Sustainable investing principles are rapidly gaining mainstream traction, but investors have prioritized these principles in some asset classes more than others. The securitized bond sector is an area that has not received much attention from an environmental, social and governance (ESG) perspective; ESG research coverage in this sector is still in the formative stages.

We have long viewed the securitized universe as an attractive opportunity for sustainable investors. As we discuss in this article, analysis of the fundamental and ESG attributes of securitized issuers and underlying collateral can help us uncover important risks and opportunities that can impact the performance of our investments. Moreover, we find that securitized bonds are attractive vehicles for investors interested in positive social and environmental impact—these bonds offer the opportunity to put capital behind issuers and underlying assets that are making a positive difference in the world.

BACKGROUND

The securitized market encompasses residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS). These bonds are backed by specific collateral and as lenders, we determine an appropriate amount of debt given the cash flow produced by that collateral. Securitized bonds can be backed by residential or commercial mortgage pools, credit card receivables, auto loans, student loans, and many other asset types that generate consistent cash flow. A benefit for investors is that securitizations are composed of different “tranches” based on a hierarchy of priority on the same pool of underlying assets. Senior tranches are the first to be repaid principal while subordinate tranches are the first to absorb losses. Investors can pick and choose the level of risk and corresponding returns that best fits their need. The securitized bond sector in total has become a meaningful segment of the fixed income universe, representing more than 25% of U.S. fixed income markets as of the end of 2019, according to the Securities Industry and Financial Markets Association.

In our view, securitized bonds offer investors several compelling opportunities from an ESG and impact perspective. First, we have long believed that ESG research can notably enhance a fixed income investor’s ability to assess the creditworthiness of an issuer and the chance of default embedded in any given security. We have integrated ESG research into every step of our fixed income investment process for this reason. We feel that ESG factors are particularly helpful in analyzing securitized bonds, as these factors can influence the financial health of the assets backing a securitized investment.

Further, these bonds offer investors the ability to put their capital behind a wide range of issuers, properties and projects that are generating positive social and environmental impact in the world. Mortgage pools representing energy efficient properties or with impactful, mission-aligned tenants, securitizations backed by smart agriculture equipment leases and bonds backed by consumer loans that improve access to credit to traditionally underserved communities are examples of concepts that can become an investable opportunity through the securitized bond market.By reviewing the ESG merits of issuers and underlying collateral, we believe we have uncovered many interesting investments whose positive impact attributes may not be readily apparent at first glance.

CASE STUDIES

Below we offer two case studies of securitized bond issues that we consider to be attractive from both an ESG and credit perspective. Although we have historically found opportunities in all corners of the securitization market, we have chosen two examples from the CMBS segment, simply because the financial stresses produced by the COVID pandemic have created meaningful disruptions to the commercial real estate market. We believe strong ESG and sustainability diligence should be a driving force behind the divergent performance we expect to see across the varied landscape of the CMBS market.

Case Study: Lineage Logistics’ Cold Storage Portfolio

Founded in 2012, Lineage Logistics is one of North America’s largest refrigerated warehousing companies, with over 200 facilities in North America, Europe and Asia. The mortgage securitization we are discussing is backed by sixty four of the company’s temperature-controlled warehouse and distribution facilities. This investment lets investors fund tangible positive impact in one of the most energy-intensive segments of the food supply chain. In handling 40 billion pounds of food annually, Lineage Logistics consumes as much energy per year as 50,000 U.S. households.

Notably, the company has been working diligently to improve energy efficiency through both technological innovation and improved operational effectiveness. From 2014 to 2017, the company reduced its energy intensity by 34%, by installing thousands of internet-connected temperature sensors in its warehouses, by using artificial intelligence to regulate refrigeration throughout the day and by implementing “densification” programs that have allowed Lineage to pack an extra 800,000 square feet of product into its 162 facilities. The company’s efforts have generated more than $4 million in annual savings, thereby cutting energy consumption by the equivalent of what 240,000 home refrigerators use per year.

Over both the short and long term, cold storage has seen growing secular demand as consumer preferences have shifted towards fresh foods, partially as a result of health and wellness trends, as well as more efficient supply chains making them more affordable. For instance, according to the Bureau of Labor Statistics’ Consumer Expenditures Survey, fresh fruits and vegetables are expected to grow 2.4% per year through 2023. Moreover, during the Great Recession of 2007-2010, fresh fruits and vegetables was the only food sector to grow (1.4% CAGR). This should bode well for Lineage Logistics. According to commercial real estate firm CBRE, 95% of food produced in or imported to the U.S. goes through third-party distribution centers before reaching consumers.

Recently, we have seen a surge in demand for freezer and cooler space from consumers who are sheltered in place during the coronavirus crisis. Per IRI’s Consumer Packaged Goods Demand Index, demand has increased as consumers are both spending more dollars at stores and increasing their trip frequency. Looking forward, we expect these trends to continue to shape the food industry. We believe that improving fundamentals, coupled with sound management, should lead to solid risk-adjusted returns and reduced risk of default for the CMBS backed by Lineage’s warehouse portfolio.

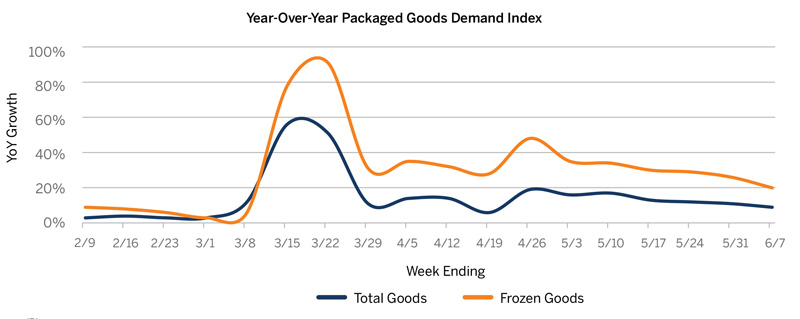

GROWTH IN PACKAGED GOODS DEMAND INDEX

Consumers’ shopping habits have been sharply impacted by the COVID-19 crisis. The chart below illustrates the year-over-year growth of a basket of packaged goods on a weekly basis. While there was a positive shock to demand for all goods at the onset of the COVID-19 crisis (blue line), demand for frozen goods (orange line) spiked considerably higher year-over-year in March 2020 and has remained elevated, attributable to consumers stockpiling food during shelter-in-place postures.

Source: IRI.

Case Study: Center for Life Science, Boston MA

The Center for Life Science, adjacent to Harvard Medical School, provides laboratory and office space to support medical research to leading clinical and academic health care institutions in Boston. These entities (see table above) are collectively responsible for a great deal of cutting-edge medical research and high-quality patient care.

Specifically, the physical building is LEED Gold certified, a testament to the environmental profile of the property itself. However, it is the tenants themselves that make this property attractive from an impact standpoint. The two largest tenants are Beth Israel Deaconess Medical Center and Boston Children’s Hospital, both high-quality teaching hospitals of Harvard Medical School and world-renowned research institutions. Indeed, Beth Israel is ranked third in the country for NIH funding among independent hospitals and Boston Children’s hospital is ranked as the top hospital for pediatric research. The space at the Center for Life Science is specifically used for neurology research with the goal to create better treatments for patients. Boston Children’s Hospital is recognized as the top hospital in the country for pediatric neurology and neurosurgery, in addition to its ranking as the number one pediatric hospital overall according to U.S. News & World Report.

Additional tenants include other leading medical institutions such as the Dana Farber Cancer Institute and Harvard College’s Wyss Institute. Centrally located in Boston’s medical hub, the Center for Life Science plays a critical role in translating research to medical practice, as the tenants work to solve some of society’s greatest health challenges.

This is a single-property securitization, so as an investor we do not enjoy the benefit of diversification that comes with a broader pool of assets. Therefore, we must have a high degree of confidence that the property’s value is supported by local market trends and other competing forces. Similarly, we want to see tenants with stable business models that are backed by solid industry trends, and finally we want to ensure that lease terms and timeframes can provide an attractive path for cash flow. We believe that this investment passes all of these tests; notably, all of the Center for Life Science’s tenants have credit ratings of A3 or higher according to Moody’s; commercial tenants with such strong ratings are relatively rare, and a building 100% occupied with such tenants is rarer still.

| Tenant | % of Occupancy | Tenant Credit Rating | Lease Expiration | Purpose |

|---|---|---|---|---|

| Beth Israel Deaconess Medical Center | 51.5% | A3 | 6/30/2023 | Teaching hospital of Harvard Medical School |

| Children's Hospital Corporation | 22.4% | Aa2 | 4/30/2023 | Pediatric teaching hospital |

| Dana-Farber Cancer Institute | 7.2% | Aa2 | 3/31/2028 | Center for cancer treatment and research |

| Immune Disease Institute | 7.1% | A1 | 4/30/2023 | Program in Cellular and Molecular Medicine |

| Harvard College/Wyss Institute | 5.7% | Aaa | 12/31/2021 | Alliance of Harvard’s Schools of Medicine, Engineering, and Arts & Sciences |

Source: Brown Advisory analysis.

CONCLUSION

Hopefully, these examples offer a sense of the impact that securitized investments can produce, and also illustrate the way in which we integrate fundamental, ESG and impact considerations into our investment process. ESG research, in our view, truly adds value to our investment decisions; we believe this to be especially true during the COVID crisis and its aftermath. The issuers behind many of our securitized investments are on the front lines of the crisis, from medical research institutions to real estate properties that offer affordable housing options to people whose fragile financial situations have been worsened by COVID. Further, we are seeing a wide range of responses among mortgage lenders to this crisis, with some offering relief to distressed borrowers, while others take a more draconian stance. We believe that the lenders who adopt a more thoughtful approach during this period should be in better shape as we emerge from the crisis. These are additional examples of the trends and insights that we seek to uncover with our ESG research in this asset class.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.