An increasing number of investors are seeking to incorporate climate change in their investment calculus. For investors with a portfolio covering multiple asset classes, the tasks of excising climate risk and finding new climate-related opportunities can be daunting.

On the risk side, nearly all asset classes and industry sectors are grappling with the impacts of climate change, and these risks can vary greatly by industry or geography--supply chain impacts, damages from weather or resource scarcity, shifts in consumer sentiment, brand erosion and more.

Of equal or greater interest to many investors are the opportunities being spawned by climate change. The pace and scale of private investment in infrastructure and solutions have reached critical mass; according to the IEA, U.S. renewable electricity generation equaled nuclear generation and surpassed coal generation in 2020, and IEA anticipates further rapid growth going forward. This energy transition is opening many opportunities for investors, from direct investment in solar, wind and other renewable technologies and projects, to broader investments in companies that are proactively readjusting strategies, even acquiring other businesses, to help them adapt more quickly to a low-carbon economy. Conversely, investors may face real risks if they invest in a company, sector or industry that is not aligned with the shift in the global energy mix.

All of this change is transforming the investment landscape. Fortunately, our process for managing multiasset sustainable portfolios was built to handle exactly these kinds of complex, overarching, intersectional issues. As we will discuss in this article, we conduct climate-related research and analysis (as part of our overall research efforts) along several separate but integrated tracks to guide our asset allocation, manager research and portfolio construction efforts.

A 360-Degree Climate Evaluation

Until recently, investors that cared about climate change primarily expressed that concern through various screens and filters to remove fossil fuel companies from their portfolios—an approach, in our view, that can fail to identify many climate-related risks and opportunities.

Simply identifying an industry as “high-carbon” and avoiding it can be a blunt instrument; we believe that a more comprehensive and more precise evaluation is needed to help understand and manage the impact of climate change on a portfolio. In our role as a strategic asset allocator, we want to dig deeper: Are there asset-class subsegments with greater or lesser risk that we can differentiate? Is the climate risk or opportunity within an industry rising or falling—due either to external factors or to strategies being implemented by leading companies and bond issuers?

For example, many companies in “at-risk” industries are sinking meaningful capex investment into climate mitigation and/or adaptation: structural improvements to operations, as well as research and development aimed at transforming their products and services. Several auto companies have announced transformative forays into electric vehicle (EV) production, with Bloomberg reporting that several firms have pledged approximately half of their entire long-term R&D and capex budgets on EVs and other digital initiatives such as smart vehicles and autonomous driving systems, including Volkswagen at 58%, GM at 51% and Ford at 47%. This trend may lead to a generation of new companies and innovative ideas related to climate, each carrying their own set of investment risks and opportunities.

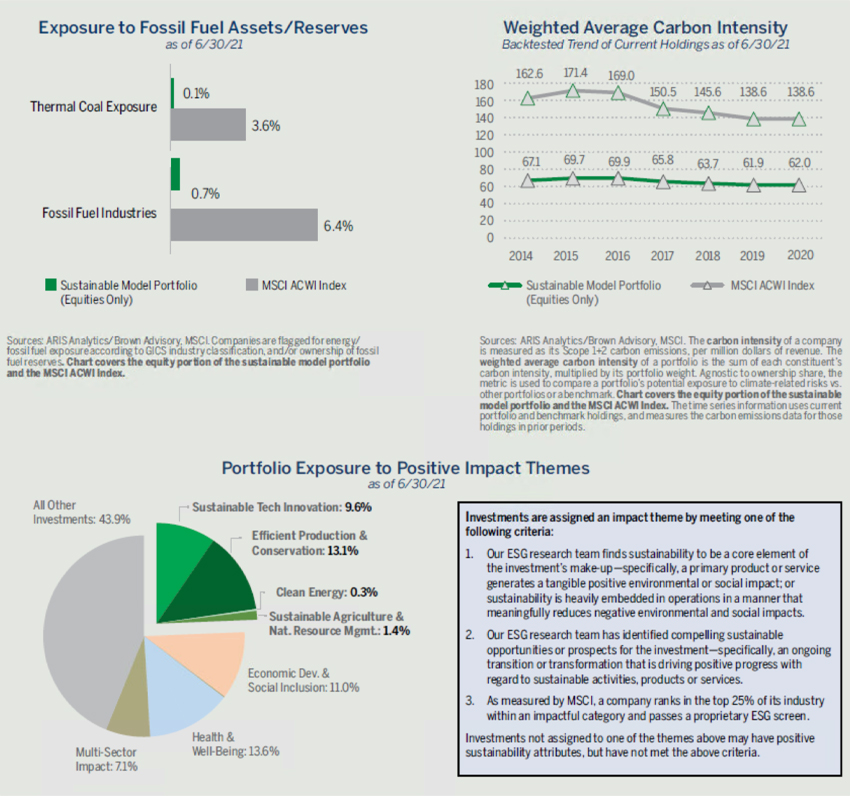

At the portfolio level, we currently look at climate factors through three primary lenses: physical asset risk, carbon exposure, and participation in low carbon solutions to drive future cash flow. The “climate dashboard” below provides several different views of our sustainable model portfolio, as compared with its benchmark, the MSCI ACWI Index.

- Exposure to physical assets or fossil fuel reserves. Many companies hold these assets on their balance sheet so there is more reliability and accuracy for reporting exposure to fossil fuels. Most companies with physical assets tend to be in infrastructure, energy, industrials or those dependent on commodity resources. There is risk some of these assets go unused and may become stranded in the future.

- Carbon footprint. This is by now a well-known term referring to the CO2-equivalent emissions that an entity generates, both directly and indirectly. We refer to several different metrics; one example is the “Weighted Average Carbon Intensity” metric, which looks at emissions per dollar of sales generated by the underlying entity.

- Participation in Climate Solutions. Here, we look at exposure to the climate opportunity, rather than risk. In 2020, Morningstar estimated that its “climate aware” universe (i.e., funds that pursue climate-related investments as a key theme) has grown to 400 mutual funds and ETFs globally, and this does not count the dizzying array of private climate-related investment opportunities available to investors. (Note: Private investments may be available to qualified purchasers and accredited investors only.) From green bonds and other labeled fixed income structures, to low-carbon businesses, to enabling technologies that are propelling clean energy forward, there are many different options for investors to drive future cash flows while also being “part of the solution.”

CLIMATE DASHBOARD: SUSTAINABLE MODEL PORTFOLIO AS OF 6/30/21

Using our in-house ARIS Analytics reporting system, we can generate a variety of climate-related data on client portfolios for reporting and analysis. As noted below, our sustainable model portfolio has de minimis exposure to physical fossil fuel assets and reserves (top left); the weighted average carbon intensity of its equity holdings is less than half that of its benchmark, the MSCI ACWI Index (top right); a healthy percentage of the model is invested in holdings that, in our view, are contributing positively, in some way, to climate change mitigation or adaptation (bottom). (Note that this model portfolio represents our “pure” thinking with regard to asset allocation, manager selection and ESG criteria, without factoring in client considerations; as a result, few if any of our clients’ portfolios will actually mirror this model exactly.)

Sources: ARIS Analytics/Brown Advisory, MSCI. Please refer to the callout box to the right of the chart for more information about the criteria used to evaluate the impact of portfolio securities. Chart covers both the equity and fixed income portions of the sustainable model portfolio and the MSCI ACWI Index.

*The portfolio information above represents a model portfolio. It is not representative of an actual portfolio. The portfolio management team will customize portfolios to meet the guidelines, requirements, and risk tolerance of each client. The information provided in this is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular investment strategy, including whether or not to buy, sell or hold investments in any asset class mentioned. It should not be assumed that investments in such asset classes have been or will be profitable.

The information in the "Exposure to Fossil Fuel Assets/Reserves" and "Weighted Average Carbon Intensity" charts reflects the equity portion of the sustainable model portfolio only.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. Please see the end of the presentation for a complete list of terms and definitions.

As the dashboard shows, as of 6/30/21, our sustainable model portfolio had de minimis exposure to physical fossil fuel assets and reserves, and the weighted average carbon intensity of its equity holdings was less than half that of the MSCI ACWI Index (even after seeing the Index exhibit steadily declining carbon intensity in recent years). Additionally, we can see that a healthy percentage of the model is invested in holdings that we believe are contributing positively to climate change mitigation or adaptation.

We should note that this kind of aggregate-level portfolio analysis depends heavily on accurate underlying data, and unfortunately, investors are limited today by the incomplete and inconsistent emissions data provided by most companies, municipalities and other entities. Companies are not consistently tracking Scope 3 emissions (which measure the downstream emissions within an entity’s value chain, vs. Scope 1 and 2 emissions which measure the specific entity’s emissions impacts), and in many industries, Scope 3 emissions dwarf those generated in the other two categories. And while research coverage within public equities is robust (our provider, for example, now covers more than 95% of the equities in the MSCI ACWI Index), it is far less extensive across most other classes.

Further, raw emissions data provides limited benefit to us as fundamental investors—two companies with similar current emissions profiles may represent completely divergent investment narratives, depending on management’s focus on improvement, new initiatives in the works, and countless other factors. Aggregate-level data helps us understand the big picture but when it comes to making decisions about asset allocation or manager recommendations, we need more information.

A final note of caution is that many ESG rating providers may overemphasize a company’s current emissions situation, while not paying enough attention to whether a company’s ESG attributes are improving, eroding or staying the same. This can lead to drawing undesirable conclusions from the raw data about companies and even entire investment strategies. We can see the benefit of our managers’ security selection in various sectors in the chart below; while the benchmark’s emissions stem primarily from traditionally high-carbon sectors like energy, materials and utilities, our holdings in those sectors generate lower levels of emissions—a primary reason why our overall portfolio emissions are notably lower than the benchmark.

“CARBON ATTRIBUTION” of SUSTAINABLE PORTFOLIOS

Security selection can have just as much impact on a portfolio’s carbon footprint as asset allocation. As shown below, the equity component of our sustainable model portfolio has similar sector weightings to its benchmark, including low weights in energy and utilities. However, our managers have chosen securities in those sectors with lower carbon intensity than those in the benchmark. (Information as of 6/30/21)

Sources: ARIS Analytics/Brown Advisory, MSCI. Sectors are based on the Global Industry Classification Standards (GICS®) classification system. Chart covers the equity portion of the sustainable model portfolio and the MSCI ACWI Index. The portfolio information above represents a model portfolio. It is not representative of an actual portfolio. The portfolio management team will customize portfolios to meet the guidelines, requirements, and risk tolerance of each client. The information provided in this is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular investment strategy, including whether or not to buy, sell or hold investments in any asset class mentioned. It should not be assumed that investments in such asset classes have been or will be profitable. The information in the chart reflects the equity portion of the sustainable model portfolio only. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. Please see the end of the presentation for a complete list of terms and definitions.

One example is Nextera Energy, one of the world’s leading solar and wind developers, which nonetheless is flagged by ratings firms for high carbon intensity (it is also a large operating utility with fossil fuels in its energy mix). In addition to its investment bona fides, we see Nextera as one of a number of high-emission businesses whose shift in business mix is reducing its emissions at a robust clip. Such companies can have, in our view, a greater positive impact on climate change than a company whose business does not generate notable emissions in the first place. Another is Casella Waste Systems, a company held by one of our outside managers; ESG ratings firms have flagged Casella in the past because it has not yet found a market “re-use” application for its recycled waste, but our investment manager believes that Casella is making progress on that front. These are examples where overreliance on static climate data may fail to capture an investment’s trajectory with regard to its climate strategy or other ESG initiatives.

In Pursuit of “Sustainable Alpha”

Our second research “track” focuses on finding investment managers that, in our view, have the potential to generate “sustainable alpha.” We use this term to describe outsized performance delivered by an investment, thanks to its sustainable strategies or characteristics.

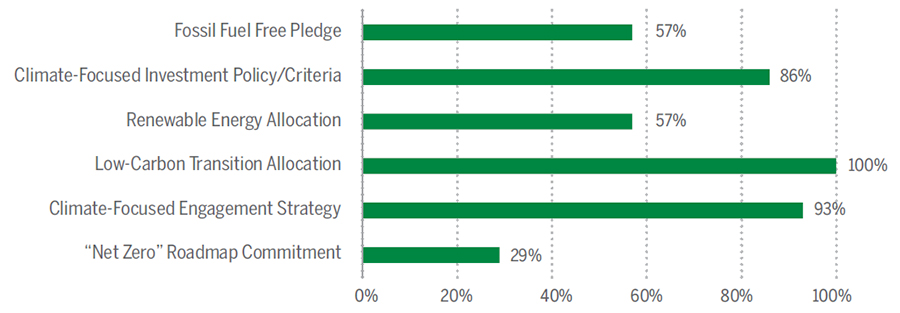

Due diligence is especially critical in vetting the ESG merits of an investment manager, given the prevalence of greenwashing in the current sustainable investing landscape. All the managers whose strategies or funds we approve for sustainable portfolios have, in our view, strong capabilities and methods in place for evaluating climate risk and opportunity. Each manager’s approach varies. As shown in the chart below, some approaches are nearly universal across our approved sustainable managers (for example, engagement strategies on climate change, or implementation of climate-specific investment criteria); other approaches are less prevalent (for example, a fossil-fuel-free pledge), and still others are new and not yet widely used (for example, commitment to a “net zero” roadmap or investment approach).

HOW ARE OUR APPROVED SUSTAINABLE MANAGERS TACKLING CLIMATE CHANGE IN THEIR PORTFOLIOS?

Among the sustainable managers that we recommend to our clients, some climate-related investment activities are nearly universal(such as shareholder engagement on climate or allocating to companies that are “decarbonizing” their strategies), while others such as fossil-fuel divestment and net-zero pledges are less common. (Information as of 6/30/21)

Source: Brown Advisory research. The chart conveys the percentage of approved and recommended sustainable managers on Brown Advisory’s platform that currently use, according to our due diligence, various tools and methods to integrate climate change analysis into their investment process. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. Please see the end of the presentation for a complete list of terms and definitions.

Carbon emissions tracking is only one method of examining a manager’s portfolio and process through a climate lens. We look for managers to show broader, tangible sustainability outcomes at a portfolio level (e.g., reduction in environmental waste, emissions from operations, etc.), and more constructive qualitative discussions (for ESG due diligence and/or engagement purposes) aimed at uncovering forward-looking risks and opportunities. Perhaps most importantly, we look at investment philosophy and process closely to help us understand whether that process is likely to identify investments consistently and repeatedly with compelling ESG attributes. Finally, we look for managers that use a broad range of methods to address climate change in their process. Having diverse methodologies within the portfolio, in our view, helps bolster long-term investment results while also giving us more tools to help clients align their portfolios with their principles and impact goals.

We should also note that proactive, thoughtful proxy voting is a common trait among our preferred sustainable managers, and in general we are seeing a notable uptick in the number of climate-related shareholder proposals filed, as well as the percentage of votes in favor of these measures.

Here are a few examples of how our approved managers are thinking about climate in their portfolios:

- One of our global equity managers put in place a new four-tiered climate change engagement strategy in 2020, with the first two tiers of engagement focus on disclosure and reporting, while the third and fourth focus on proactive climate strategies.

- Another manager now requires portfolio companies to disclose carbon and other greenhouse gas (GHG) emissions, and to provide targets for emissions intensity reduction and absolute level reduction in alignment with the Paris Agreement (in other words, in alignment with full decarbonization by 2050).

- A third manager has set clear expectations for its portfolio companies: all should disclose Scope 1 and 2 carbon emissions (and Scope 3 if possible) and should reduce carbon intensity by at least 5% year-over year. These baseline expectations are part of a plan to achieve a carbon-neutral portfolio by 2030.

- One of our emerging markets managers has done, in our view, an exceptional job of integrating ESG data into its process in a quantifiable manner. It uses each piece of relevant ESG information to adjust its market risk premium estimates, and to adjust its weighted average cost of capital (WACC) estimates to reflect long-term sustainability risks.

Know What You Own

Our third research track focuses on helping clients “know what they own,” by uncovering the individual equities, bonds and other securities that they hold with managed funds and strategies. A single holding in a client’s portfolio can impact performance (perhaps meaningfully, depending on the position’s size), in addition to bringing the client closer or further away from their values or impact goals. As multiasset portfolio managers, we have a duty to fully understand the risks and opportunities posed by a specific portfolio exposure. There are many ways that climate risk might dim an investment’s prospects:

HOW MIGHT AN INVESTMENT’S “CLIMATE RISK” TRANSLATE TO FINANCIAL RISK?

- Companies and issuers that do not get ahead of regulatory/policy evolution may find themselves playing catch up with competitors, or spending quickly and heavily to implement changes that other companies accomplished over much longer periods of time.

- A wide range of operations, products and services may see their value plummet or evaporate because of climate change.

- Current consumer trends suggest rising preference for low-carbon products and services, especially among younger consumers; some companies may be left behind by customers if that trend continues.

- Natural disasters pose a real and growing risk to many companies and operations around the world, and climate change is inexorably boosting both the intensity and frequency of these disasters.

- Technological innovation may impact the average life of assets or reserves.

Of course, climate change is not just about risk for investors—we believe there are big climate-related opportunities across all industry sectors and asset classes. Transportation companies can consider retrofits, battery technologies, charging infrastructure, or reducing energy consumption for long-haul vehicles; industrial companies can implement hydrogen technology, evaluate carbon capture options, invest in advanced materials or equipment innovation; technology companies have a multitude of opportunities to help enable the low-carbon economy of the future. What’s more, the effort to reduce emissions across the global economy will likely take decades to play out, so these opportunities are likely to drive positive outcomes for investors for many years to come.

Here is one example of how we can follow the thread from big-picture climate opportunity down to the individual company level. According to the International Energy Agency (IEA), China, India, Russia, Japan and the U.S. were collectively responsible for 58% of CO2 emissions globally in 2020. Several of these countries have created policy environments that may lead to long-term opportunities for investors:

- China holds the status as top global emitter (28% of global emissions according to the IEA, with nearly 2/3 of energy needs served by coal power). In 2020, China set two aggressive big-picture goals related to emissions, including full carbon neutrality as a country by 2060. Its ability to transition from coal to renewable energy is likely to play a big role in meeting these goals.

- India pledged under the 2015 Paris Agreement to cut its GHG emissions intensity by 33-35%, and boost non-fossil fuel power capacity to 40% of its overall total, by 2030.

- Finally, Japan recently announced its plan to reduce emissions by 46% by 2030, vs. 2013 baseline levels.

Some of our managers have added exposure to select renewable energy companies recently, as a way to access these long-term opportunities. One example is Sungrow Power Supply, a company offering solar inverters and other PV and energy storage solutions with customers in more than 150 countries. Sungrow is a leader in this space, and it claimed a 27% share of the photovoltaic inverter market in 2020. Also, the company has pledged to switch to 100% renewable energy for its electricity needs by 2028.

Putting the Pieces Together

As mentioned throughout this article, we prefer to use a holistic approach when building portfolios for our clients. Asset allocation, manager selection, and security-level analysis are all important and challenging responsibilities, and our work on one of these three tasks very often informs our work on the other two.

This is unquestionably true when it comes to grappling with climate change in our portfolios. Our long-term success depends on our ability to not only integrate these three tasks when building a portfolio, but also while monitoring its progress over time. We need our big-picture thinking to inform our due diligence of managers and our expectations for their investment processes; similarly, we need to draw on the expertise of our sustainable investing colleagues and our external managers, to help ensure that our overarching portfolio plans are reflecting the latest thinking in climate research and best practices in sustainable investing. We believe that our sustainable investment process helps us integrate our various climate-related responsibilities, and as a result helps us deliver attractive investment performance via portfolios that are also well-positioned with respect to climate change.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

ESG considerations that are material will vary by investment style, sector/industry, market trends and client objectives. Our ESG strategies seek to identify companies that we believe may have desirable ESG outcomes, but investors may differ in their views of what constitutes positive or negative ESG outcomes. As a result, our strategies may invest in companies that do not reflect the beliefs and values of any particular investor. Our strategies may also invest in companies that would otherwise be screened out of other ESG oriented portfolios. Security selection will be impacted by the combined focus on ESG assessments and forecasts of return and risk. Our strategies intend to invest in companies with measurable ESG outcomes, as determined by Brown Advisory, and seek to screen out particular companies and industries. Brown Advisory relies on third parties to provide data and screening tools. There is no assurance that this information will be accurate or complete or that it will properly exclude all applicable securities. Investments selected using these tools may perform differently than as forecasted due to the factors incorporated into the screening process, changes from historical trends, and issues in the construction and implementation of the screens (including, but not limited to, software issues and other technological issues). There is no guarantee that Brown Advisory’s use of these tools will result in effective investment decisions.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Diversification does not assure a profit, nor does it protect against a loss in a declining market. It is not possible to invest directly in an index. Holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

The MSCI All-Country World Index (ACWI) measures the global equity market, and includes large and mid-cap stocks across 23 developed market countries and 27 emerging market countries.

BLOOMBERG, is a trademark and service mark of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS), “GICS” and “GICS Direct” are service marks of Standard & Poor’s and MSCI. “GICS” is a trademark of MSCI and Standard & Poor’s. Standard & Poor’s and S&P are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc. All MSCI indexes and products are trademarks and service marks of MSCI or its subsidiaries.