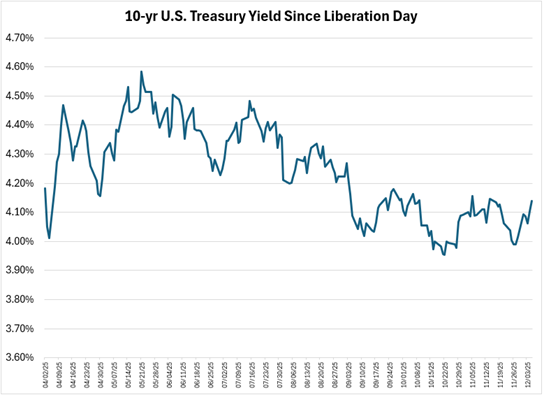

Surprise #6: Fixed Income Rate Stability

Chris Diaz, Portfolio Manager: “Since Liberation Day, 10-year Treasury yields have traded in a 60 basis points trading range. I would have expected uncertainty around trade, immigration, fiscal and regulatory policy to lead to greater uncertainty of growth and inflation, and thus volatility.”

Note: Data as of December 5, 2025.

Source: FactSet

Bold Predictions for the Year Ahead

I will reiterate Bertie’s comment from earlier, “The future is inherently unknowable over short-time periods.” That said, one could argue that a “year in review” piece is inherently IMBALANCED without the inclusion of some fun, non-consensus and bold prognostications for the year ahead. With that introduction, here are some thought-provoking predictions from our colleagues.

- Sarge McGowan, CIO of U.S. Endowments & Foundations: “Perhaps active management performs better on a relative basis in a lower returning world, but the ability to meet our clients’ required return level will get meaningfully tougher – which ultimately matters most.”

- Nick Kirrage, Portfolio Manager: “This feels like a market in which stock-picking matters, diversification will re-assert itself, and the price you pay ultimately determines the return you earn.”

- David Powell, Portfolio Manager: “NVDA underperforms in 2026 as revenue growth deceleration and gross margin fears overtake the stock. I expect NVIDIA to lose share in data center as more custom chips are used in training and inference workloads. Broadcom should grow faster within the AI ecosphere.”

- Bertie Thomson, Portfolio Manager: “The existence of multiple moats including scale, distribution, switching costs, regulatory and data advantages will provide longer fade protection for a number of software and information services companies than investors anticipate.”

- Jordan Wruble, Head of the Investment Solutions Group: “Some of the perceived AI losers like SaaS companies start to get more traction. AI will likely be delivered through software, and incumbents can still win over upstarts.”

- Jay Kraska, Equity Research Analyst: “Healthcare tools companies and healthcare in general to return to stable, durable, boring growth. This feels like a bold statement today.”

- Elizabeth Hiss, Equity Research Analyst: “We are overestimating the amount of incremental power that will be required to support new data center compute based on the ingenuity of the semiconductor, energy and tech sectors now collaborating to solve this challenge.”

- Kif Hancock, CIO International: “I’m just not convinced that a broad-based bubble in technology exists. Don’t get me wrong, it certainly may within a few select names. However, I’m not convinced a high-quality set of tech leaders won’t continue to beat the market despite conviction amongst many that we are in an AI bubble.”

- Amy Hauter, Portfolio Manager, Director of Sustainable Fixed Income: “Sectors like ABS, CMBS and CLOs offer compelling advantages in the current environment given wider spreads, strong structural credit enhancement and lower correlation to macro volatility. For corporates, security selection likely matters more than broad market beta.”

- Chris Diaz, Portfolio Manager: “The new Chairman of the Fed, Kevin Hassett, gets outvoted by the committee and is forced to dissent in favor of an interest rate cut.”

As for my bold prediction, I’m giving the nod to scientific innovation. Early human clinical trials will raise confidence that cellular rejuvenation therapies can help reverse aging in ways that improve long-term health outcomes. After all, any progress here aligns perfectly with my New Year’s resolution.

Take that, Spotify Wrapped!

Happy holidays! And remember to never skip a Beat – Eric

1Magnificent Seven stocks: Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA).

Source: FactSet®. FactSet is a registered trademark of FactSet Research Systems, Inc.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. An investor cannot invest directly into an index.

The S&P 500® Index is a capitalization weighted index of 500 stocks that is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns assume reinvestment of dividends and do not reflect any fees or expenses. An investor cannot invest directly into an index. Benchmark returns are not covered by the report of the independent verifiers. Standard & Poor’s, S&P®, and S&P500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc.

The MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characteristics across Developed Markets countries* around the world, excluding the US and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI All Country Europe Index captures large and mid cap representation across 15 Developed Markets countries* and 5 Emerging Markets countries in Europe*. With 445 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid cap representation across 26 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country

The MSCI AC Asia Pacific Index captures large and mid cap representation across 5 Developed Markets countries* and 8 Emerging Markets countries* in the Asia Pacific region. With 1,242 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

An investor cannot invest directly into an index.

All MSCI indexes and products are trademarks and service marks of MSCI or its subsidiaries.

Forward P/E Ratio is determined by dividing the price of the stock by the company's forecasted earnings per share.

Morningstar is a registered trademark of Morningstar, Inc.

BLOOMBERG is a registered trademark of Bloomberg Finance L.P. or its affiliates