I was barely in grade school when I first attended the Ringling Bros. and Barnum & Bailey Circus at Madison Square Garden in New York City, but it left quite an impression. I can remember, popcorn in hand, the sensory overload of watching multiple simultaneous performances, by humans and animals, on the ground and in the air, all of whom amazed. The ringmaster, dressed in customary red tailcoat, top hat and tall, polished boots, introduced the acts with an authoritative voice and a commanding yet calm presence, maintaining order amongst the chaos. “Ladies and Gentlemen, children of all ages, welcome to the Greatest Show on Earth!” At that time, there was nothing else like it.

Today, the title of ‘Greatest Show on Earth’ has been passed down to an annual January gathering in Las Vegas, where nearly 150,000 people flock to the multiple venues of CES, previously known as the Consumer Electronics Show. CES isn’t simply a trade show; it is the global stage where the future of technology is revealed by thousands of exhibitors. Sony’s portable cassette player was first introduced at CES in 1981. HDTVs, flat screens, tablets, wearables, smart homes and smartphones followed in the ensuing years. 2026 proved to be the year of physical Artificial Intelligence (AI), with a wide variety of robotics and smart machines on display. Robot vacuums capable of navigating multi-floor levels, cyber-pets with expressive behavior and AI interaction, humanoid robots demonstrating advanced autonomy, and of course, autonomous vehicles (“AVs”).

Source: Associated Press

The ringmaster of CES 2026 was undoubtedly Jensen Huang, CEO of NVIDIA (NVDA), who delivered the keynote address. Dressed in his own signature shiny, black leather jacket, Jensen reiterated his confidence in the current AI revolution, while introducing new products and concepts that underscored why semiconductor chip leaders like NVIDIA and Taiwan Semiconductor Manufacturing Co. (TSM) continue to experience upward revenue revisions and why hyperscalers are still accelerating their AI-related capital investments. His speech focused on advancements in two broad areas: physical AI, and NVIDIA’s shift from Blackwell GPUs to its next generation, known as Vera Rubin.

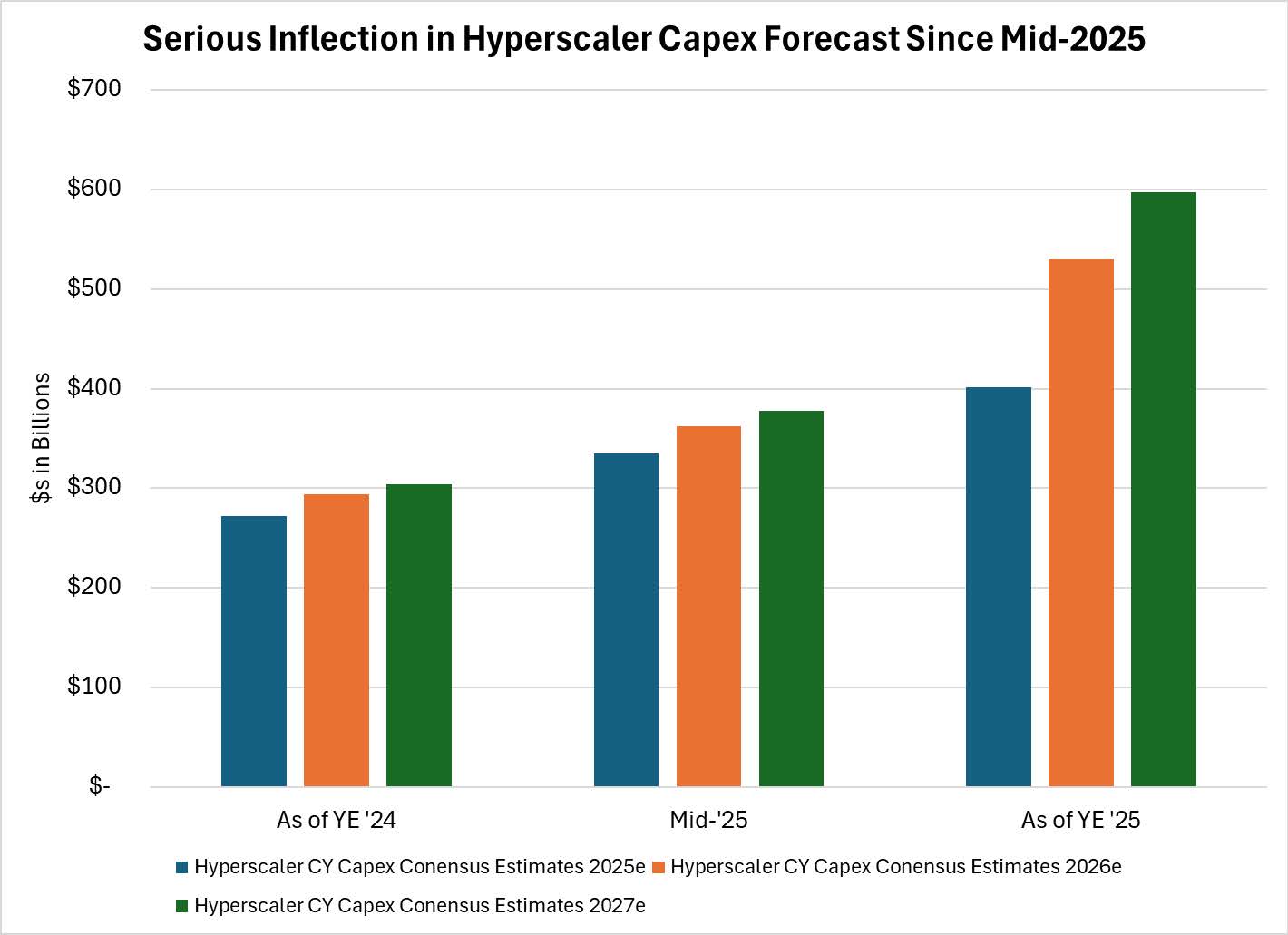

Note: Data as of January 16, 2026.

Source: FactSet

Physical AI

At CES, Jensen announced Alpamayo, the world’s first thinking, reasoning AV model that has been trained by a combination of human-generated and simulated data. It is designed to think through situations, not just react to them. Thus, it can interpret a scene and reason step-by-step what should happen next. It’s built specifically to address high-risk scenarios such as a pedestrian behaving unpredictably or conflicting/ambiguous cues, such as encountering a green light at a blocked intersection.

Today, most self-driving systems pattern-match; they’ve seen millions of examples and react based on what’s worked in similar situations before. In effect, they represent a driver who has learned only by repetition and instinct. Through its Vision-Language-Action (VLA) approach, Alpamayo is able to handle rare, potentially messy situations more effectively. In addition, its ability to express why a decision was made could speed up public trust of AVs.

Mercedes-Benz is the first auto manufacturer utilizing this technology, which is expected to debut in its CLA-Class in the U.S. early this year. The first rollout is Level 2+ driver assistance, although the goal is for this autonomous architecture to evolve toward Level 4 autonomy (within defined area, no human assistance/input required). Importantly, Mercedes does not own the technology – it licenses NVIDIA’s software stack. Thus, other auto manufacturers could access this technology, potentially changing the AV deployment trajectory and competitive landscape. During the Q&A session with financial analysts, Jensen stated, “Tesla and Waymo are excellent at doing it for themselves, and we do it basically for everybody else.”

To be clear, all of these car companies, including Tesla, use NVIDIA’s data center systems to train their models. During his keynote, Jensen added, “This is going to be the first large-scale mainstream physical AI market. I’m fairly certain a very, very large percentage of the world’s cars will be autonomous. This inflection is probably happening in the next ten years. But this technique applies to every form of robotic systems.” In other words, this is just the beginning.

Source: Mercedes-Benz

Vera Rubin

While technology investors are anxiously awaiting whether large language models trained on NVIDIA’s Blackwell architecture will produce step-change improvement in performance (we should know this spring), Jensen is already on to bigger things. The company’s Vera Rubin system is designed to handle significantly larger and more complex tasks. And according to Jensen, it is already in full production.

Vera Rubin is a complete system of GPUs, CPUs, high-speed networking and memory systems, all designed to work together to support reasoning-focused AI. It delivers about five times the AI inference performance (faster) of Blackwell, while inference can be up to ten times cheaper per token on the new system.

According to Jensen, it took NVIDIA five years to develop this system, while the company’s AV announcements with Mercedes required eight years of effort. He sounds a lot like Elon Musk when suggesting, “I like these things that take a long time, but when you finally get there, it’s very likely you will be quite alone.”

Patience is a Virtue

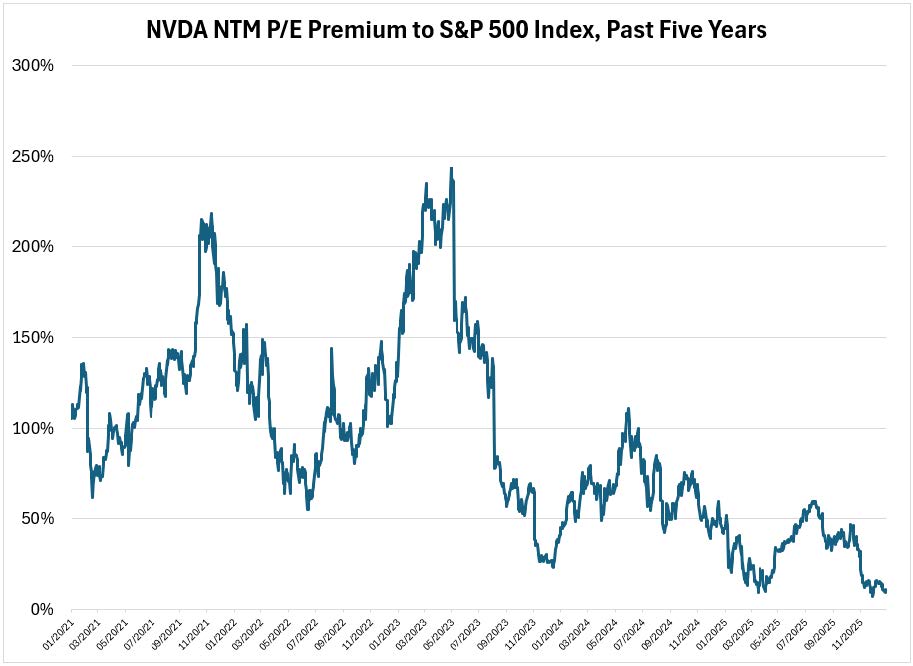

For most equity investors, five years or eight years might feel like an eternity. It is no exaggeration to state that on a daily basis, tweets, rumors and very short-term data releases dominate individual stock and even broad equity market movement. In recent months, NVDA’s premium valuation to the market has evaporated – today the stock trades at only a 10% premium to the S&P 500® Index on forward P/E – perhaps driven by Alphabet (GOOG)’s recent success with both its chips and AI model (Gemini 3). In contrast, GOOG now trades at a 30% premium to the S&P 500 Index (and a premium to NVDA) for the first time in many years.

Note: Data as of January 16, 2026.

Source: FactSet

NVIDIA is worth $4.5 trillion today and incredibly similar in value to the economies of Japan, Germany and India. Trees don’t grow to the sky; shouldn’t the same physical laws apply to company market capitalizations? Yet, if the world of tomorrow looks like the venues of CES 2026, it will require both the brawn of NVIDIA’s GPUs and the brains of its platforms and software. Said differently, with a longer-term aperture, I find it hard to bet against Jensen Huang. At CES 2026, or anywhere else for that matter, he is currently the ringmaster.

Source: ChatGPT 5.2

Thanks for reading, and remember to never skip a Beat – Eric

Source: FactSet®. FactSet is a registered trademark of FactSet Research Systems, Inc.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

An investor cannot invest directly into an index.

The S&P 500® Index is a capitalization weighted index of 500 stocks that is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns assume reinvestment of dividends and do not reflect any fees or expenses. Benchmark returns are not covered by the report of the independent verifiers. Standard & Poor’s, S&P®, and S&P500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc.

Forward P/E Ratio is determined by dividing the price of the stock by the company's forecasted earnings per share.

CapEx, or capital expenditures, are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment.