Record issuance, growing demand for capital to fund green projects and returns in line with other bonds of similar profiles: Green bonds can be a great opportunity for clients interested in sustainable investing—if they are incorporated with clear allocation goals in mind. We discuss our strategies for investing in this dynamic and evolving arena.

As professional investors, we are constantly searching for the elusive “no-brainer.” Our holy grail is the investment that offers our clients clear additional benefits without additional risk.

Such investments are not easy to find. For every growth story, there’s the chance that market forces will undercut that growth. For every fund with a stellar track record, there’s the chance that its style will drift or its manager will depart or lose focus, potentially leading to disappointing results.

We think that green bonds are a “no-brainer” for clients focused on sustainable investing. Green bonds offer similar yields, ratings and return profiles to other fixed income investments, and they fund projects that are making a tangible and measurable impact in the effort to address environmental challenges. In other words, they offer additional impact benefits for investors, without additional financial risk.

That said, there are still diversification challenges for those who want to invest in green bonds. We believe that our approach to building sustainable bond portfolios, in which we use green bonds alongside other bonds with attractive environmental and social characteristics, is an effective way to achieve our clients’ investment and sustainability objectives.

Green Bonds 101

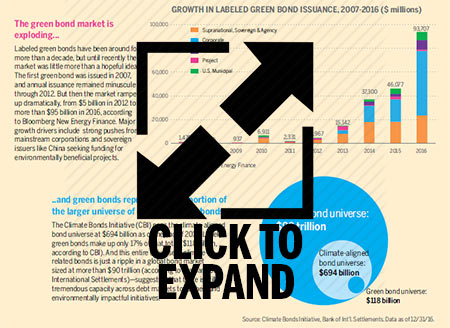

In the past few years, the green bond market has experienced explosive growth. We expect that this growth will continue due to high investor demand and the mounting demand from both governments and corporations for capital to fund environmental projects. (Click the thumbnail at right to expand the infographic with an overview and snapshot of the green bond market.)

There are a number of reasons that clients may be interested in adding green bonds to their portfolios. The primary incremental benefit that green bonds provide is as an “impact investment”—investors in these bonds know that they are directly funding projects that address environmental challenges. Labeled green bonds earn their certification during the underwriting process by following a set of guidelines such as the Green Bond Principles or the Climate Bonds Standard. Issuers of a labeled green bond must identify how proceeds will be used in advance of issuance and pledge to report about the resulting environmental outcomes. There is also a large body of “climate-aligned” bonds that are issued outside of any labeling process but nonetheless target projects that address climate change issues in a variety of sectors.

Georgia Power’s green bond, issued in 2016, is a good example. Georgia Power has a strong sustainability profile relative to its industry. It has the largest voluntary renewable portfolio of any U.S. utility—approximately 2 gigawatts, according to the company; it leads its peers in supporting solar generation by its customers; it is in the midst of a $5 billion environmental construction program aimed at reducing emissions of sulfur dioxide, nitrogen oxide and mercury from its power plants; and it returns 90% of the water it uses in daily operations (more than 1 billion gallons per day) safely to public waterways. The proceeds of its green bond are earmarked for projects that will produce 250 megawatts of wind energy—enough electricity to power more than 50,000 homes.

Before Brown Advisory invests in green bonds, we perform our own review of the intended use of proceeds for the bond and the sustainability profile of the issuer, on top of the rigorous credit research we conduct on any potential bond holding. Once we gain conviction in both the fundamental and sustainable characteristics of a green bond, we then look to see where it might fit across all of our fixed income strategies, not just our sustainable portfolios. Georgia Power, for example, offers a strong fundamental credit outlook, in our view. As a rate-regulated operating company, it inherently benefits from strong, stable cash flow generation. Due to vertical integration, it enjoys diverse income streams from generation, transmission and distribution, and it has a strong relationship with the Georgia Public Service Commission, which provides a level of comfort about its rate outlook going forward. Finally, it benefits from relatively strong economic conditions in the regions it serves.

The labeling and impact reporting processes for green bonds are still entirely voluntary, but the market has benefited greatly in recent years as issuers have begun to coalesce around a standard issuance and reporting framework. The International Capital Markets Association has been instrumental in that effort, bringing together investors, issuers and underwriters into an unofficial governing body that developed and published the Green Bond Principles in 2014. These principles are voluntary guidelines for green bond issuers that outline the proper use of proceeds, project evaluation and selection, management of proceeds, and reporting. Even though the framework is voluntary, green bond investors increasingly expect issuers to adhere to them. The Climate Bonds Certification process provides standards with some clearer sector-specific eligibility criteria, and various other groups, such as the Investor Network on Climate Risk organized by Ceres, are contributing to the promulgation of standards.

Increased investor appetite has led many firms, such as Standard & Poor’s, Bank of America, Barclays and MSCI, to launch green bond indexes. These can be helpful tools, but investors must understand that every index has its own distinct definition of what is, and is not, a green bond. An important aspect of our research as well as that of other green bond investors is reviewing a second opinion regarding use of proceeds from an impartial third party; the Center for International Climate Research is a leading provider today, and Moody’s recently became the first ratings agency to develop a process to assess use of proceeds. Unfortunately, second opinions are generally limited to a review at time of issuance. Bond and issuers are not closely monitored after the fact, which in our view underlines the importance of the ongoing use-of-proceeds research we conduct on bonds that we hold.

The importance of an independent view on use of proceeds was exemplified recently in a green bond issued by an agency in Massachusetts. This bond made headlines once it became known that some of the proceeds were actually earmarked for a 725-space parking garage at Salem State University near Boston. The issuer justified the green label, citing a small number of spaces allotted for electric car-charging stations and spots for carpoolers in the lot. We, and many others, viewed the use of proceeds for this bond with skepticism, and we see some danger of the market being discredited if rare cases like this become more common and buyers become wary of green bonds due to lack of confidence in their impact. For our part, we must guard against the potential for greenwashing and remain focused on conducting our own due diligence.

Adding Green Bonds to Portfolios

As noted earlier, individual green bonds generally perform in line with any other bond with comparable duration, sector and maturity, but in aggregate, the green bond market is not entirely comparable to the broader market.

For one, the green bond market is not as diverse across credit qualities, sectors, maturities and geographies as the broader global bond market. As noted in the infographic, the majority of green bond issuances are from various government entities—local governments, multilateral development banks, agencies or state owned entities. From a sector standpoint, transportation and energy dominate issuance. According to CBI, the climate bond universe is relatively long-dated (70% of bonds have maturities of 10 years or more), concentrated in high-quality investment-grade issues (43% of the entire universe is AAA-rated) and concentrated geographically (70% of issuance comes out of China, the U.S., the U.K. and France).

Also, because the green bond market is still quite young—the first green bond was issued in 2007, and most of the outstanding inventory was issued in the past couple of years—any strategy focused solely on green bonds will have a short track record and may need to grapple with limited secondary liquidity.

Although a focused green bond strategy may struggle to track with a broader bond benchmark, green bonds can still play an important role within any client’s fixed income allocation. Here are three general principles we keep in mind when building portfolios for clients.

- Cast a wider net. In our sustainable bond portfolios, we invest in other issues that are not officially labeled green bonds but nonetheless provide a path to environmental impact or alignment with a general environmental protection mission. CBI notes that the climate-related bond market totals approximately $694 billion, and green-labeled bonds are only about 17% of that total. So a first step for us is to focus research on finding bonds that are funding impactful projects, regardless of whether those bonds are issued under a green bond certification program. We further expand our universe by investing in the debt of companies or other issuers with strong environmental, social and governance profiles. In this way, we can build more diverse portfolios of bonds with positive sustainable characteristics, not to mention more robust, in our view, in terms of their likely tracking with standard performance benchmarks.

- Be benchmark aware, not benchmark driven. As bond managers we adhere strongly to a philosophy that fundamental credit research is the best way to drive attractive returns. While we have no control over interest rates and economic trends, we do have control over our knowledge of individual issuers, their creditworthiness and their long-term prospects. We believe that this credit-focused approach offers the potential for core stability and outperformance by being highly selective about the bonds within our benchmarks that we choose to own. However, being different from our benchmarks does not mean that we ignore them—to do so would likely lead to unintentional bets on interest rates or other factors. As stated previously, the green bond universe is quite concentrated in long-dated, investment-grade bonds from a few countries, and by pairing bonds from this universe with bonds offering complementary characteristics, we can achieve the diversification we seek.

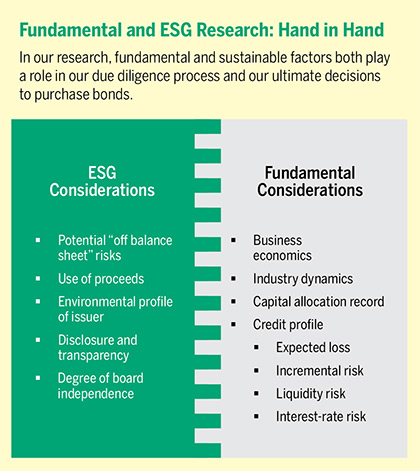

- More research is better. We believe that maintaining both a fundamental standard and an ESG standard in all of our research leads to better decisions in our portfolios. Any labeled green bond we consider still needs to clear our hurdles for creditworthiness, as well as the environmental and social risk profile of the issue and our independent evaluation of use of proceeds. Likewise, we carry out ESG research on all potential holdings— not just those being added to our sustainable portfolios. Fixed income research is all about identifying risk, and if we examine a bond using a broader set of research tools, we believe we improve our ability to assess that bond’s risks. And as we noted previously, by fully vetting green bonds, we can confidently use them in any of our fixed income portfolios. As of the end of 2016, 68% of the green bonds that we own in our sustainable strategies are owned in other fixed income strategies as well—evidence that we consider these bonds to have broad merit.

The future for green bonds appears bright. The need for capital for climate-related investments in the coming decades is immense; various global agencies estimate that as much as $2 trillion to $3 trillion of capital will be needed annually to mitigate the worst climate-related scenarios, and the fixed income markets will need to provide a large proportion of that funding. Meanwhile, green bond issues are regularly oversubscribed today, and demand appears to be growing among mainstream investors. For investors focused on sustainability, green bonds represent a powerful opportunity to pursue positive environmental change while also earning attractive fixed income returns, and with proper attention to due diligence and portfolio construction, we believe that such bonds can play a role in any investor’s bond allocation.

Total Return is the actual rate of return of an investment or a pool of investments over a given evaluation period. Total return includes interest, capital gains, dividends and distributions realized over a given period of time.

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed or it will cease to exist. The term is commonly used for deposits, foreign exchange spot and forward transactions, interest rate and commodity swaps, options, loans and fixed income instruments such as bonds.

Duration is a measure of the sensitivity of the price–the value of principal–of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond prices are said to have an inverse relationship with interest rates. Therefore, rising interest rates indicate bond prices are likely to fall, while declining interest rates indicate bond prices are likely to rise.

Credit Quality is one of the principal criteria for judging the investment quality of a bond or bond mutual fund. As the term implies, credit quality informs investors of a bond or bond portfolio's credit worthiness, or risk of default.

The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multicurrency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. Bloomberg Barclays Indices are trademarks of Bloomberg or its licensors, including Barclays Bank PLC. The BofA Merrill Lynch Green Bond Index tracks the performance of bonds whose proceeds are to be used solely for projects and activities that promote climate or other environmental sustainability purposes. The index includes debt of corporate and quasi-government issuers, but excludes securitized and collateralized securities. The BofAML indices, including all trademarks and service marks relating to BofAML, remains the intellectual property of Bank of America Corporation.

Private investments mentioned in this article may only be available for qualified purchasers and accredited investors.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.