Sustainable investing is smart investing.

Investors all over the world are realizing how the intersection of financial, social and environmental ideas can lead to better investment results. In the past, many investors believed that they needed to make a tradeoff between returns and values, but over many years we have found that our sustainable research has contributed positively to returns.

A thoughtful sustainable investment strategy can go beyond financial results, and help investors achieve a broader set of goals through their investment decisions. We have decades of experience working with clients to develop strategies that reflect their values, and help them deploy their capital in a manner that positively impacts society.

From our wide variety of equity and fixed income managed portfolios, to our work with nonprofits and families to develop bespoke long-term investment plans, we have the experience and capabilities to help clients pursue the specific sustainable investment goals that are most important to them.

Investment Capabilities

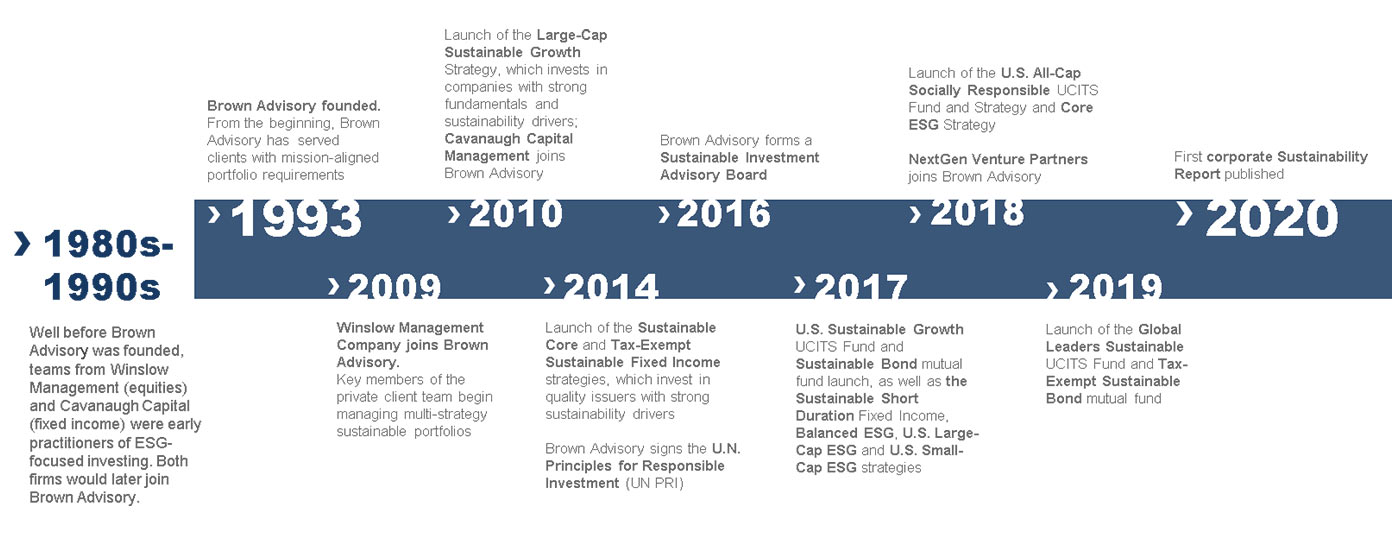

Our roster of sustainable investment strategies continues to grow as we develop solutions for clients across various asset classes. The end of 2019 marks the 10-year anniversary of our Large-Cap Sustainable Growth (LCSG) strategy and it has been one of our firm’s best-performing strategies relative to its benchmark and category peers since its inception. Other equity strategies embrace sustainable research as a key driver of their investment processes. This includes our Global Leaders strategy, which recently launched a Global Leaders Sustainable UCITS Fund that delivers exclusions, above and beyond the existing ESG integration in the Global Leaders strategy. In addition, we also provide specifically desired outcomes to clients in an efficient structure. These include a number of Active ESG strategies. Finally, our sustainable fixed income strategies—Sustainable Core and Tax-Exempt Sustainable—have rapidly gained traction with clients and performed well.

We also provide a comprehensive solution for families, nonprofits and other clients with balanced portfolios, including an in-depth process for specifying priorities and developing investment policies, as well as sustainable asset allocation models and a robust platform of third-party managers. For a discussion on how we have helped nonprofits build mission-aligned investment programs, read our article The Other 95%.

Learn more about our sustainable investment strategies

Reporting and Policy Statements

Transparency and disclosure are essential drivers of progress in sustainable investing. We seek to hold ourselves to the same standards that we expect of companies, municipalities and bond issuers, in terms of offering clear policies that describe our sustainable investment approach, as well as periodic reports on the impact and sustainable merits of our strategies.

Policies

Balanced Portfolio Reporting

We have in-depth research regarding the ESG risk and impact exposures present in every single strategy we recommend to balanced-portfolio clients. We have painstakingly translated that research into a comprehensive reporting tool, which allows us to provide complete transparency to our clients about their investments, and greatly enhances our conversations with those clients about progress to date and potential actions to consider in the future.

Reports

Our latest sustainable investing insights.

Corporate Sustainability Report

We are pleased to present Brown Advisory’s second Sustainability Report. In this report, we express our commitments and report our progress on initiatives that aim to contribute to a more just, healthy and prosperous future for all.

With every action we take, we have the opportunity to improve the circumstances of our clients, colleagues and communities. We have always pushed ourselves to set an example for the role that we can play in helping, supporting and speaking for these groups. We believe that, as leaders, we need to pursue multiple paths forward. We must satisfy the current expectations of our clients, colleagues and communities, but also think ahead, and act in thoughtful and innovative ways to deliver on expectations that are not yet widely expressed by our stakeholders. To us, that is what sustainability leadership is all about.

CLIMATE WEEK SPECIAL EDITION PODCAST EPISODE

Fighting Fire:

Investing in Climate Resilience

With devastating wild fires and floods filling our news feeds, the consequences of a changing climate have rarely felt more acute or urgent. In the midst of Climate Week, Brown Advisory’s Karina Funk sat down with Kate Gordon, who leads climate policy for the state of California and is one of the world’s foremost authorities on the intersection of business and climate.