A few weeks ago, I was watching tennis phenom Carlos Alcaraz take on American Taylor Fritz in the final of the Japan Open. As a fan and former player, I marvel at the diversity of shots in the Alcaraz toolkit. On the final two points of the match, “Carlitos” delicately placed unreturnable drop shots on Taylor’s side of the court. Alcaraz is known for finishing points off with these finesse shots that barely go over the net. Even so, Fritz – a top five player in the world – was frozen by the accuracy and creativity of his opponent, who could just as easily smack 100 mile-per-hour forehands deep to the court’s corners. Carlitos shined his famous smile to the crowd after the final point, another title secured.

Source: Reuters

Albert Einstein famously stated that, “Creativity is intelligence having fun.” In the world of sport, Carlos Alcaraz exemplifies this statement. However, creativity is not just reserved for physical competition. Company executives must often think creatively to solve complex problems, particularly those involving strategy and competitive moats. I’m not referring to creative financing solutions that are often rife with risk, nor research and development driven inventions that have the potential to accelerate the arc of global productivity (both can currently describe Gen AI). Instead, a company may deliver a strategic solution that appears opportunistic against a dynamic competitive or regulatory backdrop, taking both the competition and shareholders by surprise.

In this piece, we highlight the examples of creative strategic decisions at Generac (GNRC) and Fair Isaac (FICO) this year. In addition, we’ll discuss the dilemma executives at DraftKings (DKNG) are currently facing and consider whether a creative solution could benefit shareholders.

Generac

Generac is one of the market leaders in U.S. home standby generators, with an established brand and estimated market share near 80%. For $10,000-$15,000, a homeowner can have peace of mind in the event a storm or grid malfunction leads to widespread, prolonged power outages. The company estimates that its target market is only 6% penetrated. While Generac has other business lines, the residential segment has long driven the company’s financial performance. Similarly, the stock typically trades on storm-related activity, as outages create customer awareness.

The company’s residential and even commercial generators have historically run on natural gas, which tends to have lower power output than those utilizing diesel fuel. Yet, in recent years a new source of demand for backup power generation has blossomed from the proliferation of data centers. Many of the leading diesel generator manufacturers (Cummins, Caterpillar and Kohler for example) are vertically-integrated, meaning they also make the diesel engines that go into the generators. Lead times for diesel generators for data centers are currently close to two years, given the imbalance of demand versus productive capacity at these established entities.1

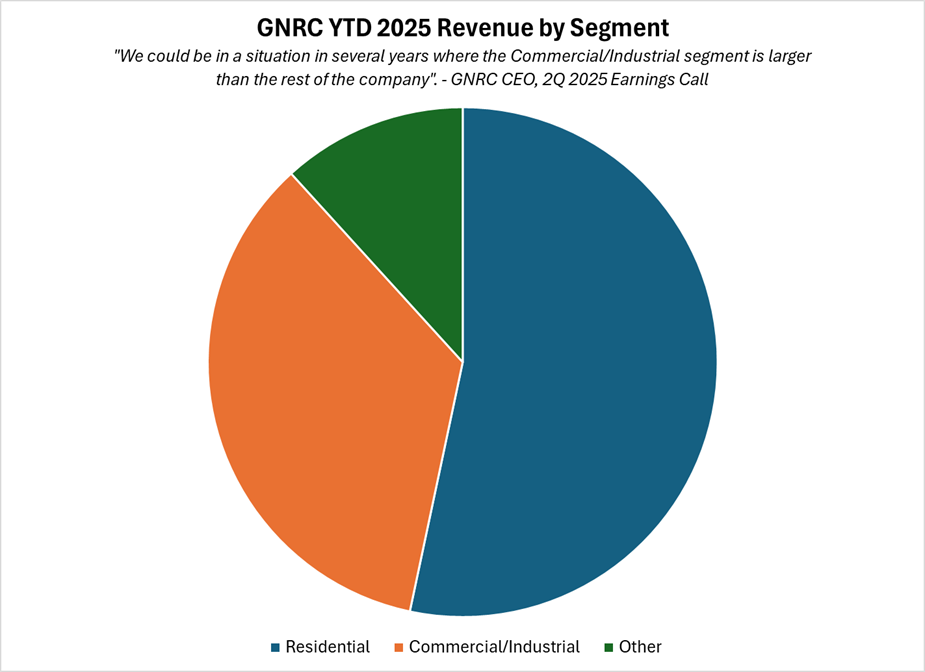

Enter Generac, whose management team has consistently evolved its energy technology offerings over time. Years ago, the company opportunistically entered and eventually dominated the backup power generation needs of the telecom industry. More recently, the company has partnered with the lone remaining global diesel engine manufacturer to construct backup generators to support the AI infrastructure buildout. On the company’s July earnings call, CEO Aaron Jagdfeld announced Generac’s entry into this underserved market, calling out a current industry supply deficit for backup generators valued at $5 billion while expressing confidence that the company’s commercial segment revenue could be larger than the rest of the company within a few years. Unlike peers, Generac has available manufacturing capacity to take on significant orders today, while it is considering ways to quickly expand capacity. We’ll see how competitors respond to a new entrant in the marketplace. However, based on the industry’s supply/demand imbalance and Generac’s available capacity and experience in generator manufacturing, the company’s future success suddenly seems less tied to extreme weather events.

Source: Company reports as of 06/30/2025

Fair Isaac (FICO)

FICO offers an example of strategic creativity in a dynamic regulatory environment. This company is synonymous with its credit score, the three-digit number that calculates a borrower’s creditworthiness. The scores business accounts for nearly all of FICO’s profitability. While not a monopoly, FICO’s credit score has been deeply embedded in loan origination systems and risk models for decades. In recent years, the company has increased the price of its score, which is primarily sold to the credit bureaus and calculated from credit report data. Despite a 2025 price of only $4.95 per score compared to an average home closing cost of $6,000, FICO has been an aggressive price taker in recent years, much to the chagrin of regulators.

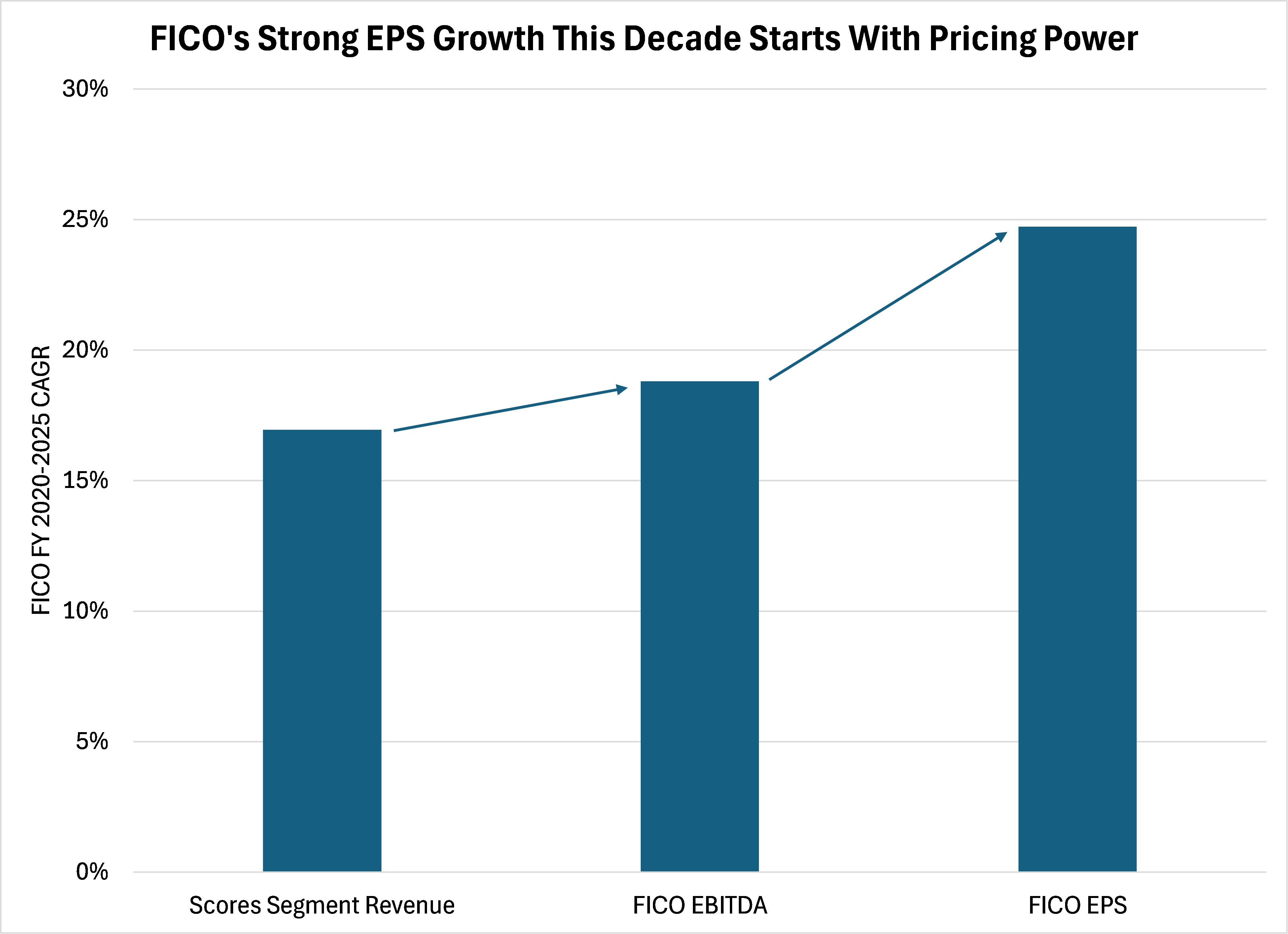

Earlier this year, the Federal Housing Finance Agency (FHFA) announced that mortgage lenders could now use VantageScore 4.0 (owned by the credit bureaus) as an alternative to FICO scores for conforming loans (those sold to Fannie Mae and Freddie Mac) to promote competition in this market. FICO management has expressed confidence in the superiority of the predictiveness and reliability of its credit score versus VantageScore, driven by its 90+% share in markets where the two have historically competed. Still, investors questioned whether FICO could both take price and maintain share in conforming mortgage loans, a combination that has supported the tripling of earnings per share (EPS) since 2020.

Note: FY 2025 figures are based on consensus estimates.

Source: FactSet as of 10/14/2025M

FICO’s strategic response this month was the launch of the Mortgage Direct License Program, allowing lenders and resellers to bypass credit bureaus and license scores directly from FICO. Marketed as a cost reduction for end consumers who would typically pay for bureau markups, the company is in fact doubling the flat-rate price of its offering for 2026 (to $10) while also providing a performance-based price option that would equate to a meaningful revenue increase for FICO. The FHFA lauded the decision despite the potential favorable impact on FICO’s financial results under the headline of “lower cost to the consumer.” FICO’s stock initially responded positively on the announcement, although it remains to be seen whether a heavily discounted VantageScore offering (as countered by credit bureaus Equifax and Experian) will drive a shift in market share over time.

DraftKings (DKNG)

DraftKings is best known for its online U.S. sports betting (OSB) business, a legal activity in 30 states. The industry is as young as it is controversial, with New Jersey becoming the first state to launch legal OSB in 2018. Since then, through investments in customer acquisition, brand awareness and technology (user interface and live/complex transactions) DKNG has secured 30-40% market share, in line with FanDuel (owned by Flutter Entertainment - FLUT).2 These two companies have effectively won the industry land grab and are positioned to benefit from future state legalizations, a growing number of players and more time spent on these apps.

Source: Sports Handle as of 12/31/2024

That is, until a regulatory loophole created mass confusion regarding the competitive moat around these two companies. Kalshi, an online prediction market, has begun offering sportsbook-style wagers on its platform. Technically, Kalshi doesn’t set odds itself and earns revenue only from transaction fees – thus it carries a different business model than the OSB companies. Yet, through the backing of institutional market makers who provide liquidity, Kalshi has begun offering lucrative parlay-style contracts, effectively competing with the OSBs in the most profitable part of their business. Importantly, unlike the OSBs which are regulated by states, Kalshi operates under federal regulation (Commodity Futures Trading Commission – CFTC). While the CFTC hasn’t formally approved sports-related events, Kalshi is currently self-certifying. Thus, it has been able to avoid state-mandated procedures, local regulations and importantly, can operate in states where OSB is still illegal – most notably California, Florida and Texas.

FLUT announced a partnership with CME Group to develop a prediction market solution in late August, although the competitive landscape is moving very quickly. Since Kalshi introduced its first parlay on September 29, FLUT and DKNG have declined 10-20%. Several states have already sued or taken legal action against Kalshi, challenging its sports event contracts as unlicensed sports betting – either taking away commissions that the states would otherwise receive from the OSBs, or operating in states where such activity is illegal.

DKNG CEO Jason Robins is in an interesting position. He remains resolute that where OSB is legal, the customer experience is far superior with a sportsbook rather than a prediction market product. Yet nearly half the U.S. population resides in states where an online sportsbook may not operate today. It’s difficult to gauge whether the CFTC will eventually block Kalshi’s actions, but if they do not, DKNG would appear to be missing out on a wonderful opportunity to immediately enter markets in which they have been prohibited by state law. Mr. Robins, the proverbial ball is in your court!

Source: Los Angeles Times

Investors and potentially competitors of Generac and FICO were initially caught flat-footed by these companies’ creative strategic actions this year – much like Taylor Fritz at the mercy of Carlos Alcaraz’s dropshots in Tokyo. It remains to be seen whether a creative solution to the predictive market threat will propel DraftKings towards accelerated growth and opportunity, and a recovery in share price. More broadly, our research team remains on the lookout for company executives who can put Einstein’s phrase, “Intelligence having fun”, into practice.

Thanks for reading, and remember to never skip a Beat – Eric

1Source: StreamData Centers as of 10/17/2025. SDC-Brief-Supply-Chain-250429.pdf

2Source: H2 Gambling Capital as of 10/17/2025. H2 Gambling Capital | Trusted Data for the Gambling Sector

Source: FactSet®. FactSet is a registered trademark of FactSet Research Systems, Inc.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

An investor cannot invest directly into an index.

Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock.

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is sometimes used as an alternative to net income.