With the World Series barely in our rearview mirror and my brain reaching the familiar point of fatigue towards the end of a very busy corporate earnings season, I’ve amused myself by reminiscing about the 1989 movie classic Major League. Former catcher and broadcaster (in real life) Bob Uecker plays the Cleveland Indians’ (now Guardians) broadcaster in the movie, a total underdog of a team whose management wants to lose so they can relocate the team to a warmer climate. Bob’s character, Harry Doyle is hilarious and wears his emotions on his sleeve (the formality of his attire is in direct correlation to the success of the team as shown below).

Doyle’s most famous quote from the movie is when Charlie Sheen’s character (a.k.a. ‘Wild Thing’) throws his first career pitch a good five feet wide of the plate and the cheerful broadcaster sarcastically exclaims, “JUST a bit outside”. If you want a good laugh, Google it.

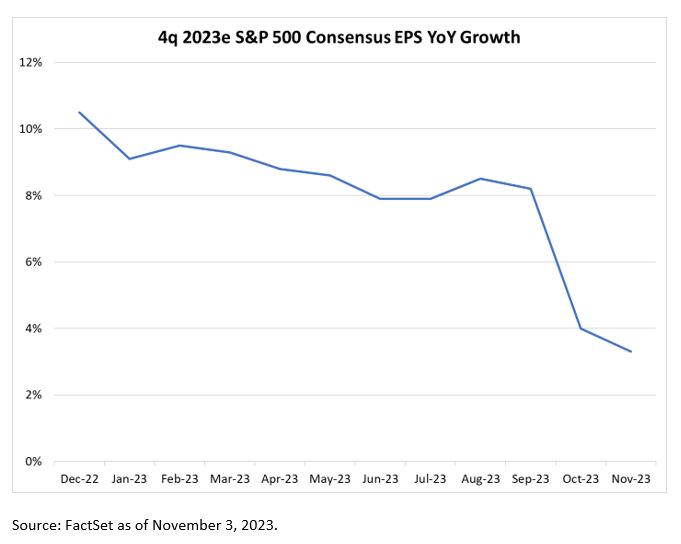

What does any of this have to do with the topic of investing? Well, if I were broadcasting the third quarter earnings season, I’d probably need to borrow Doyle’s line a few times. In terms of outlooks for the December quarter, it’s been a rough go. It’s becoming painfully clear that the early-year expectation of meaningful EPS growth by the fourth quarter is not likely to occur. Not quite through 3q earnings season in full, we’ve seen the S&P 500® Index 4q year-over-year EPS growth expectations drop to only 3%, versus double-digits at the beginning of the year.

Despite comments from several companies that have their fingers on the pulse of the consumer (large banks, Visa, Mastercard) who have stated the U.S. consumer remains resilient and even healthy, we are starting to see some cracks in that narrative. META commented that it’s observed softer ad spend in the beginning of 4q, correlating to the start of the conflict in the Middle East. UPS offered that while spending has been resilient in 2023, headwinds are mounting for the consumer in 4q. Harley-Davidson shared that it is seeing a more stressed customer base. Align Technologies (Invisalign) stated that demand (particularly among adult customers) didn’t recover in September and didn’t improve in October. Spirit Airlines said it hasn’t seen the anticipated return to normal demand and pricing for the peak holiday periods. Life science tools companies are broadly taking down forecasts on more conservative spending by pharma companies.1

To be balanced, there have been some patches of optimism among the fields of negative earnings revisions. Microsoft saw an acceleration of Azure revenue growth and strength across its platform, with guidance for the December quarter ahead of consensus. Amazon guided to strong operating profit in the December quarter, on the heels of signing several new cloud related deals in September. ServiceNow delivered a solid quarter and outlook through its innovative approach to enterprise workflow automation. Lastly, DexCom showed why the death of continuous glucose monitoring (CGM) at the hands of GLP-1 use has been greatly exaggerated (at least for now), with a strong 3q beat and 4q raise (see our October Equity Beat for further context on this last point).

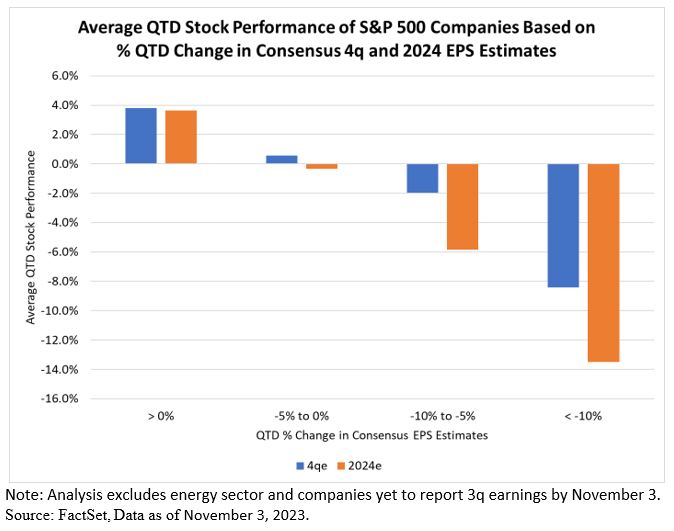

However, According to FactSet as of November 3, 2023, fewer than one in three S&P 500 Index companies have seen an increase in 4q EPS estimates since the beginning of the quarter (among those who have reported). In addition, fewer than 40% of reporting companies have seen their 2024 consensus EPS estimates climb quarter-to-date. While S&P 500 2024 consensus estimates continue to call for a sharp acceleration of growth next year (11.5%) it seems like a very high bar to achieve given the current macro environment.

Not unexpectedly, stocks of companies that have seen their EPS estimates rise for either 4q or 2024 have on average been rewarded with positive stock moves thus far this quarter, while those with declining estimates are largely in the red.

Given the large number of disappointing corporate outlooks we’ve experienced so far this earnings season, the crystal ball predicting 2024 S&P 500 Index earnings growth is getting cloudier by the moment. Instead of over-analyzing the near-term, our analysts are attempting to evaluate the medium to long-term competitive landscape of companies in our portfolios and coverage lists, determine whether we can make a good return over the next few years (not months), and have that process dictate our investment decisions.

It's easy to feel like Major League announcer Harry Doyle in mid-season form as companies broadly disappoint while providing their quarterly outlooks. It’s our job to continue to evaluate companies through a longer-term investment lens and make investment decisions that will reward our clients over the long run.

Thanks for reading, and remember to never skip a Beat - Eric

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Terms and Definitions:

The S&P 500® Index, an unmanaged index, consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock's weight in the Index proportionate to its market value.

Standard & Poor’s, S&P®, and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc.

All financial statistics and ratios are calculated using information from FactSet as of the report date unless otherwise noted. FactSet® is a registered trademark of FactSet Research Systems, Inc.

Earnings per share (EPS) is a measure of a company's profitability, calculated by dividing quarterly or annual income (minus dividends) by the number of outstanding stock shares. The higher a company's EPS, the greater the profit and value perceived by investors.