We do what we do, so that you can focus on what matters most:

Your Business.

One of Brown Advisory’s first clients was a remarkable inventor and entrepreneur. Since then, we have guided hundreds of leaders in planning the future of their business and building their legacy.

At Brown Advisory, a dedicated team helps business builders navigate the investment and financial planning process, allowing them to stay focused on their business. We tailor our guidance by addressing the specific challenges our clients face, rather than focusing on just the benefits of our solutions. We assist clients in transitioning from relying solely on their business for income and wealth creation to building a diversified portfolio of financial assets. It is our commitment to ensure wealth created through a business is thoughtfully and strategically equipped to meet the builder’s future goals.

How We Partner with Business Builders

As with running any business, relationships and access can be the key to success. Our team can coordinate against all aspects of need and will collaborate with experts outside of Brown Advisory when specialized knowledge is required, ensuring comprehensive service.

Our Business Builder methodology aligns every element—business, estate, and family—to meet our clients’ business mission and personal goals.

Corporate Structure

Financial Health

Valuation

Operational Health

Business Planning

Sustainable Transferable

Growth Strategy

Equity Compensation

Management Succession

Cashflow

Wealth Protection

Legacy

Tax Strategy

Wealth Planning

Trust and Legal Structure

Valuation

Investment Consulting

Investment Platform

Family Mission

Values

Family and Relationships

Wealth Transfer

Personal Family Planning

Governance

Legacy

NextGen Preparation

Philanthropy

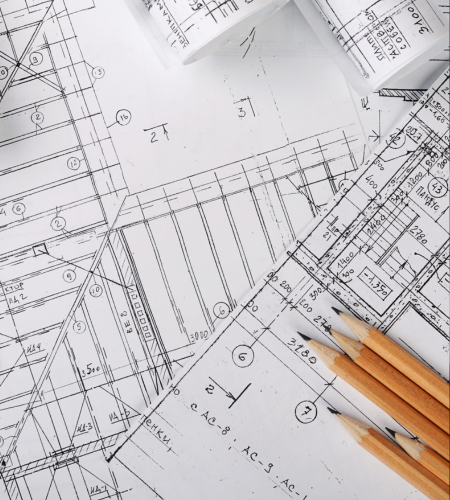

Our Tailored Approach

DEDICATED TEAMS

We assemble bespoke, cross-disciplinary teams that aim to bring strategic clarity and long-term perspective—leveraging our independence and deep expertise across investments, legal and tax to help families navigate complexity with confidence.

LISTENING FIRST, SOLUTIONS SECOND

We create client-first solutions that marry careful listening to a client’s values, objectives and goals with thoughtful awareness of external dynamics.

INSTITUTIONAL-GRADE INVESTMENTS

We provide institutional-quality access to public equity, fixed income, private equity and alternatives investments—leveraging our independence and broad strategic lens to identify opportunities across markets that matches your goals.

Client Stories

Our clients think of us as true partners – providing unbiased guidance throughout every stage of their lives, personal and professional.

We support our clients at every stage of their journey to help simplify demands and ensure that they have the freedom to focus on what really matters – the success of their business.

Read about some of our clients’ challenges and how we were able to solve their problems.