As winter gave way to spring, my family binge-watched The Reluctant Traveler with Eugene Levy – a 2023 Apple TV+ series that brought the neurotic protagonist to exotic locations around the world. The comedic legend’s fear of the unknown was put to the test throughout the series, although by the end of each episode Mr. Levy developed a sense of comfort with the land and people with whom he visited.

Source: Apple TV+

To the contrary of Mr. Levy’s travelling trepidations, I carried a tinge of excitement last month when I headed to the faraway city of Cincinnati (one-hour flight), with some of my research colleagues. Due to COVID and other factors, it had been a while since I’d traveled with teammates to visit a facility of one of our portfolio companies. I’ve always found that these trips are more educational and memorable than attending conferences. Although, there is some efficiency to consecutive 30-minute meetings with different management teams in hotel suites, this version of “speed dating” struggles to offer the proper backdrop to really learn what makes a company tick.

These road trips allow for focused time with colleagues that you don’t get, even as we are all back in the office. On the road we’re able to collaborate on our learnings from these visits in real-time, as well as debate the significance of these takeaways within the context of an investment thesis. Beyond the investment discussions, the value is in building rapport with tenured colleagues and connecting with newer team members hired during or after the pandemic. The strong relationships built across the team over time have led to honest dialogue, less “groupthink” and colleagues finding their voice more quickly. In my opinion, that is one of the key competitive advantages an investment team can have.

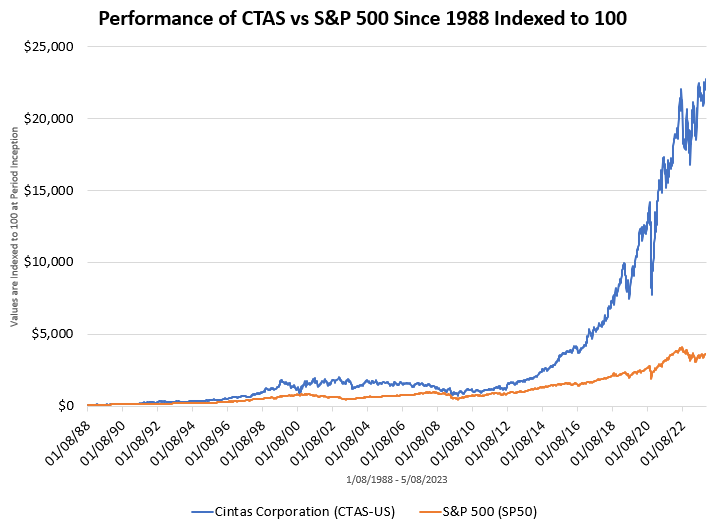

It's hard to doubt the competitive advantages of Cintas (“CTAS”) today; the largest provider of uniform rentals and facility services in North America. We’ve owned CTAS in our Large Cap Growth and Mid Cap Growth strategies for a number of years. CTAS has been a wonderful investment for a very long time, having returned nearly 18% annually since going public forty years ago (the S&P 500 has risen nearly 9.5% annually since that time). This type of long-term compounding only occurs with a phenomenal underlying business model, competent management vision and execution.

Source: FactSet

We were privileged to receive an invitation to visit a Cintas facility on the outskirts of Cincinnati. The sheer volume of garments in the facility, transported from one station to another through automation, was astounding and we believe instantly showcased the company's scale advantage. The facility manager commented that the workspace reminded her of a scene from Monsters, Inc., where doors were whizzing around everywhere. However, the Cintas facility was decidedly more organized, with each garment tagged for identification.

Source: Cintas

During the tour, we gained an understanding of the importance Cintas places on its employees, including comprehensive training and opportunities for career advancement. We also developed a sense of the complexity surrounding the logistics in optimizing delivery route efficiency, especially when new customers are added. Route density (a single vehicle picking up/delivering uniforms and equipment regularly) leads to more time spent servicing customers and less time driving. As management likes to say, “we don’t generate any revenue when wheels are moving; it’s only when the wheels stop.”

The tour was followed by a discussion with senior management over lunch. While “speed dating” type meetings tend to feel rushed and often focus on reiterating recent quarterly results, discussions over meals are often more relaxed and provide the opportunity for management teams to broadly express their strategic vision over the next five or ten years (or even longer). The primary question on our minds centered around the sustainability of the company's robust organic growth, which has averaged in the high-single digits for many years.

Source: Cintas

We came away with an enhanced confidence that Cintas has numerous levers at its disposal, including innovation, new markets and further partnering with its existing customer base of over one million clients. We believe that this will maintain profitable top line growth at multiples of GDP for a long period of time. However, not every company visit concludes with a favorable or reinforced outlook; I can recall several instances in the past when we’ve visited an existing portfolio company only to conclude that our long-term investment thesis was no longer valid.

The true value of the research road trips lies in gaining a deeper understanding of a business and management team while simultaneously building an informal connection with colleagues for honest intellectual debate. This combination of knowledge and culture is essential to executing on our investment decision making process.

It almost sounds inviting enough for The Reluctant Traveler to join our next trip! 😊

Thanks for reading, and remember to never skip a Beat - Eric ![]()

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Factset® is a registered trademark of Factset Research Systems, Inc.