One size definitely doesn't fit all.

Every family is unique and we approach each relationship as such. Drawing on our extensive experience with generations of families, we design creative, advantageous strategies to help families reach their goals. In appreciation of both the responsibility and opportunity that wealth carries, we understand that successful families require distinct attention. As such, our practice is to create a unique solution for each family office client. Whether you are seeking a discrete set of services to complement an existing family office structure or would prefer to outsource the full family office experience, Brown Advisory is equipped to provide you with investment management, strategic advice, client service, oversight and/or administration to satisfy any of your family office goals and needs.

Some families come to us looking for a robust solution to streamline their financial life and help them achieve a certain peace of mind. Others come seeking just a specific expertise.

Brown Advisory can act as your family office, providing a comprehensive and strategic partnership for your family. We will act as a centralized advisor for your complex financial affairs, and coordinate and organize all aspects of your financial life, from investment management across multiple providers, to tax administration and organization, to entity and payroll management, to trust and generational wealth concerns.

For families with a professional family office already in place, we can augment and complement that service to help address hard-to-reach goals. Whether that requires a highly focused alternative investment portfolio, unique reporting requirements, foundation or trust administration, or aviation management, Brown Advisory works with you and your team to define a scope of work that completes the expertise your family requires.

Managing Investments

In an environment where the investment and advisory landscape is evolving—shaped by transitions of capital, management, and responsibility from one generation to the next—we partner with families to help them navigate complexity with confidence and clarity. Drawing on decades of experience working with successful families seeking diversified, long-term portfolios, we focus on delivering stability and thoughtful perspective, which we believe is enabled by our private and independent structure.

Our family office investment teams embrace a broad strategic lens that integrates insights across the investment spectrum. Supported by our global research platform, we combine internal and external expertise to identify the opportunities best aligned with each client’s goals. Our public equity, fixed income, private equity and alternatives teams collaborate closely to source high-conviction ideas across asset classes—creating portfolios designed to endure and evolve through changing market environments.

Our portfolio managers, strategic advisors and client service colleagues act as true thinking partners—marrying research rigor with agility and curiosity. They move seamlessly across public and private markets, from deals to managers and everything in between, in pursuit of distinctive, client-first solutions. By carefully listening to each family’s values and objectives and maintaining thoughtful awareness of external dynamics, we design portfolios that reflect both subjective aspirations and objective realities.

We believe the depth and breadth of our expertise positions us well to provide tailored portfolio solutions to family offices with diverse mandates. Whether building an alternatives portfolio, developing a municipal bond strategy, or curating a focused portfolio of our best equity ideas, each portfolio management team draws upon a deep bench of investment professionals and strategic insight to help clients achieve their long-term goals.

Strategic Advice

We strive to provide counsel that extends well beyond traditional investment advice—encompassing strategic planning, estate and generational wealth transfer, financial education, tax and philanthropic strategy and fiduciary oversight. Our strategic advisors serve as true thinking partners, crafting tailored solutions that reflect both the unique perspectives and objectives of each family.

In an environment shaped by transitions of capital, leadership and responsibility, our private ownership and independence allow us to remain a stable, trusted partner focused on the long term. We view each client relationship through a broad strategic lens—one that integrates legal, tax and planning considerations with ongoing investment management decisions. By collaborating closely with a family’s external advisors, we ensure that every aspect of their financial life moves in concert toward their long-term goals.

This holistic approach—drawing insights from across asset classes, macroeconomic trends and the evolving needs of family dynamics—enables us to address complex requirements with agility, continuity and strategic clarity.

Read more in our article,

Family Matters: New Considerations for Structuring Family Offices

Andrea Ayres, Director, Family Office.

Client Service

Since our founding, we have been a leading family office by strategically investing in experience and innovating to provide best-in-class solutions for our clients. Understanding that successful families require attention tailored to their specific goals and needs, we create thoughtful, customized, solutions for each family office client. Each solution incorporates:

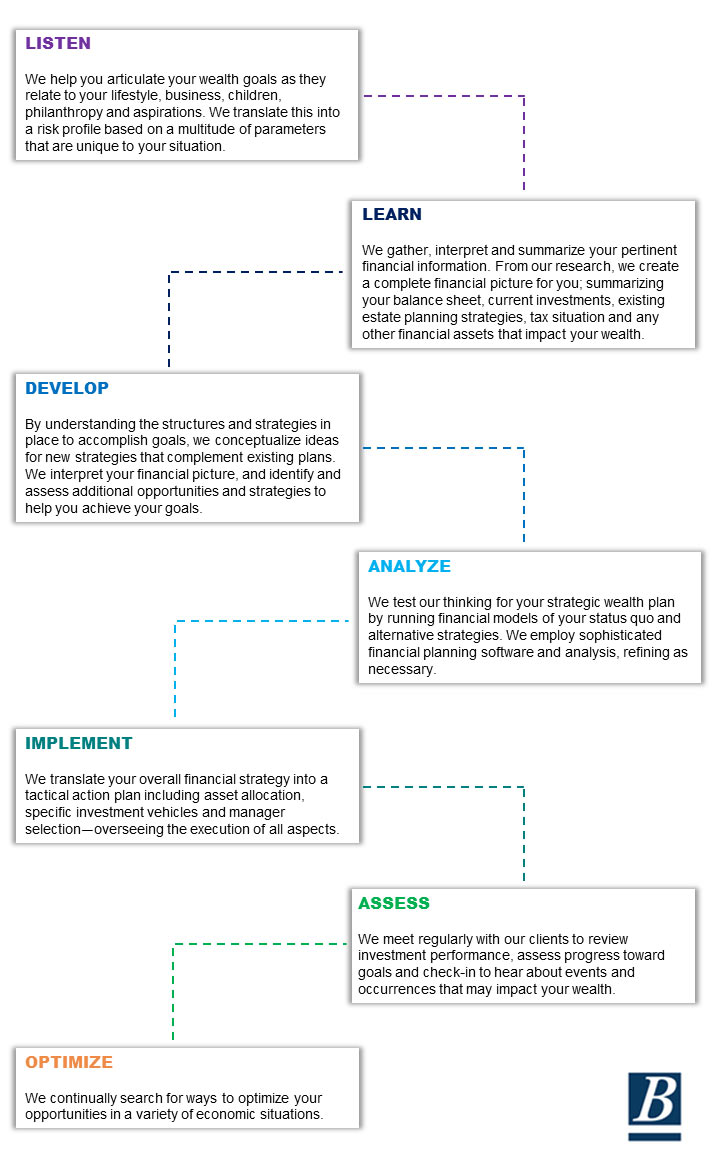

- Careful Listening. Every family’s needs are unique, as are the needs of every family office. We listen carefully to your needs before offering any advice.

- Intellectual Capital. Our 1,000+ colleagues around the world bring experience across every discipline relevant to family offices of all sizes.

- Deep Experience. Our senior team includes a number of executives who have run single-family offices with more than $1 billion in assets.