To mark the ten-year anniversary of our Global Leaders strategy, Mick and Bertie, moderated by Susanne, share their reflections on the first decade of managing the Global Leaders strategy at Brown Advisory. In a live webinar on 12th June, they discussed the evolution of the investment philosophy and process, highlight the ongoing development and learning, and provide insights into the current positioning and outlook for the portfolio.

The webinar can be replayed below and is followed by a brief write-up. For more information on our Global Leaders strategy, please visit the strategy webpage or contact us.

Fast Reading

- Ten years ago, the Brown Advisory Global Leaders Strategy was launched with an aim to provide investment excellence – both relative and absolute returns – to clients.

- The highly differentiated process generates alpha through strong investment selection and robust capital allocation, and is further reinforced by organisational alignment, process engineering and time-based arbitrage.

- This first decade has seen the co-portfolio managers compound their knowledge, skills and process to ensure the exceptional outcomes delivered so far are repeatable for the next ten years and beyond.

Successful investing is not just about being good at one thing. It’s a blend of multiple processes that can be combined to generate alpha. After ten years of running the Brown Advisory Global Leaders Strategy, co-portfolio managers Mick and Bertie have succeeded in their mission to provide investment excellence to their clients – both relative and absolute returns – thanks to adding value through multiple sources.

Their approach focuses on two distinct processes: investment selection and capital allocation. They also draw on organisational alignment, process engineering and time-based arbitrage, which all contribute to helping them achieve their investment goals.

The result is a strategy that not only offers exceptional outcomes for clients, but its repeatable and highly differentiated process has successfully navigated the differing and challenging market environments of the last decade and we believe it is well-positioned to continue to do so.

First principles

Ten years ago, there was an opportunity to build on Brown Advisory’s incredible history of investing in the U.S. by offering clients a similar global format. The first principle of their philosophy was that they wanted to put their prospective clients first. They wanted to be able to solve a problem for them by creating value consistently over long periods of time. If they could do that, then they knew that they would have happy clients who would want to work with them over the long term.

Secondly, they recognised that the achievement of investment excellence is about more than just finding great companies; they firmly believe that an effective and repeatable capital allocation process can add to the value generation. Finally, they were humble and, despite any potential forthcoming success, they believed they could always get better at what they do. Therefore, they committed to an iterative process of constant improvement which has also led to better outcomes.

From these foundations, the Global Leaders Strategy was launched, aiming to deliver double-digit annual returns over the long term via a global, concentrated, bottom-up equity portfolio, with a long-term investment horizon.

Investment selection: customer-focused, quality businesses

Mick and Bertie have crafted a unique approach that seeks to build a concentrated portfolio of 30-40 high-quality global companies in any sector or country that they believe are capable of compounding excess economic returns over time. To find such companies, they first need to define what quality actually means. As mentioned, this all comes back to the customer, and they believe the best businesses are those that deliver something special for their customers. This laser focus typically results in happy, repeat customers, which in turn drive profitability and could generate outstanding returns for investors. Yet, this is not quality at any price – their process is very valuation sensitive, and they have high hurdles for portfolio inclusion.

To find these companies, the team undertakes meaningful fundamental research and travels to ensure they gain a wide understanding of the business models. And importantly, this analysis has to be continuous, as businesses don’t stand still after the initial review has been undertaken – companies get stronger, their moats may expand, or they can face challenges and may become weaker.

Over time, Mick and Bertie have identified certain areas that host a number of companies with the quality business characteristics they admire. These include financial market infrastructure, such as stock exchanges and data businesses that support financial decision-making; industrials and consumer aftermarkets – companies that boast a strong consumer surplus; and in the technology sector, they favour vertical market software companies and also cloud infrastructure businesses, which benefit from the explosion in data as well as the growth in artificial intelligence.

Source: Brown Advisory research. Portfolio information is based on a Global Leaders representative account, as of 06/12/2025. The use of names and logos of these entities should not be construed as an endorsement by these entities. Please see the end for important disclosures.

Capital allocation: a vital source of alpha generation

Many investors understandably focus their energy on finding the right companies in which to invest. Yet, for Mick and Bertie, this is just one aspect of alpha generation. To truly attempt to maximise outcomes, they need to allocate capital effectively by flexing their buying, selling and sizing skills. Essentially, a weekly capital allocation meeting ensures that they are allocating the most capital to their highest probability-weighted ideas. They look at the upside and downside potential and resulting IRRs of each company within the portfolio regularly. As prices reach either the upside or downside bound of their analysis, they take action to manage the overall risk accordingly. This active portfolio management approach promotes risk/reward optimisation.

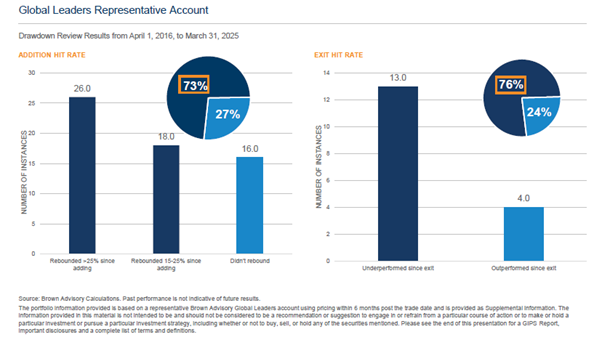

At the same time, they also prioritize protecting on the downside. While the quality aspect of their investment selection – identifying companies with strong economic moats – should provide some downside protection, they recognise that they are not investing in a perfect world, and sometimes companies do not perform as expected. To help them deal with underperformers, they employ their drawdown review process, which is triggered when a stock declines by 20% since purchase or underperforms by 20% on a rolling 12-month basis. When this occurs, they have to act. This does not necessarily result in a sale – in fact, their review often highlights a temporary or resolvable issue that implies an improved buying opportunity – but what is important is that they make a decision about their investment in the company. They don’t get it right every time, but they believe their process and resulting decisions do add value. The chart below reveals that the success rate of post-drawdown reviews has been over 70% since inception.

The chart on the left shows the number of times a drawdown review has been undertaken with the result being to add to the investment. The dark blue bars show a rebound in the company’s share price, a total of 73% of the time, while 27% of the time the share price did not recover. The right-hand chart shows the same story but for those investments where the portfolio managers decided to exit their investment following the drawdown review. In 76% of the instances, the company’s share price underperformed following the sale.

Downside risk management is core to their process and a key reason why it is split into two parts. Investment selection is about finding great companies that we believe will outperform over the long term; whereas capital allocation is all about using behavioural economics to drive alpha in real time. It’s been particularly rewarding for the team to see that both of these components have contributed to alpha generation over the last decade, with capital allocation increasingly adding value as Mick and Bertie continuously hone their portfolio management skills.

Process engineering: continuous improvement

The team’s north star is to deliver strong investment results, and their core philosophy hasn’t changed since the launch of the Global Leaders strategy ten years ago. That said, Mick and Bertie are also believers that their processes can be fine-tuned to engineer even better outcomes over time. Their day one mindset means they are continually challenging themselves about how they can improve, as individuals and as a team.

To facilitate this environment of continuous learning and improvement, they have initiated a series of events throughout the year that are designed to generate improvements. For example, their ‘Think Week’ is a week of uninterrupted reading time where they shut out other distractions to help inspire new ideas and ways to improve. They also have a team offsite every year, where they collectively pull apart their processes to see what can be enhanced.

In addition, Mick and Bertie have taken inspiration from the world of professional sport and use an external coach to review their processes and investment decisions. This interchange has been invaluable. As portfolio managers, they have to make decisions amid uncertainty and with incomplete information in a complex, adaptive system. Working with a coach who is an expert in behavioural economics helps them recognise and adapt to concepts, such as loss aversion, that can mitigate the behavioural biases embedded in the decision-making process. Such introspection forces them to be humble, as they’re often presented with information they may not like, but it has become one of the most important aspects in helping them build a more robust investment process over the last decade.

Organisational alpha

The legendary former Chief Investment Officer of Yale University, David Swensen, wrote that small, focused, independent firms with excellent people provide the highest likelihood of identifying the contrarian path to excellent investment results.1

We strongly feel Brown Advisory embodies such an environment, and that having the right set-up has supported the Global Leaders team from the start and will continue to enable them to succeed into the future. As a privately held firm in which every colleague is a shareholder, we all share the responsibility of delivering positive outcomes for our clients.

In a world of business optimisation, Brown Advisory offers the resources that Mick and Bertie need from a broad, expert team of analysts, to making sure their time is not diverted towards non-investment-related activities. The benefit of this is that they get to focus 90% of their time on investing – an advantage that they believe adds value (or what they call ‘organisational alpha’) to their overall process.

Brown Advisory initiated and has nurtured their co-portfolio management structure, which they believe has been a defining differentiator that enables their partnership to be stronger than it would be as individuals. Everybody has strengths and everybody has weaknesses, but having a teammate who is on the same quest can help mitigate these weaknesses and amplify the strengths. Such equanimity creates a safe space for them to exchange ideas with one another, express concerns as well as hopes and offer differing, but non-judgmental, perspectives.

This alignment of individual and organisational values has created a very solid foundation for the portfolio managers to hone their process over the last decade and facilitate ongoing improvements into the future.

Compounding success

Compounding is one of the most valuable tools in finance. After a decade of managing the Global Leaders strategy, Mick and Bertie believe that the benefits of compounding don’t solely apply to cash flows and share prices. They have found that their knowledge of industries and understanding of business models has also compounded, helping them with incremental improvements.

Just as Dave Brailsford, a British coach, has proven in sport, they believe the theory of marginal gains can help deliver better outcomes for investors. So, even though their process has delivered what they deem to be desirable outcomes during these first ten years, they cannot afford to sit still. They believe that they can be better investors tomorrow than they are today, and are committed to compounding their knowledge, skills, and efforts to ensure this happens, ultimately resulting in better outcomes for their investors.

1Source: David Swensen, Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment

Disclosures

Past performance may not be a reliable guide to future performance and investors may not get back the amount invested. All investments involve risk. The value of the investment and the income from it will vary. There is no guarantee that the initial investment will be returned.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell or hold any of the securities or funds mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent that specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. This material is intended solely for our clients and prospective clients, is for informational purposes only and is not individually tailored for or directed to any particular client or prospective client.

Sustainable investment considerations are one of multiple informational inputs into the investment process, alongside data on traditional financial factors, and so are not the sole driver of decision-making. Sustainable investment analysis may not be performed for every holding in the strategy. Sustainable investment considerations that are material will vary by investment style, sector/industry, market trends and client objectives. The Strategy seeks to identify companies that it believes may be desirable based on our analysis of sustainable investment related risks and opportunities, but investors may differ in their views. As a result, the Strategy may invest in companies that do not reflect the beliefs and values of any particular investor. The Strategy may also invest in companies that would otherwise be excluded from other funds that focus on sustainable investment risks. Security selection will be impacted by the combined focus on sustainable investment research assessments and fundamental research assessments including the return forecasts. The Strategy incorporates data from third parties in its research process but does not make investment decisions based on third-party data alone.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients.

Sectors are based on the Global Industry Classification Standard (GICS®) classification system. Global Industry Classification Stradndard(GICS®) and “GICS” are service marks/trademarks of MSCI and Standard & Poors.

Please see the end of the webinar for important disclosures.