UPDATED 3Q2025

Background: The Resource Tipping Point

The rise of generative artificial intelligence (GenAI)1 is driving a transformative technological revolution. The data center value chain stands at the precipice of one of the largest capital allocation opportunities in modern history. This could amount to nearly $7 trillion in capital outlay by 2030 to meet compute power demand.2

Regardless of which methodology you reference to project capital expenditures and compute power growth, this massive buildout exposes both compelling investment opportunities and constraints. In this era, power is king. As GenAI workloads increase, some experts project that electricity demand from data centers worldwide could more than double by 2030 to around 945 terawatt-hours (TWh), slightly more than the entire electricity consumption of Japan today, threatening grid capacity.3 Critical questions arise for investors: How will hyperscale data centers overcome resource constraints? Which companies are poised to benefit and which will face disruption? To what extent, and when, will the capital-intensive investments pay off?

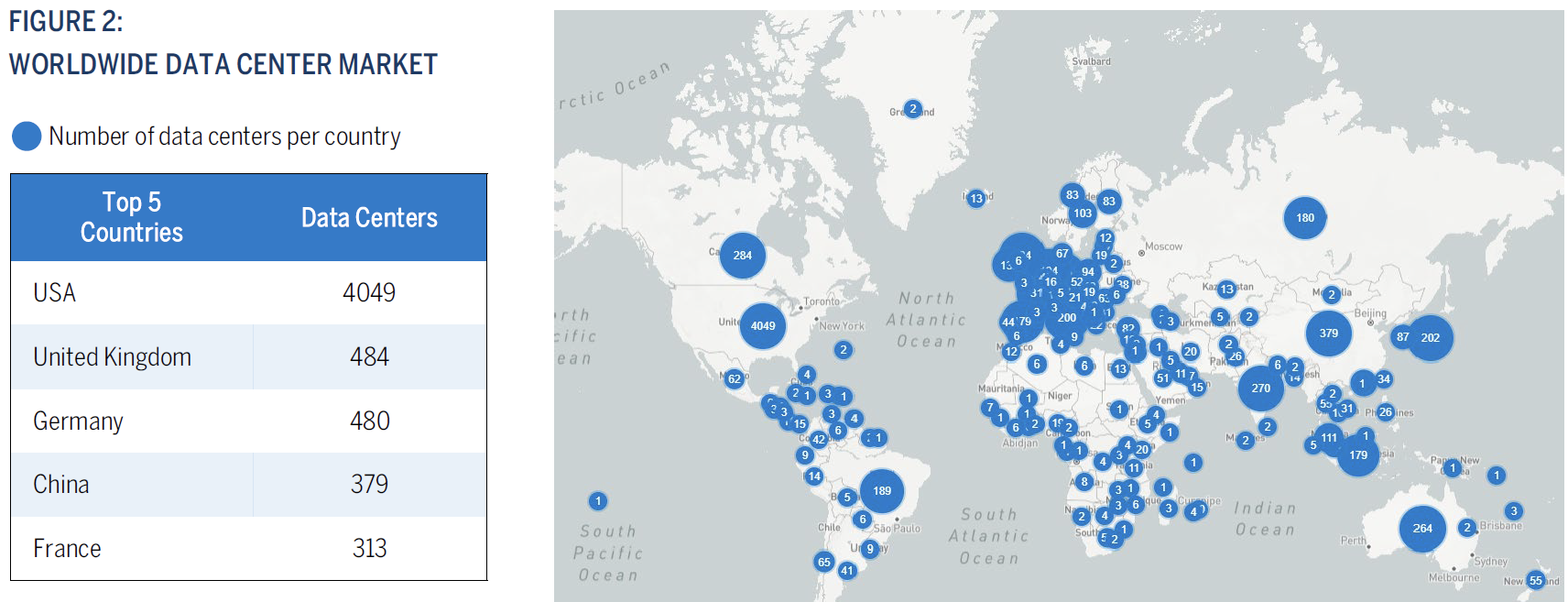

The United States (U.S.) is home to 45% of global data center energy consumption.4 After more than 30 years of falling or flat demand for on-grid electricity, electric utilities forecast that the U.S. will need 38 gigawatts (GW) of new power production, equivalent to about 34 new nuclear plants, through 2028 to supply power for data centers, electrification, and new industry.5

Historically, rapid improvements in energy efficiency and off-grid supply, such as domestic solar, have helped moderate growth in energy consumption from data centers and data transmission networks globally, despite global internet traffic expanding 25-fold since 2010.6 Specifically, there have been efficiency improvements in IT hardware and cooling, as well as a shift away from small, inefficient enterprise data centers towards more efficient colocation and hyperscale data centers.7 Yet, the forward-looking scenario presents new and unique challenges. AI-specialized data centers require more power than traditional data centers, as AI-specific compute consumes significantly more power per rack than traditional compute.

This prompts a range of environmental implications, which in turn has economic effects. In addition to the global focus on greenhouse gas emissions, data centers present challenges for water conservation, e-waste, and concerns around natural resources, such as the mining of rare earth elements required to manufacture hardware components. As Katherine Kroll, Head of Institutional Sustainable Investing, depicts in the Energy Expansion and Independence series, “Advanced economies have learned firsthand that resilience and diversification in energy infrastructure are critical to national security and economic vitality”.

Our focus in this piece is on data centers, the buildings that house the compute, storage, and networking equipment which underpins our digital world. Data centers are key to realizing the promise of artificial intelligence, but their growth puts pressure on existing power grids and pushes against limits on key inputs, which also impacts local communities. If these essential ingredients are not adequately accounted for, we could face a tipping point. We will examine data center market dynamics and steps hyperscalers are taking to increase the likelihood that these limits do not gate the exciting opportunities at the forefront of GenAI. We will highlight investment implications across the data center supply chain, from energy-efficient chips and renewable energy, to advanced cooling technologies, that could revolutionize the power balancing act and perhaps catalyze a sustainable grid transformation.

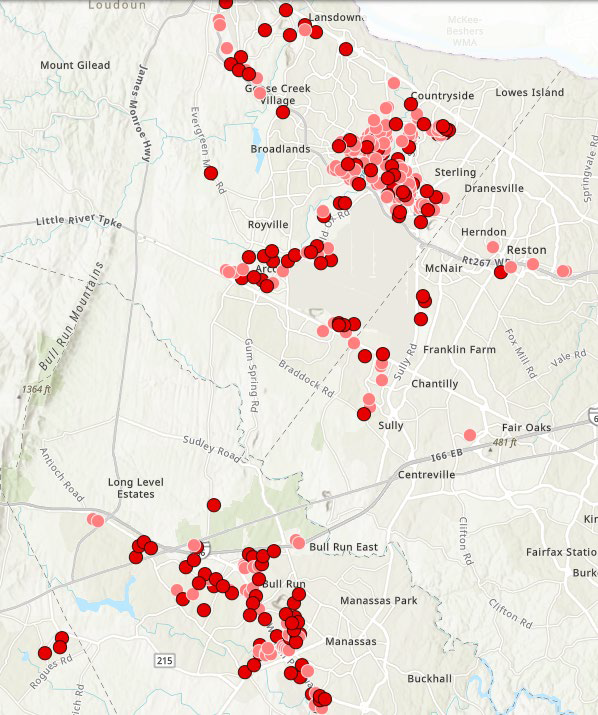

Victoria Schlotterback, Elisabeth Hiss, and Tiffany Ernest, Brown Advisory’s Director of Infrastructure, visiting Quality Technology Services (QTS), a Blackstone portfolio company that delivers secure data center solutions with over two gigawatts of power capacity in North America and Europe. QTS owns four data centers in Loudoun County, Virginia, including Ashburn-Broderick, Ashburn-Lockridge, Ashburn-Moran, and Ashburn-Shellhorn.

Discovering The Data Center Market

The data center sector in North America has been growing at a 20% CAGR since 2017. Over that time, most markets have doubled or tripled in size.8

Northern Virginia, home to the greatest concentration of data centers in the world, is experiencing constraints sooner than most.9 Dominion Energy, a company that supplies electricity in the region, stated in its 2024 Annual Report that data centers — representing 26% of Virginia Power’s electricity sales for the year ended December 31, 2024 — have been a source of significant increase in demand, which is expected to continue over the next decade. Dominion Energy says it has received customer orders that could double the amount of data center capacity in Virginia by 2028, with a projected market size of 10GW by 2035.10

The concentration of data centers primarily in Loudon County, Virginia, represents a complex challenge. Current data center power constraints often arise due to transmission and distribution limitations rather than a lack of power generation capabilities. In other words, the near-term hurdle in the region isn’t insufficient power generation but rather the inability to distribute it effectively. This is leading to significant investments in electric transmission facilities to meet the growing demand.11 We have heard from industry experts that electric transmission constraints are forcing some data centers to wait up to seven years or more to secure grid connections. Nonetheless, Virginia expansion continues. Alphabet, as one example, is investing an additional $9 billion in Virginia through 2026 in cloud and AI infrastructure. 12

Source: Piedmont Environmental Council, as of 09/15/2025; https://www.pecva.org/work/energy-work/data-centers/existing-and-proposed-data-centers-a-web-map/

Despite the continued investment in Virginia, due to the region’s constraints, data center development is expanding beyond Northern Virginia into secondary and tertiary markets. High power and grid availability, electricity cost, reliability, connectivity, and regulations are key factors in site selection. Meta is developing a $10 billion AI-focused data center — the largest in the Western Hemisphere — on a 2,250-acre site in Louisiana, a project expected to reshape how companies approach grid reliability by adding at least 1,500 MW of new renewable energy to the grid and bringing next-generation nuclear technologies on track.13

Regulatory frameworks governing data center expansion vary widely across local, state, federal and international jurisdictions. The industry must adapt to the evolving zoning rules, demand environment and resource impact assessments, and impose guidelines on water usage. The U.S. is increasing focus at the Federal level, evidenced by the recent America’s AI Action Plan14 and subsequent publication of three Executive Orders, including the Executive Order “Accelerating Federal Permitting of Data Center Infrastructure.”15 Concurrently, Virginia’s Clean Economy Act mandates that Dominion Energy and American Electric Power transition to 100% renewable energy sources by 2045 and 2050, respectively.16 Europe mandates emissions reporting for facilities larger than 500 kilowatts.17 Some regions are extending coal plant operations to meet data center demand. This has prompted development moratoriums such as Dublin through 2028 and similar restrictions across Northern Virginia.18 As we mentioned previously, local communities can be negatively impacted by this expansion. The potential use of eminent domain – the power of local and state governments to take private property for public use, in exchange for compensation – to complete transmission line projects is a looming concern for citizen groups.

While the question on where to build data centers is fluent, these constraints have also called for a bigger debate. Space-based datacenters could be a viable solution in this next decade. Orbital data centers are said to dramatically improve efficiency by leveraging the cold vacuum of space for passive cooling and harnessing solar energy with up to 40% greater efficiency than Earth-based systems. With operating costs as low as 0.1 cents per kilowatt-hour—compared to 5 cents on Earth—and emissions up to 10 times lower, they offer a compelling alternative for sustainable, high-performance computing.19 Starcloud is one of a handful of companies daring to think beyond terrestrial constraints. Starcloud’s CEO has lofty goals, expecting Starcloud’s orbital data centers to be able to slash the energy cost of inference by 10X, with the biggest inhibitor being current cost to launch.20

Source: Data Center Map, as of 09/15/2025; https://www.datacentermap.com/datacenters/

Rising Hyperscaler Capex: A Race for Resources

The U.S. hyperscalers are among the largest buyers of compute and installers of data center capacity.21 Hyperscalers provide cloud computing and data management services to organizations that require vast infrastructure for large-scale data processing and storage. Amazon, Microsoft, and Alphabet (Google), in aggregate, account for over 60% of global hyperscale data center capacity, with Meta closely following in ranking.22 These companies have a distinct competitive advantage in accessing limited resources, and we believe, are uniquely positioned to catalyze a sustainable transformation of our power systems — which may still be underappreciated by the broader market.

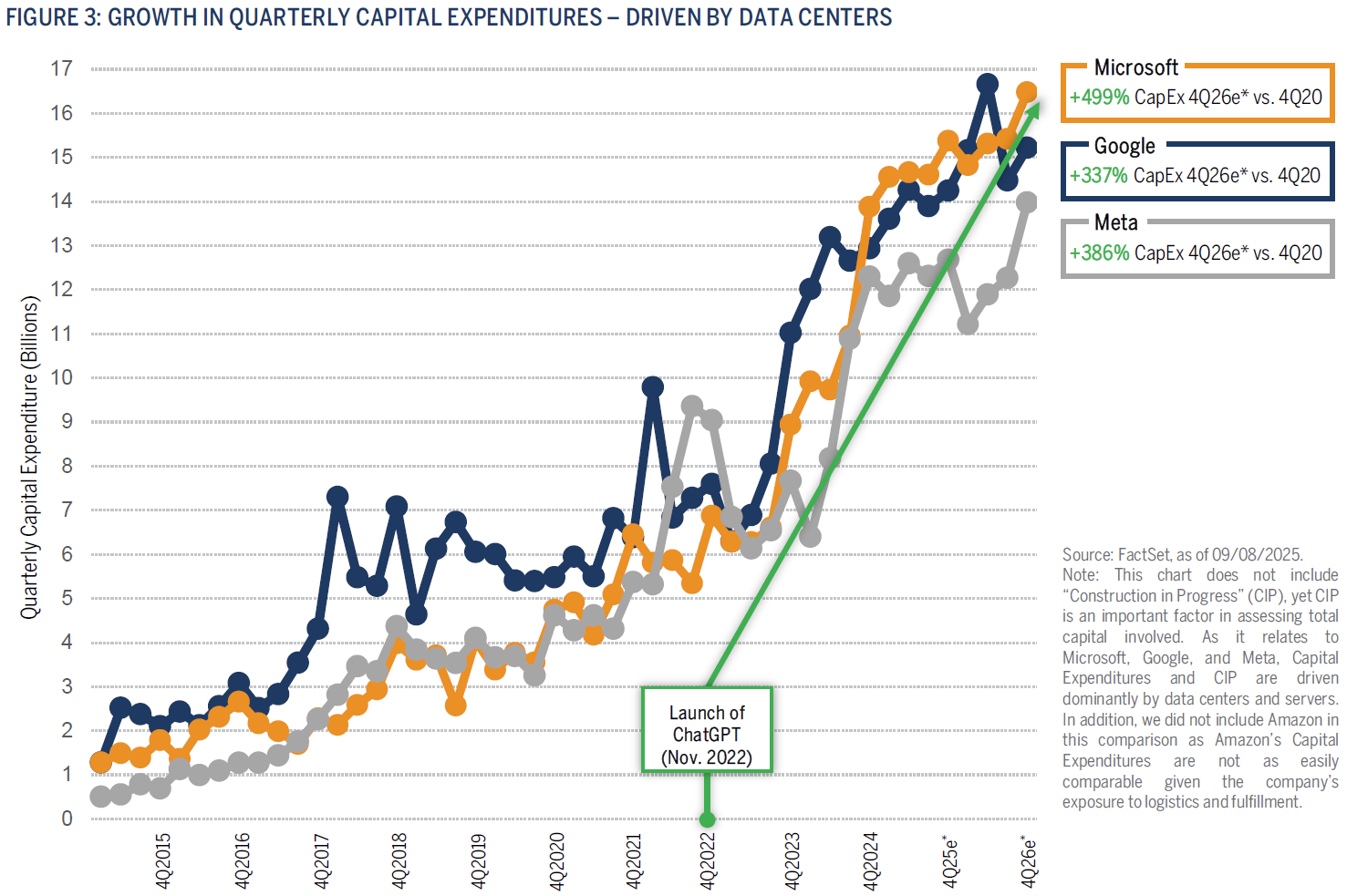

It’s well known that hyperscalers are racing to capture share in the AI market with a sizable wave of capital investment. Alphabet, Amazon, Microsoft and Meta alone are set to spend more than $350 billion this year on data centers and $400 billion in 2026.23 See Figure 3.

Hyperscalers have worked to reduce costs and resource consumption through increasing efficiency, with a strong lever being the semiconductor industry. NVIDIA’s Blackwell platform enables organizations to build and run real-time GenAI on trillion-parameter large language models at up to 25x less cost and energy consumption than its predecessor.24 However, while semiconductor efficiency will continue to play a critical role, as transistors approach the size of individual atoms, it’s becoming more difficult for the industry to benefit from Moore’s Law.

Recent developments highlight both the promise and peril of efficiency improvements. Chinese company DeepSeek’s release of its R1 model in January 2025 disrupted the market. DeepSeek AI’s models are said to operate up to 40% more efficiently than ChatGPT, achieved through optimized algorithms and hardware that reduce energy consumption and carbon emissions.25 Such innovations could dramatically reduce computational, financial and energy costs of AI training and deployment. Yet this efficiency breakthrough illustrates a critical challenge known as the “rebound effect” or Jevons paradox. When AI becomes cheaper and more efficient to operate, demand typically increases proportionally — or even exceeds the efficiency gains. Substantial progress has been made in making models more efficient, and this is certain to continue. Efficiency is both a software and a hardware issue.

Hyperscalers: Catalyzing Sustainable Energy

The data center power challenge is not merely a fossil fuels versus renewables debate. The practical reality is that grid operators and utilities need to adopt an “all-of-the-above” energy expansion strategy - deploying every available power source from natural gas and nuclear to solar, wind and emerging technologies such as geothermal and small modular reactors (SMRs). The sheer scale of electricity demand accelerated by AI infrastructure exceeds what any single generation type can provide within required timeframes. This requires bringing more energy online, optimizing how we use it, and advancing innovative energy solutions.

As renewables continue to develop, grid interoperability becomes increasingly important. Amazon, Microsoft, Meta, and Google are the four largest purchasers of corporate renewable energy power purchase agreements (PPAs), having contracted over 50GW, equal to the generation capacity of Sweden.26

Companies utilizing heat batteries and other storage methods are already making it easier and cheaper to store excess renewable generation. The key lies in potentially transforming data centers into giant batteries that absorb excess solar and wind energy. The industry is piloting early examples of supporting grids such as Alphabet’s demand response method which allows reduced data center power demand during periods of grid stress by shifting now-urgent computing tasks to an alternative time and location. Demand response can be a useful tool to reduce the need for new power investment on the grid. This minimizes environmental risk in grid expansion as well as detrimental community impact.

Nuclear power is gaining renewed attention as a reliable, low-carbon source of always-on electricity that could help balance intermittent renewables. Although, hurdles exist around regulatory, cost, timing, and safety concerns. Data center operators are exploring the potential to site facilities near existing nuclear plants. As nuclear technology continues to advance, utility regulators could become more comfortable approving new nuclear capacity.

Listen to the Brown Advisory NOW Podcast27 on this subject:

All of this points to a future where data centers are not just power consumers, but active partners in laying the foundation for a more sustainable, resilient grid. Hyperscalers, with their substantial energy demand, have both the incentive and the influence to drive this transformation. Erika Pagel, Brown Advisory Portfolio Manager, Co-CIO of Private Client, Endowments & Foundations, aptly describes this as an “unlikely relationship, or marriage” of technology and energy.28

As it relates to water usage, cooling presents a multifaceted challenge. While research continues and each data centers’ water intensity varies, the most common range we hear is the average data center consumes 3-5 million gallons of water per day. Most is local freshwater, putting pressure on drinking water supplies, especially in drought-prone areas. The World Resources Institute forecasts that about one-third of data centers globally are now located in areas with high or extremely high levels of water stress.29 Accordingly, leading data center operators are prioritizing water conservation and exploring alternative cooling methods, such as immersion cooling and direct-to-chip cooling.

What is often overlooked is how AI itself is being harnessed to solve the energy and power grid constraints. Prominent energy companies worldwide have swiftly embraced AI, recognizing its potential to optimize planning, facility management, environmental impact, energy storage, and distribution. Leveraging AI to drive efficiencies is not a new phenomenon in the technology sector. In 2016, Google announced that by applying DeepMind’s machine learning to their own Google data centers, the company managed to reduce the amount of energy used for cooling by up to 40%.30

Microsoft’s newest datacenters are designed with chip-level liquid cooling. Once filled during construction, the system continuously circulates water between the servers and chillers, dissipating heat without requiring additional water.31 Amazon also introduced a novel, direct-to-chip liquid cooling solution for high-density AI compute chips in new and existing data centers. These components are said to reduce mechanical energy consumption by up to 46% during peak cooling — without increasing water usage.32

Hyperscalers remain committed to their ambitious sustainability goals despite the challenges deterring progress as GenAI scales. This is not a “nice to have”, it’s a business imperative. Data centers are the heart of hyperscalers revenue generation, so the incentive is clear – cost effective and efficient resources (energy and water) are lifelines to economic growth. Microsoft’s indirect emissions (Scope 3) increased in FY24 by 26% from their 2020 baseline, which “primarily comes from the construction of more datacenters”. Still, Microsoft aims to be a carbon negative, water positive, zero waste company that protects ecosystems — all by 2030.33

There are ongoing examples of hyperscalers accelerating and enabling scale of innovative solutions. Microsoft’s 2025 Environmental Sustainability Report highlights the launch of their first datacenters constructed with mass timber, a strong, ultralightweight wood in a hybrid construction model which is projected to reduce the embodied carbon footprint of new datacenters by up to 65% compared to typical precast concrete.34 Microsoft also announced a monumental $10 billion renewable energy deal with Brookfield Asset Management. Commencing in 2026, Brookfield will spearhead the deployment of more than 10.5GW of renewable energy capacity, equivalent to the output of 10 nuclear power plants.35 Microsoft entered into the world’s first fusion energy purchase agreement with energy developer Helion Energy for the provision of electricity from its first fusion power plant expected to be online by 2028.36 We’re also seeing companies such as Microsoft showing early signs of investment in SMRs, with the first SMRs expected to be built this decade and accelerated global deployment in the 2030s.37 Similarly, Amazon purchased a nuclear-powered data center campus in Pennsylvania for $650 million to supplement its renewables. Alphabet added new clean energy generation by signing contracts for 8GW and bringing 2.5GW online in 2024 alone and signed a first-of-a-kind partnership to unlock new, clean power from a series of SMRs, which will be developed by Kairos Power.38 In July, Alphabet said it invested in CO₂-based battery storage that can dispatch clean energy for up to 24 hours compared with the typical four hours of lithium-ion batteries.39

Investment Implications

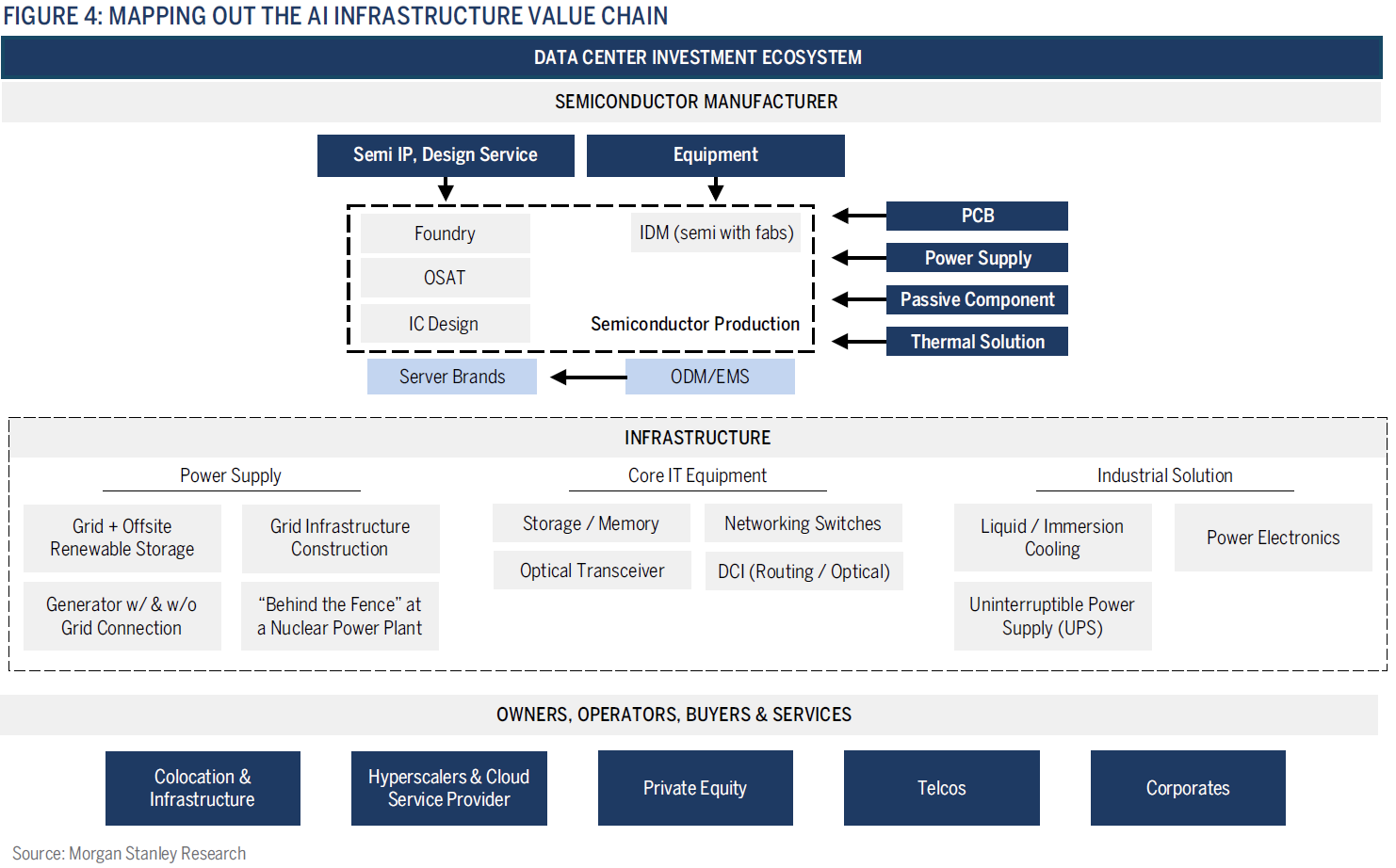

GenAI sparks an inflection point to stress-test our power infrastructure while unleashing innovation to make data centers, our digital infrastructure, more efficient. We believe that hyperscalers have the scale, capital, and engineering prowess to balance compute growth with resource sustainability in the long run. This will require a multi-pronged approach including substantial investments in renewables, storage, and grid balancing capabilities; focus on water conservation and alternative cooling technologies; deployment of onsite generation and dedicated renewable energy where feasible; policy incentives to modernize power grids and market structures; and innovation in AI infrastructure (potentially on Earth and in space) to be more efficient. As investors, we monitor companies across the data center value chain, including operators, semiconductors, power electronics, cooling, and software providers, to name a few.

Semiconductors are the early beneficiaries in a compute cycle, with the other components of data center infrastructure to follow. Time will tell the extent to which data centers catalyze scaling grid storage and flexibility, creating markets for new technologies and software. An interesting software investment example is Cadence Design Systems’ “Cadence Reality DC,” the first campus-wide digital twin simulator for data centers.40 Customers are modeling liquid cooling within Cadence Reality DC to facilitate more efficient cooling for high-density AI equipment.41 The most innovative companies in the supply chain will enable sustainable data center development. One potential solution is Modular Data Centers (MDCs). An MDC is a compact and portable collection of all the key components of a traditional data center, including servers, networking equipment, cooling, and storage.42 Dell, for example, has a portfolio MDC solutions which significantly reduces deployment and resources needed onsite.43

In balancing near-term challenges with long-term upside, we find attractive investment opportunities in technology enablers across the broader ecosystem that are helping data centers overcome constraints and become more efficient and grid flexible. As Portfolio Manager Eric Gordon, CFA, explains, "This One Theme [GenAI] has almost single-handedly driven the market recovery post-Liberation Day."44

From power management, storage, cooling and energy solutions, the opportunity set is large and diversifying. Pure Storage, a leading provider of all-flash data storage solutions, enhances data center efficiency by delivering up to 54% lower energy consumption per terabyte and dramatically higher storage density than traditional systems.45 Vertiv is another example driving efficiency in AI data centers through advanced cooling systems such as its hybrid CoolPhase Flex and liquid-based CoolChip technologies — reducing energy consumption and minimizing deployment time by up to 50%.46 Technology evolves quickly, and the tale of GenAI is unfolding at an unprecedented pace. The vast majority of GenAI use cases and implementations remain in the early stages. Yet, what is quite clear is that as GenAI applications and inferencing scale, power demand is set to increase commensurately — making efficiency increasingly critical. There are endless unknowns of what the future holds, and we do not hold a crystal ball. This is what makes the role of an investment analyst thrilling. Data centers demonstrate the critical intersection of environmental sustainability being both a business imperative and a competitive advantage. If hyperscalers catalyze a more robust, resilient and sustainable power grid while continuing to achieve step-changes in compute efficiency, we believe immense value will be unlocked.

Victoria Schlotterback, CPA

Equity Research Analyst

Joe Pasqualichio

Equity Research Analyst

John Bond, CFA

Equity Research Analyst

1. Generative artificial intelligence (GenAI) is a type of AI that can create new content and ideas, including conversations, stories, images, videos, and music. Source: AWS, as of 09/08/2025: https://aws.amazon.com/what-is/generative-ai/

2. Source: https://www.mckinsey.com/industries/technology-media-and-telecommunicat…

3. Source: IEA, IEA Energy and AI 2025 https://www.iea.org/reports/energy-and-ai , and Deloitte, “As generative AI asks for more power, data centers seek more reliable, cleaner energy solutions,” https://www.deloitte.com/us/en/insights/industry/technology/technology-…

4. Source: IEA, Energy and AI 2025 https://www.iea.org/reports/energy-and-ai/executive-summary

5. Source: Clean Grid Initiative, According to filings made to the Federal Energy Regulatory Commission and compiled by Grid Strategies. “Grid Strategies The Era of Flat Power Demand is Over,” as of 12/2023; https://gridstrategiesllc.com/wp-content/uploads/2023/12/National-Load-…

6. Source: IEA, “The transformative potential of AI depends on energy”, as of 07/11/2023; https://www.iea.org/energy-system/buildings/data-centres-and-data-trans…

7. Source: IEA, “Data Centres and Data Transmission Networks”, as of 07/11/2023; https://www.iea.org/energy-system/buildings/data-centres-and-data-trans…

8. Source: JLL, “JLL North America Data Center Report Midyear 2025” as of 06/2025; https://www.jll.com/en-us/insights/market-dynamics/north-america-data-c…

9. Source: Northern Virginia Technology Council 2024; https://www.nvtc.org/communities/data-center-and-cloud/report/

10. Source: Data Center Frontier, “Dominion: Virginia’s Data Center Cluster Could Double in Size,” as of 10/11/2023; https://www.datacenterfrontier.com/energy/article/33013010/dominion-vir…

11. Source: Dominion Energy, “Dominion Energy Annual Report 2023,” as of 2023; https://s2.q4cdn.com/510812146/files/doc_downloads/2024/2024/03/20/20/D…

12. Source: Governor of Virginia, “Governor Glenn Youngkin Announces Google Investing $9 Billion Across Virginia” as of 08/27/2025; https://www.governor.virginia.gov/newsroom/news-releases/2025/august/na…

13. Source: Data Center Frontier, “ Meta Sees $10B AI Data Center in Louisiana Using Combo of Clean Energy, Nuclear Power ” as of 12/12/2024; https://www.datacenterfrontier.com/hyperscale/article/55248311/meta-see…

14. Source: https://www.whitehouse.gov/wp-content/uploads/2025/07/Americas-AI-Actio…

15. Source: https://www.whitehouse.gov/presidential-actions/2025/07/accelerating-fe…

new%20datacenter%20will%20use,sustainability%20and%20responsible%20resource%20management

16. Source: https://energy.virginia.gov/renewable-energy/documents/VCEASummary.pdf

17. Source: Official Journal of the European Union - Article 12; https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ%3AJOL_2023_231_R…

18. Source: RTE, “No new data centres for the capital for the foreseeable future, greater Dublin area ‘constrained’” as of 01/10/2023; https://www.rte.ie/news/dublin/2022/0110/1272869-eirgrid-datacentres-du…

19. Source: https://cacm.acm.org/news/datacenters-go-to-space/

20. Source: https://theinnovator.news/startup-of-the-week-starcloud/

21. Source: ENCONNEX, “Where Are Most Data Centers Located? Exploring the World’s Data Center Markets,” as of 02/22/2024; https://blog.enconnex.com/where-are-most-data-centers-located-top-marke…

22. Source: Synergy, “Hyperscale Data Centers Hit the Thousand Mark; Total Capacity is Doubling Every Four Years,” as of 07/12/2024;https://www.srgresearch.com/articles/hyperscale-data-centers-hit-the-th…

23. Source: Financial Times https://www.ft.com/content/efe1e350-62c6-4aa0-a833-f6da01265473

24. Source: NVIDIA, “NVIDIA Sustainability Report 2024” as of 2024; https://images.nvidia.com/aem-dam/Solutions/documents/FY2024-NVIDIA-Cor…

25. Source: Medium, “Impact of AI Performance Efficiency on Long-Term GPU Demand: The Case of DeepSeek AI” as of 01/30/2025; https://bytebridge.medium.com/impact-of-ai-performance-efficiency-on-lo…

26. Source: IEA, “Data Centres and Data Transmission Networks” as of 07/11/2024; https://www.iea.org/energy-system/buildings/data-centres-and-data-trans…

27. Source: Brown Advisory, “CIO Perspectives Podcast: Powering the AI Boom, Investing in Aerospace, and a Surge in Drug Innovation” as of 06/06/2024; https://www.brownadvisory.com/now/S4E4

28. Source: Brown Advisory, as of 06/06/2024; https://www.brownadvisory.com/us/insights/cio-perspectives-podcast-powe…

29. Source: World Resources institute, “Aqueduct Water Stress Projections Data” as of 05/15/ 2015; https://www.wri.org/data/aqueduct-water-stress-projections-data

30. Source: Google DeepMind, as of 07/20/2024; https://deepmind.google/discover/blog/deepmind-ai-reduces-google-data-c…

31. Source: Microsoft, “Microsoft 2025 Environmental Sustainability Report reporting on 2024 fiscal year”; https://cdn-dynmedia-1.microsoft.com/is/content/microsoftcorp/microsoft…

32. Source: AWS, “AWS Announces New Data Center Components to Support AI Innovation and Further Improve Energy Efficiency” as of 12/02/2024; https://press.aboutamazon.com/2024/12/aws-announces-new-data-center-com…

33. Source: Microsoft, “Microsoft 2025 Environmental Sustainability Report reporting on 2024 fiscal year”; https://cdn-dynmedia-1.microsoft.com/is/content/microsoftcorp/microsoft…

34. Source: Microsoft, “Microsoft 2025 Environmental Sustainability Report reporting on 2024 fiscal year”; https://cdn-dynmedia-1.microsoft.com/is/content/microsoftcorp/microsoft…

35. Source: Energy Digital, “ Microsoft & Brookfield Sign World’s Biggest Clean Power Deal” as of 05/03/2024; https://energydigital.com/articles/microsoft-brookfield-sign-worlds-big…

36. Source: Helion, “Announcing Helion’s fusion power purchase agreement with Microsoft” as of 05/10/2024; https://www.helionenergy.com/articles/announcing-helion-fusion-ppa-with…

37. Source: NEA, as of 09/16/2025; https://www.oecd-nea.org/jcms/pl_73678/nea-small-modular-reactor-smr-da…

38. Source: Google, “Google 2025 Environmental Report”; https://www.gstatic.com/gumdrop/sustainability/google-2025-environmenta…

39. Source: Google, “Our first step into long-duration energy storage with Energy Dome”; https://blog.google/outreach-initiatives/sustainability/long-term-energ…

40. Source IBM, “Cheat Sheet: What is Digital Twin?” as of 07/16/2024; https://www.ibm.com/topics/what-is-a-digital-twin

41. Source: Cadence, “Revolutionary Cadence Reality Digital Twin Platform to Transform Data Center Design for the AI Era,” as of 03/18/2024; https://www.cadence.com/en_US/home/company/newsroom/press-releases/pr/2…

42. Source: Data Span, “What Is A Modular Data Center?,” as of 08/24/2023; https://dataspan.com/blog/what-is-a-modular-data-center/

43. Source: DELL Technologies, “Modular Data Center Brochure,” as of 2023; https://www.delltechnologies.com/asset/en-us/solutions/infrastructure-s…

44. Source: Brown Advisory, “Equity Beat: One Theme to Rule Them All”, as of 08/20/2025; https://www.brownadvisory.com/us/insights/equity-beat-one-theme-rule-th…

45. Source: Pure Storage, “Efficient IT Infrastructure Saves More Than Just Energy Costs”; https://www.purestorage.com/content/dam/pdf/en/white-papers/wp-efficien…

46. Source: Vertiv, “Vertiv launches high-density prefabricated modular data center solution to accelerate global deployment of AI compute,” as of 07/25/2024; https://www.vertiv.com/en-us/about/news-and-insights/corporate-news/ver…

Disclosures

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance, and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or issuers mentioned. It should not be assumed that investments in such securities or issuers have been or will be profitable. References to specific securities or issuers are to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data.

Sustainable investment considerations are one of multiple informational inputs into the investment process, alongside data on traditional financial factors, and so are not the sole driver of decision-making. Sustainable investment analysis may not be performed for every holding in the strategy. Sustainable investment considerations that are material will vary by investment style, sector/industry, market trends and client objectives. Certain strategies seek to identify companies we believe may be desirable based on our analysis of sustainable investment related risks and opportunities, but investors may differ in their views. As a result, these strategies may invest in companies that do not reflect the beliefs and values of any particular investor. Certain strategies may also invest in companies that would otherwise be excluded from other funds that focus on sustainable investment risks. Security selection will be impacted by the combined focus on sustainable investment research assessments and fundamental research assessments including the return forecasts. Certain strategies incorporate data from third parties in their research process but do not make investment decisions based on third-party data alone.

Terms and Definitions:

Capital Expenditure (CAPEX)are funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment.

Power Purchase Agreements (PPAs)are contracts between two parties, one which generates electricity (the seller) and one which is looking to purchase electricity (the buyer).

Compound Annual Growth Rate (CAGR)is the rate of return that an investment would need to have every year in order to grow from its beginning balance to its ending balance, over a given time interval. CAGR assumes that any profits were reinvested at the end of each period of the investment’s life span.

Small modular reactors (SMRs)are advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit, which is about one-third of the generating capacity of traditional nuclear power reactors.