On the first two nights of November, a young man from a small, coastal Japanese town became the biggest star of America’s pastime. Yoshinobu Yamamoto, standing all of 5’10’’ (half-a-foot shorter than the average MLB pitcher), pitched on consecutive days to win the final two games of the 2025 World Series for the Los Angeles Dodgers. He threw a combined 130 pitches over two days, a feat last accomplished by Randy Johnson, an intimidating figure at 6’10”, in the final games of the 2001 World Series.

Yamamoto is calm and stoic on the mound. He also owns the largest pitching contract in the history of the game.1 In December 2023 the Dodgers signed the 25-year-old Yamamoto to a 12-year, $325 million guaranteed deal after seven outstanding seasons with the Orix Buffaloes, winning Nippon Professional Baseball’s MVP award three times. Despite initial criticism over the contract size and terms for someone who had never pitched in MLB, Yamamoto likely earned the ENTIRETY of his contract during the 2025 playoffs.

High profile contracts, among sports figures and corporate executives, can become lightning rod topics. Just ask Elon Musk. On Tesla (TSLA)’s third quarter of 2025 earnings call, Musk labeled proxy advisory firms ISS and Glass Lewis as “corporate terrorists” for not supporting his proposed $1 trillion pay package, which could give him 25% ownership in the company if all milestones are achieved. Tesla’s Board of Directors describes the package which includes ambitious targets such as one million robots sold and one million robotaxis in operation, as “pay for performance”. The final tranche of awarded equity would require an $8.5 trillion market cap for TSLA – compared to the company’s $1.5 trillion market cap today. Thus, one could argue this mind-blowing package does in fact align directionally with other shareholders’ interests. In fact, more than 75% of the voting shares approved Musk’s pay package at the company’s shareholder meeting earlier this month.

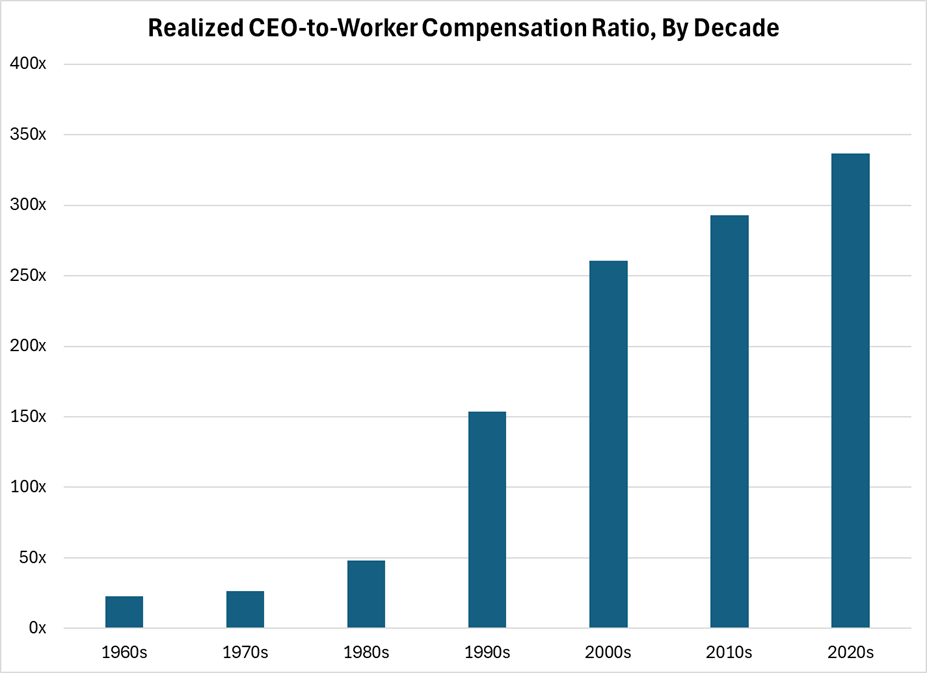

Still, there’s something to be said regarding corporate excess. According to the Economic Policy Institute, the ratio of realized compensation for CEOs at the 350 largest U.S. firms compared to the average worker at these firms has risen dramatically since the 1960s, from about 20x to close to 300x today.2 Initially, little executive compensation was tied to stock performance. However, that changed in recent decades, with the majority of total CEO pay moving to equity. Chris Berrier, one of Brown Advisory’s Small Cap Growth Strategy portfolio managers, wonders if this trend and the well documented ever-growing concentration of equity markets are inextricably linked.

Source: ChatGPT 5

Our research team spends considerable time thinking about the nuances of executive compensation, and whether these ample awards align with shareholders. John Bond, Technology sector analyst states, “I do think the CEO is most able to influence value creation at a company, thus I really don’t mind paying for performance. However, I want to see much of their compensation in any year to be at-risk, determined by shorter-term fundamental performance and longer-term relative stock outperformance.”

Mick Dillion, one of Brown Advisory’s Global Equity portfolio managers adds, “We are really happy to pay for performance and value creation, but most restricted stock unit (RSU) programs with only time vesting don’t accomplish that goal.”

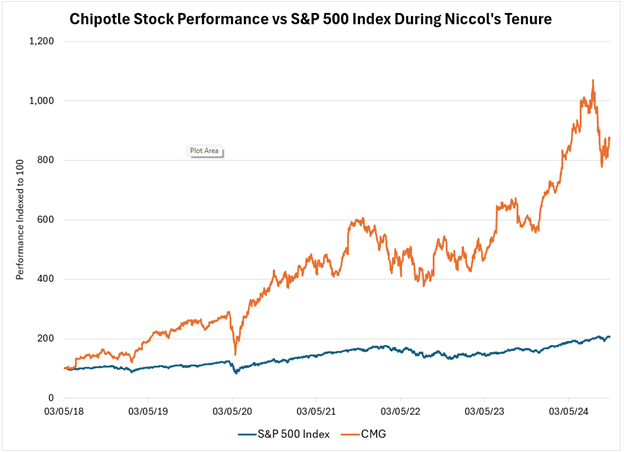

Furthering Mick’s point let’s look at another high-profile corporate executive. Brian Niccol became CEO of Starbucks (SBUX) effective September 2024. In his prior role as CEO of Chipotle (2018-2024), Niccol inherited a business in crisis following a series of foodborne illness outbreaks. During his tenure, the company’s reputation and fundamental performance was restored, while Chipotle’s market cap climbed from below $10 billion to nearly $80 billion. Over the same time frame, the S&P 500® Index doubled.

Source: Economic Policy Institute as of 2024.

Source: Economic Policy Institute as of 2024.

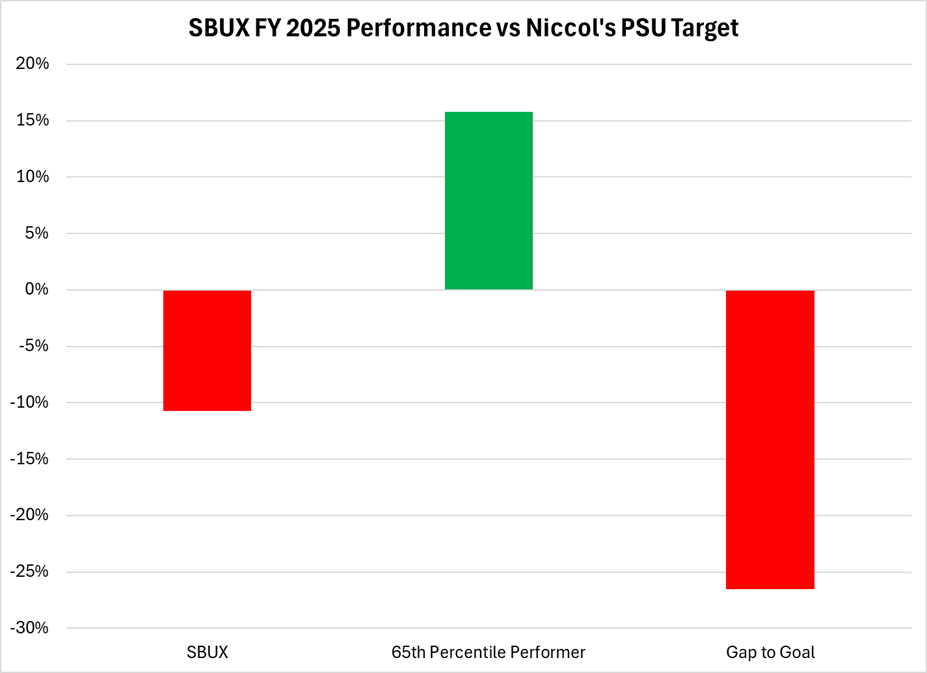

Clearly, Niccol came to Starbucks with a phenomenal pedigree like our pitching protagonist, Mr. Yamamoto. And like the 2025 World Series MVP, there was considerable initial criticism about his pay package. The headlines last year focused on Niccol’s $95.8 million compensation and the eye-popping 6,666:1 CEO pay ratio at Starbucks that year. However, the headlines may have missed the nuances. Nearly the entirety of his fiscal year 2024 compensation ($90 million of the $96 million) relates to “replacement awards” that account for unvested equity and incentives Niccol forfeited when leaving Chipotle. In addition, 60% of the replacement award value is in the form of Performance Stock Units (PSUs) that require SBUX to outperform roughly two-thirds of S&P 500 Index companies over a three-year period. The minority of the replacement awards are in the form of time-vested Restricted Stock Units (RSUs) that are not tied to specific performance targets. During the company’s fiscal year 2025 ending in September, SBUX finished in the bottom third of all S&P 500 Index constituents. In other words, SBUX needs to substantially outperform its large cap peers over the next two years for Niccol to be “made whole” for leaving Chipotle. That seems like good motivation for the Starbucks CEO and an alignment with shareholder interests to me.

Source: FactSet. Performance is from 3/5/2018 through 8/30/2025.

Source: FactSet. Performance is from 3/5/2018 through 8/30/2025.

Earlier this year, the Federal Housing Finance Agency (FHFA) announced that mortgage lenders could now use VantageScore 4.0 (owned by the credit bureaus) as an alternative to FICO scores for conforming loans (those sold to Fannie Mae and Freddie Mac) to promote competition in this market. FICO management has expressed confidence in the superiority of the predictiveness and reliability of its credit score versus VantageScore, driven by its 90+% share in markets where the two have historically competed. Still, investors questioned whether FICO could both take price and maintain share in conforming mortgage loans, a combination that has supported the tripling of earnings per share (EPS) since 2020.

Source: FactSet as of 09/30/2025

Source: FactSet as of 09/30/2025

Berrier believes the discrepancy between executive compensation and that of the average worker has in many cases gone too far. “You can become disconnected from the company’s actual work as well as the employee base when the pay gap gets too wide, and you are no longer relatable as CEO. When this happens, it suggests a breakdown in Board oversight.” He continues, in agreement with Bond’s earlier point, “Executive compensation should be a reasonable combination of cash and stock based on key underlying performance metrics which balance both the short and long-term.”

Much like the height discrepancy between flamethrowers Yoshinobu Yamamoto and Randy Johnson, every company is different. There is no one-size-fits-all approach to executive compensation. According to Bond, “The Board of Directors knows best what matters for its company to achieve performance. Yet, it’s our responsibility as investors to engage with each of our holdings to ensure we understand the company’s nuanced philosophy on executive compensation and to reinforce our views as well.”

Thanks for reading, and remember to never skip a Beat – Eric

1Source: CBS Sports as of 11/14/2025. https://www.cbssports.com/mlb/news/biggest-pitcher-contracts-in-mlb-history-yoshinobu-yamamoto-beats-gerrit-cole-with-325m-dodgers-deal/

2Source: Economic Policy Institute as of 09/25/2025 CEO pay increased in 2024 and is now 281 times that of the typical worker: New EPI landing page has all the details | Economic Policy Institute

Source: FactSet is a registered trademark of FactSet Research Systems, Inc.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. An investor cannot invest directly into an index.

The S&P 500® Index is a capitalization weighted index of 500 stocks that is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns assume reinvestment of dividends and do not reflect any fees or expenses. An investor cannot invest directly into an index. Benchmark returns are not covered by the report of the independent verifiers. Standard & Poor’s, S&P®, and S&P500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc.