The 2024 Summer Olympic Games in Paris were nothing short of spectacular to a couch potato like myself. It was thrilling to watch the greatest athletes in the world compete for their respective countries against the backdrop of the breathtaking Eiffel Tower. I cannot fathom the amount of pressure an Olympian must feel performing in a once-every-four-years event in front of a global audience of more than three billion people. Although, the recent Netflix docuseries Simone Biles Rising offers us a pretty good idea.

It is ironic (maybe only to me) that the Summer Games concluded in parallel with the unofficial end of 2q earnings season. While I have neither the magnificent platform of the Stade de France nor the budget for an elaborate closing ceremony, I will instead offer up five “Olympic Rings” of earnings season, in a nod to the ageless symbol of The Games. As with the Olympic symbol, the five “Rings” of earnings season are interlocked and set against a common, white backdrop – in this case, the Federal Reserve’s upcoming decision on U.S. monetary policy.

Source: Shutterstock

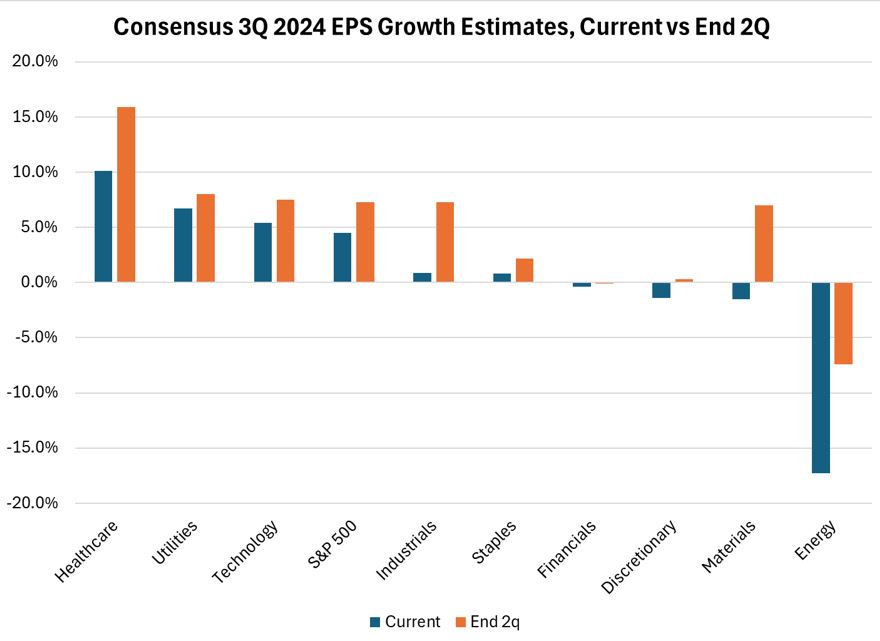

Ring 1: 3q Estimates Are Coming Down

As is often the case, most companies have beaten quarterly 2q earnings per share (EPS) consensus expectations. However, "Mr. Market" tends to respond less to reported results, and more to comments on earnings expectations for future periods. In that vein, 3q consensus estimates for EPS have broadly declined. At the end of June, the S&P 500® Index consensus EPS growth rate estimate for the September quarter was 7.3%; as of August 14th, it stands at 4.5%1. More to the point, every single sector has seen its expected 3q EPS growth rate decline since the end of 2q.

Source: FactSet; as of 6/30/2024 Sectors are based on the Global Industry Classification Standard (GICS) sector classification system.

Ring 2: Generative AI Spend No Longer Gets A Free Pass

Investors are seemingly less willing to give companies the benefit of the doubt on rising capital spending levels associated with Generative AI without an accompanying acceleration in top line growth (proof of concept). The most high-profile examples reside within the Magnificent Seven2, all of which have reported quarterly results except for Nvidia. On their earnings calls, each company made the upside case for their heavy current investments in infrastructure and hardware. No one was more succinct than Alphabet's CEO Sundar Pichai on this topic who stated, “The risk of underinvesting is dramatically greater than the risk of overinvesting for us.”

Yet, Brian Chesky, CEO of Airbnb may have said it best: “When [ChatGPT] launched, I think we all got incredibly excited. You had this feeling that everything was going to change. But one of the things we’ve learned over the last nearly two years is that it’s going to take a lot longer than people think for applications to change."

Ring 3: Consumers Are Under More Pressure

While lower income consumers have been struggling for quarters now, those who account for the bulk of consumer spending remain in stable condition, according to companies like American Express, Visa and Mastercard. However, we’ve started to notice more cracks in that narrative based on earnings call commentary than existed even only 90 days ago:

- Travel. Booking Holdings noted a mild moderation of travel market growth in Europe as well as the US. Airbnb talked about signs of slowing demand from US guests. Hilton discussed leisure travel “normalizing” from post-COVID levels. Southwest Airlines noted some “choppiness” with regards to off-peak travel demand.

- Aspirational luxury purchases. Kering (Gucci) called out lower traffic of aspirational consumers. LVMH is seeing champagne demand down double digits.

- Eating out. McDonald’s stated the consumer is eating at home more often. First Watch Restaurant Group commented that consumers are trimming weekday occasions. Even Chipotle saw a moderation in traffic growth (albeit slight) in June and into July.

- Convenience stores. Murphy USA called out softer traffic than expected in its QuickChek convenience stores. Hershey called out consumers shifting away from convenience stores into mass dollar discount stores, as did Monster Beverage.

- Theme parks. Comcast/Universal commented that visitation rates at its parks were “normalizing” from post-COVID levels. Disney expects the recent demand moderation in domestic parks could impact the next few quarters of results.

- Spending within the home. Best stated by Wayfair: “Customers remain cautious in their spending on the home, and our credit card data suggests that the category was down by nearly 25% from the peak. Adjusting for inflation suggests we’re now in the midst of a correction in excess of 35%.”

Ring 4: Deflationary Commentary Spreads Across Consumer To Industrial

While widely followed gauges such as consumer price index (CPI) and personal consumption expenditures (PCE) have shown inflation declining towards 2.5-3%, earnings season has provided tangible commentary that pockets of actual deflation now exist. Price declines are occurring within certain commodities, consumer products and the industrial supply chain. While we may cheer prices coming down, it’s important to note that persistent deflation can lead to a negative feedback loop where consumers delay purchases in the hopes of buying things for less at a later date.

- Pepsi: “There is some value to be given back to consumers after 3-4 years of a lot of inflation.”

- PPG Industries: “We experienced mid-single-digit percentage raw material deflation.”

- Eating out. McDonald’s stated the consumer is eating at home more often. First Watch Restaurant Group commented that consumers are trimming weekday occasions. Even Chipotle saw a moderation in traffic growth (albeit slight) in June and into July.

- Fastenal: “Fastener prices remained down, which is not new, but we also experienced some slippage in price from non-fastener products.”

- A.O. Smith: “We’re seeing a bit more promotional activity.”

- SiteOne Landscape Supply: “More persistent commodity price deflation in select products like grass seed and PVC pipe.”

Ring 5: M&A Activity Is on The Mend

M&A activity is at the precipice of a meaningful recovery according to investment banks and private equity firms. That is, unless the economy is about to worsen materially, or regulation becomes increasingly restrictive.

- KKR: “Announced mergers and acquisitions (M&A) is up approximately 25%. These numbers understate the run-rate activity we are feeling today. If this momentum continues, we believe you will see even more activity and announced deals and exits in 2H.”

- Goldman Sachs: “The size and scope of the companies that are out there, that have to be refinanced, recapitalized, sold, changed hands, sponsors continue to look, distribute proceeds to their limited partners, I think bodes well over the course of the next 3-5 years.”

- Morgan Stanley: “The pre-announced M&A backlog continues to build and suggests diversification across sectors. As buyers and sellers make progress to close the valuation gap, we expect that we are still in the early innings of an investment banking rebound.”

In Conclusion

The common thread across these interconnected five “Rings” remains the prospect of a Federal Reserve rate cutting cycle starting later this year and going into 2025. The Olympic motto (Latin) reads, “Citius, Altius, Fortius – Communiter” which in English means “Faster, Higher, Stronger – Together”. I can almost hear the hundreds of S&P 500 Index company CEOs who have reported results in recent weeks calling out to the Federal Reserve this same motto with regards to prospects of the economy – and rate cuts. We’ll know if our central bank hears the same message following its September meeting.

Thanks for reading, and remember to never skip a Beat – Eric

1Source: Factset®. FactSet is a registered trademark of FactSet Research Systems, Inc

2Maginficent Seven stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

Company information is sourced from each company’s earnings call.

The views and opinions expressed in this podcast are those of the speaker(s) and do not necessarily reflect those of Brown Advisory. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. The information provided in this podcast is not intended to be and should not be considered a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Sectors are based on the Global Industry Classification Standard (GICS) sector classification system. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS), “GICS” and “GICS Direct” are service marks of Standard & Poor’s and MSCI. “GICS” is a trademark of MSCI and Standard & Poor’s.

The S&P 500® Index represents the large-cap segment of the U.S. equity markets and consists of approximately 500 leading companies in leading industries of the U.S. economy. Criteria evaluated include market capitalization, financial viability, liquidity, public float, sector representation and corporate structure. An index constituent must also be considered a U.S. company. These trademarks have been licensed to S&P Dow Jones Indices LLC. S&P, Dow Jones Indices LLC, Dow Jones, S&P and their respective affiliates (collectively "S&P Dow Jones Indices") do not sponsor, endorse, sell, or promote any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. This document does not constitute an offer of services in jurisdictions where S&P Dow Jones Indices does not have the necessary licenses. S&P Dow Jones Indices receives compensation in connection with licensing its indices to third parties.

An investor cannot invest directly into an index.

Terms and Definitions:

Earnings per share (EPS) is a company's net income subtracted by preferred dividends and then divided by the number of common shares it has outstanding.