When we launched the U.S. Large-Cap Sustainable Value strategy in October of 2022, we identified a compelling opportunity at the intersection of value investing and sustainable investment research — a space we felt was underappreciated by the broader market. At the time, many strategies that integrate sustainable investment research into the investment process were concentrated in high-growth sectors, where innovation and disruption often came with elevated valuations and lofty expectations. Our belief was that sustainable business practices weren’t exclusive to one segment of the market. In fact, we saw numerous companies within sectors that are commonly associated with the value universe adopting best-in-class operational and governance standards to enhance long-term financial performance.

We often like to say that the irony of running a strategy called “sustainable value” is that if you ask ten investors what each of those words mean, you’ll likely get twenty different answers. But that’s precisely where we believe the opportunity lies. Our “dual lens” approach — combining rigorous fundamental analysis with a focus on sustainable investment research — is differentiated within the value space.

Three years into this journey, I’m proud of the progress our team has made in building a robust and repeatable investment process and energized by the investment opportunities we are seeing in the market.

“If there is one lesson we have learned from years of investing in public markets, it’s that the only true constant is change."

Free Cash Flow As Our Compass

For those new to the strategy, we define value as companies that consistently generate high levels of free cash flow, exhibit strong capital discipline through prudent balance sheet management, and trade at an attractive valuation. These “three pillars” form the bedrock of our approach, providing a margin of safety during periods of market volatility and stress.

We believe that protecting capital and minimizing drawdown risk is essential to compounding returns over the long term. When companies demonstrate free cash flow, maintain a sound capital structure, and trade at undemanding valuations, we believe shareholders are well-positioned to be rewarded over time.

Beyond financial metrics, we seek businesses and management teams that embrace sustainable business practices to extend the duration and reduce the volatility of their cash flows - what we call a Sustainable Cash Flow Advantage. While all organizations are subject to a variety of external forces like interest rate cycles, tariffs, and geopolitical tensions, our focus is on those that are laser-focused on “controlling the controllables”. Through the use of our “3P” investment filter, we evaluate how companies manage the three areas they can directly influence: the people they hire and the culture they foster, the processes they implement to run their business, and the products or services they deliver to customers.

We believe companies that leverage sustainable business practices through the 3P’s - while actively managing material risks – are best positioned to achieve a Sustainable Cash Flow Advantage. Though it may sound simple, a consistent focus on taking care of employees, running an efficient and adaptive organization, and delivering a superior product or service that allows customers to meet their goals is not only good business — it’s good for shareholders. Our long-held belief is that a “continuous improvement” mindset, when aligned with sustainable business practices, can drive differentiated and meaningful performance over time.

Embracing Change But Staying Disciplined

If there is one lesson we have learned from years of investing in public markets, it’s that the only true constant is change.

When we launched the strategy in October 2022, the market backdrop was dramatically different from where we stand today. Following a sharp post-COVID rally, markets came under pressure in 2022 as aggressive rate hikes from the Federal Reserve sparked fears of a looming recession. Those concerns ultimately proved unfounded — the S&P 500® Index bottomed in mid-October and has since climbed over 80% in just three years.1

And yet, those twelve quarters of strong returns were anything but smooth. We’ve navigated persistent inflation and elevated interest rates, a war in the Ukraine, rising geopolitical tensions, trade disputes, a shift toward deglobalization, and the boom in artificial intelligence (AI) - to name a few. We highlight these events not to dwell on the past, but to underscore a simple truth; predicting the future and timing markets is incredibly difficult. There will always be unknowns. That’s why, like the companies we invest in, we focus on “controlling the controllables.”

We leverage the depth and breadth of our research team to act with urgency and discipline - combing through our investable universe of over 1,000 companies, balancing speed with patience and a commitment to our philosophy. If change is the only constant, then embracing it is essential. Short-term volatility often creates long-term opportunity. As a team we actively seek out change — whether in price, business model, leadership, or capital allocation — leaning into these inflection points when they line up with our value discipline.

Recent investments in the strategy that were driven by such change agents include:

- CRH Plc (CRH)2 – Relocated its primary listing from Ireland to the NYSE in 2023, opening access to U.S. investors and index inclusion.

- Dell Technologies (DELL)3 – Shifted capital allocation in 2023, committing to return 80% of free cash flow to shareholders via buybacks and dividends.

- Pentair (PNR)4 - Executed a “Transformation Program” that streamlined operations and improved margins by over 500 basis points (bp) over three years, despite muted end-market growth.

- Citigroup (C)5 – Undertook a targeted divestiture and simplification initiative, consolidating into five core business lines to enhance transparency and returns.

No two market environments are alike, and volatility is inevitable. It is our job to stay prepared and separate the signal from the noise. I am deeply grateful for the team of analysts who’ve supported the strategy since inception — their dedication and daily effort are the engine behind our success. Together, we continue to scour the addressable universe for change agents and inflection points that could unlock the next compelling opportunity.

We accept mistakes will happen and that our investing style may fall in and out of favor in the short term. But by embracing the same “continuous improvement” mindset we expect from our portfolio companies; we strive to get better each day — while remaining grounded in our process and disciplined in our value investing philosophy.

We continue to believe that a portfolio of companies generating consistent free cash flow, possessing a Sustainable Cash Flow Advantage, demonstrating capital discipline, and trading at attractive valuations will deliver compelling risk-adjusted returns over the long term — while providing a margin of safety for our investors.

We appreciate your continued support and interest in the strategy. As always, we look forward to staying connected and sharing more as the journey unfolds.

– Mike

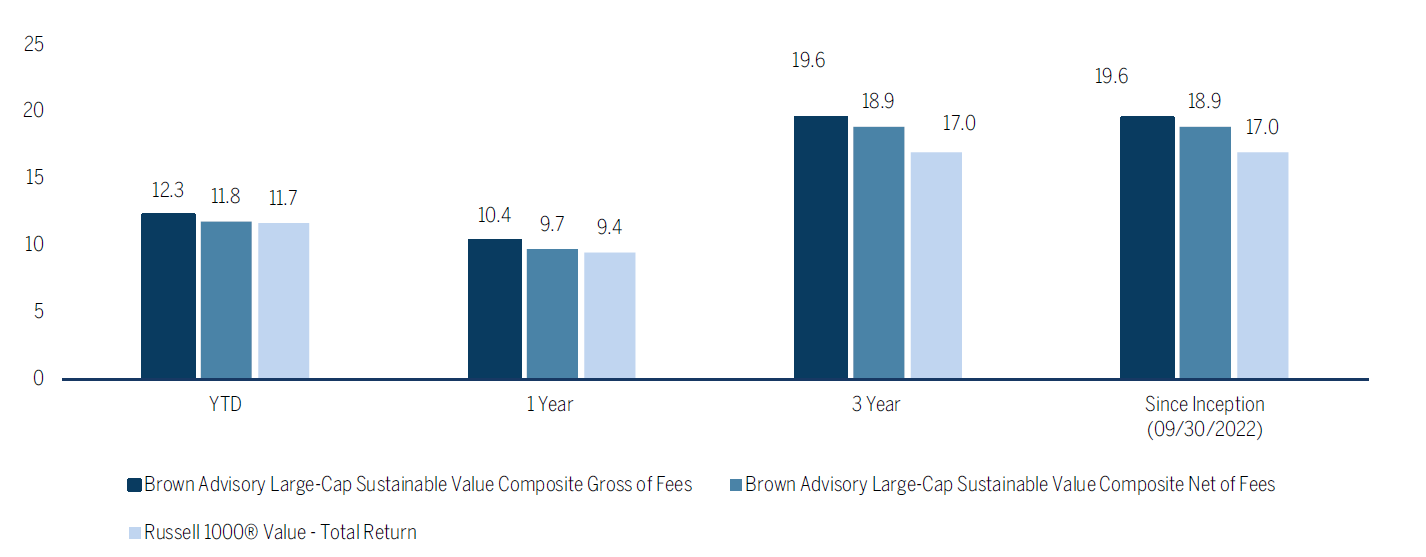

Large-Cap Sustainable Value Composite Performance6

1. Source: FactSet®, as of 08/31/2025

The listed companies represent current holdings within the Brown Advisory Large-Cap Sustainable Value strategy as of 9/30/2025. The portfolio information is based on a Brown Advisory Large-Cap Sustainable Value representative account and is provided as Supplemental Information:

2. Source: Brown Advisory analysis and CRH company reports.

3. Source: Brown Advisory analysis and Dell Technologies company report as of October 5, 2023.

4. Source: Brown Advisory analysis and Pentair company reports.

5. Source: Brown Advisory analysis and Citigroup company reports.

6. Source: FactSet® as of 9/30/2025. All returns greater than one year are annualized. Past performance is not indicative of future results and you may not get back the amount invested. The primary benchmark is the Russell 1000® Value Index. The composite performance shown above reflects the Large-Cap Sustainable Value Composite, managed by Brown Advisory Institutional. Brown Advisory Institutional is a GIPS Compliant firm and is a division of Brown Advisory LLC. Please see the end of this presentation for a GIPS Report, important disclosures and a complete list of terms and definitions.

Disclosures

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance, and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or issuers mentioned. It should not be assumed that investments in such securities or issuers have been or will be profitable. References to specific securities or issuers are to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data.

Sustainable investment considerations are one of multiple informational inputs into the investment process, alongside data on traditional financial factors, and so are not the sole driver of decision-making. Sustainable investment analysis may not be performed for every holding in evert strategy. Sustainable investment considerations that are material will vary by investment style, sector/industry, market trends and client objectives. Certain strategies seek to identify companies that we believe may be desirable based on our analysis of sustainable investment related risks and opportunities, but investors may differ in their views. As a result, these strategies may invest in companies that do not reflect the beliefs and values of any particular investor. Certain strategies may also invest in companies that would otherwise be excluded from other funds that focus on sustainable investment risks. Security selection will be impacted by the combined focus on sustainable investment research assessments and fundamental research assessments including the return forecasts. These strategies incorporate data from third parties in its research process but do not make investment decisions based on third-party data alone.

Brown Advisory Limited is registered in the Abu Dhabi Global Market (ADGM) as a branch of Brown Advisory Limited domiciled in the United Kingdom and is regulated by the ADGM Financial Services Regulatory Authority. This material is communicated on behalf of Brown Advisory Limited.

An investor cannot invest directly into an index.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index, representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The index was developed with a base value of 140.00 as of December 31, 1986. The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Value Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.

The strategy’s benchmark is theRussell 1000® Value Index. The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates. The Russell 1000® Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. The Russell 1000® Value Index and Russell® are trademarks/service marks of the London Stock Exchange Group companies. An investor cannot invest directly into an index. Benchmark returns are not covered by the report of the independent verifiers.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and / or Russell ratings or underlying data and no party may rely on any Russell Indexes and / or Russell ratings and / or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

The S&P 500 Index is a capitalization-weighted index of 500 stocks that is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns assume reinvestment of dividends and do not reflect any fees or expenses. An investor cannot invest directly into an index. Benchmark returns are not covered by the report of the independent verifiers. Standard & Poor’s, S&P®, and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc.

Factset ® is a registered trademark of Factset Research Systems, Inc.

Factset® is a registered trademark of Factset Research Systems, Inc. Global Industry Classification Standard (GICS) and “GICS” are service makers/trademarks of MSCI and Standard & Poor’s. “Bloomberg®”, and the Bloomberg Indices used are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”), and have been licensed for use for certain purposes by Brown Advisory. Bloomberg is not affiliated with Brown Advisory, and Bloomberg does not approve, endorse, review, or recommend Brown Advisory strategies. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Brown Advisory strategies.

Free Cash Flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets..