JULY 2025 CHANGES EXPLAINED

The Qualified Small Business Stock (QSBS) tax exemption may allow you to avoid up to 100% of the capital gains taxes incurred when you sell a stake in a startup or small business. Here we discuss how you can apply this exemption and what you need to do to qualify.

If you own a stake (or plan to invest) in a startup or small business, you need to know about an important tax planning tool available to you. If you qualify, you may be able to avoid federal taxes on any and all capital gains you realize when you exit.

The tax benefit we are discussing is called the “QSBS exclusion,” which is shorthand for a provision in Section 1202 of the Internal Revenue Code (IRC). This section of the IRC outlines rules that potentially let you exclude from federal taxation the entire gain on the sale of Qualified Small Business Stock (QSBS). This exclusion was enacted in 1993 with a 50% limit, but recent updates to the Code have expanded it to a 100% gain exclusion. The One Big Beautiful Bill Act (OBBB) includes expansion of QSBS rules that provides favorable outcomes for Business Builders. These changes took effect on July 4, 2025.

Key Changes include:

- Shortened Holding Period with a phased in exclusion amount

- 3<4 years: 50% exclusion

- 4<5 years: 75% exclusion

- 5+ years: 100% exclusion

- Higher Exclusion Cap

- Raised from $10M to $15M per issuer

- Indexed for inflation starting 2027

- Expanded Company Eligibility

- Gross asset threshold increased from $50M to $75M

- Indexed for inflation starting 2027

- Pre-OBBB rules will remain in effect for shares acquired pre-OBBB

Note that the exclusion is limited to gains of $15 million, or 10 times the basis of your initial investment, whichever is greater. If your gains exceed those limits, you will not be able to exclude all of your gains from federal taxation; however, the allowable exclusion is still likely to be quite meaningful in nearly all cases.

So what boxes do you need to check to use the QSBS exclusion? Generally, you can use the exclusion if:

- You have held the stock for at least three years to get partial exclusion benefit and at least five years to get the full benefit

- The stock was issued after August 10, 1993

- The stock was issued by a domestic C corporation, with a max of $75 million of gross assets when the stock was issued

- The company uses at least 80% of its assets in an active trade or business

- You are a non-corporate taxpayer.

We often advise clients to think about these provisions if and when they are initiating a startup or small business investment. Although a business can be formed as a domestic C-corporation from the outset to qualify for the QSBS exclusion, a non-C-corporation entity may also convert to a domestic C-corporation at a later date—starting the QSBS holding period at the time of conversion. An additional note for those seeking to use this exclusion: Tracking which shares qualify for this benefit can be complicated because stock certificates and investor reporting rarely list this information—another reason why working closely with your tax advisors along the way can be key. Your advisors may also help you amend returns (up to three years past) to take advantage of a qualifying QSBS exclusion that you did not initially leverage.

The QSBS exclusion is most commonly applied in situations when an entrepreneur sells their company, or when investors in a private equity fund receive an in-kind distribution of post-IPO shares after a portfolio company in the fund goes public.* To be clear, there are many dimensions to this rule, and to any small business owner’s situation. We frequently work with our clients and their tax advisors to develop plans that make sense for each client. Here are a few wrinkles to keep in mind that may play a central role in your specific situation.

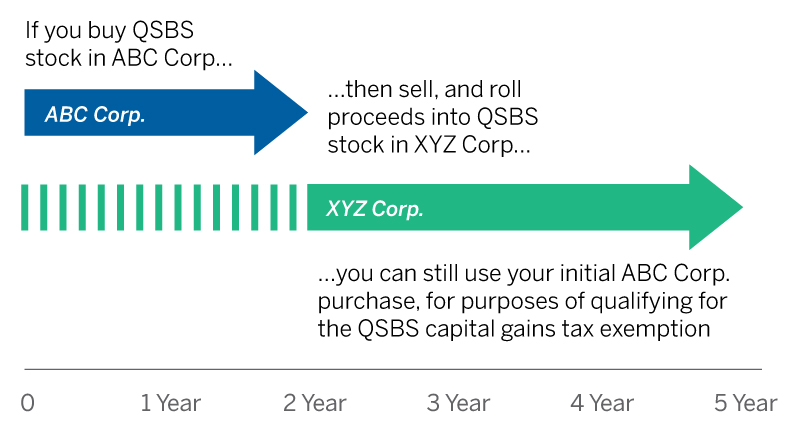

If your exit falls within the five-year window, you can still qualify if you roll your investment into another qualified small business if you wish to reach the five-year holding period. Another section of the IRC, Sec. 1045, governs this planning step, which is accordingly called a “1045 rollover” in planning parlance. This topic warrants a more detailed discussion, but you could, for example, own QSBS stock in ABC Corp. for two years, then roll that investment over into QSBS stock in XYZ Corp. In this scenario, your holding period for XYZ is, in reality, one day. But for purposes of determining eligibility for the QSBS exemption, the holding period for XYZ is considered to be two years (i.e., the period dating back to your original purchase of ABC stock). If you further hold that XYZ stock for an additional three years, then it will be treated as if you held it for a five-year term, and thus you will be eligible for the QSBS exemption.

You still benefit from the exclusion in a stock-for-stock reorganization with a non-qualifying business. Even if you exchange your QSBS stock for “non-qualified” stock (for example, stock from a large public company in an acquisition), you may still be able to benefit from your “earned” QSBS gain exclusion down the line. For example, let’s say you’ve owned qualifying stock in Startup Co. for seven years, and your basis is $1 million. Your stock is acquired by Large Public Co. (Large Public Co. does not qualify as QSBS) in a stock-for-stock transaction equal to $7 million in Large Public Co.’s stock. Your $6 million gain qualifies for QSBS exclusion. Twelve months later, your stake in Large Public Co. increases another $2 million in value, and you sell your stake for $9 million. Of your total capital gain of $8 million, you can exclude $6 million from federal taxes.

The 1045 Rollover: Additional flexibility for the QSBS tax exemption

The QSBS tax exemption requires you to hold the stock for five years, but if you sell within that window and roll the proceeds into another QSBS investment, the "clock keeps ticking"―in other words, your initial purchase date is still valid for purposes of reaching that five-year threshold.

Source: Brown Advisory.

Hopefully, this brief explanation of the QSBS exclusion rules is helpful for entrepreneurs and other small-business investors. When you initiate a startup or small business investment, it is important to consider your options with regard to business structure, and the availability of this exclusion should be one factor among many that guide your decision. And of course, no investment of this type should be made primarily for its tax benefits; the paramount considerations should be the merits of the underlying business, its potential for success, and whether the associated risk is acceptable given your circumstances. But with a moderate amount of planning and forethought, the QSBS exclusion can be a powerful tool for extracting maximum value from a startup or small business venture.

For more information on the September 13, 2021 House Tax Bill and its implications on QSBS, please read this article.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. Any business or tax discussion contained in this communication is not intended as a thorough, in-depth analysis of specific issues. Brown Advisory does not render legal or tax advice. Prior to making an investment decision, a prospective investor should consult with its own legal, tax, accounting and other advisors to determine the potential benefits, burdens, and other consequences of such investment.