The Global Leaders strategy is focused on delivering long-term performance by building a concentrated portfolio of market-leading companies from across the globe. We believe that companies that combine exceptional outcomes for their customers with strong leadership can generate high and sustainable returns on invested capital (ROIC) which can lead to outstanding shareholder returns.

We have witnessed a host of macroeconomic, political and other events over the last five years since the launch of the Global Leaders strategy, not least of all the global COVID-19 pandemic. We are saddened by the considerable impact and disruption this is having on society globally.

Mick Dillon and Bertie Thomson, portfolio managers of the strategy, are keenly aware of the events that have disrupted markets over the last five years, yet equally aware of the risk to the portfolio if they let those events distract them from their research and investment decisions. Therefore, they try to keep it simple by focusing on businesses that deliver superior outcomes to customers. In their view, the best businesses serve their customers in some unique way, and over time should compound their advantages to deliver attractive investment returns for shareholders.

At a time like this, they believe it is even more important to focus on the two key elements of their process which they feel provide their greatest source of investment edge—their long-term vision and understanding of human behaviour. You can read more about their current thinking in their latest investment letter Blinded by the Flashes of Light.

In this short reflective interview, we will draw upon a few of the areas that have helped shape Mick and Bertie’s Global Leaders journey so far. The strategy passed its five-year milestone on 1st May delivering 4.7% annualized outperformance (net of fees) since inception, but consistent with our investment team’s culture of continuous improvement, Mick and Bertie are eager and hungry for opportunities to learn and develop in the years ahead.

Q&A

At the heart of your investment selection process is an appreciation for the customer. Why is the customer such a big focus of yours?

Dillon: For us, at the most basic level, if you don’t have a customer you don’t have a business! It’s easy to lose sight of the essence of commerce: a transaction is a simple act, involving a buyer and a seller, of swapping one good or service for another. But it is those businesses that are able to go further by delivering something special to their customers that are of particular interest to us. The companies we seek are able to entice customers to return time after time, and this customer loyalty helps those companies maintain higher profits than their peers.

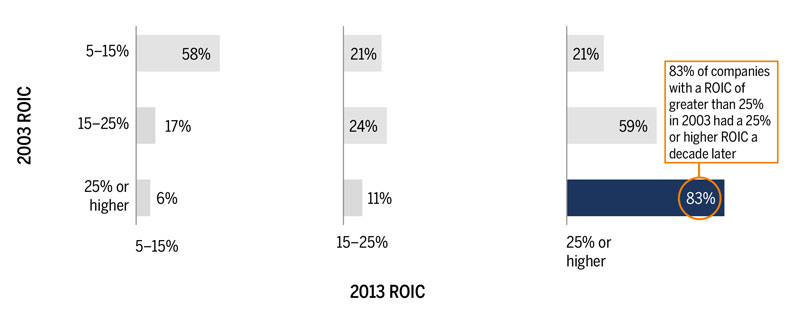

Thomson: We spend a considerable amount of time examining the different strategies that each franchise employs, in an effort to deduce whether the company has a competitive advantage that will enable it to keep satisfying its customers in a way that others can’t. Breadth of research is an important aspect of this analysis, and where possible, we spend as much time as we can with competitors, customers and suppliers assessing how wide each company’s economic moat is. We aren’t looking for companies that simply provide good outcomes resulting in a relative competitive strength. We are looking for those companies that provide goods or services that satisfy the customer in a unique way, in turn giving the company a dominant and sustainable position among its peers. We call this the ‘win-win’ and believe evidence of this shows up in a company’s return on invested capital (ROIC), which for us is a clear indicator of long-term success. According to a decade-long study by McKinsey & Company, companies that produce a ROIC in excess of 25% in 2003 still produced a ROIC in excess of 25% a decade later.

Empirical Research: High ROIC Tends To Show Persistency (So Time Can Be On Our Side)

S&P 500® Index, ROIC, 2003-2013 Data based on a McKinsey & Company study, “Valuation: Measuring and Managing the Value of Companies”

Chart reproduced with permission from McKinsey & Company as featured in the book, “Valuation: Measuring and Managing the Value of Companies, University Edition.” 6th Edition, 2015. ROIC is calculated as percentage without goodwill. The selected sample is the S&P 500® Index.

“We are looking for companies that provide goods or services that satisfy their customers in a unique way that gives the company a dominant and sustainable position among its peers. We call this the win-win.”

Further reading on this subject: Q1 2016 Investment Letter.

You often talk about portfolio managers being responsible for not just stock selection, but also capital allocation. Can you describe why this dual process is so important to you?

Thomson: It continues to amaze us how little energy is dedicated to the subject of capital allocation in the investment management world. The overarching focus of the industry appears to us to be on the treasure hunt of picking winners (and avoiding losers), but we believe the question of how much to invest is mistakenly neglected. We are equally focused on stock selection and capital allocation, and as such we like to distinguish between the two processes. We believe it is ultimately the responsibility of the portfolio managers to turn great stock selection into even better returns. We will keep evolving both our processes with the ambition to deliver great stock picking (having more winners than losers) and great capital allocation (having more capital in our winners than our losers). In baseball terms this is defined as batting average (how often batters connect) and slugging percentage (their effectiveness when they connect). With the investment world seemingly more focused on batting averages, we’ll share with you this evergreen quote from Michael Mauboussin:

“Great investors recognize another uncomfortable reality about probability: the frequency of correctness doesn’t really matter (batting average), what matters is how much money you make when you are right versus how much money you lose when you are wrong (slugging percentage). This concept is very difficult to put into operation because of loss aversion, the idea that we suffer losses roughly twice as much as we enjoy comparably sized gains. In other words, we like to be right a lot more than to be wrong. But if the goal is grow the value of a portfolio, slugging percentage is what matters”.

Michael J. Mauboussin, ‘Thirty Years: Reflections on the Ten Attributes of Great Investors’

Further reading on this subject: Q1 2018 Investment Letter.

Your focus on continuous learning and self-improvement is admirable, can you describe the ways you foster a continuous learning environment?

Dillon: It would be arrogant to think that we could not continually learn and improve and I believe that successful investing shares a lot of similarities with elite sport. Process, practice, discipline, persistence, longterm focus, decisions under uncertainty with incomplete information, probability-based thinking, control of inputs not outputs, and skill mixed with luck are all traits common to both sport and investing. Using a coach is also an important part of self-improvement in both disciplines. I very much live to learn, and I read a lot across business and investment topics, as well as physics, pro-cycling and personal/team improvement.

Thomson: Mick and I are lucky enough to have been able to marry our interests together in our process to help us continually seek improvements. The part that fascinates me is trying to understand why we behave in certain ways in different scenarios—a deep dive into our human behavior can help us learn from our mistakes.

One of the best ways we think we do this is by using a third-party “coach”—an objective evaluator from outside the firm that helps us analyze our investment decisions—to see where we added value and where we lost ground. Every part of using a coach is about seeking to move the probabilities into our favour, to help create better returns for our clients. We believe our coach helps us become better capital allocators by ironing out the damaging impact of human behaviour which can destroy capital values if left unchecked. Over time, we have extended this process to develop a number of behavioral rules, probably the best example being our loss aversion rule which aims to minimise the impact of arguably the most damaging behavioural trait in our industry. Due to our inherent survival instinct, human beings feel pain twice as much as pleasure meaning that most investors find it difficult to face up to the pain of losing. As a result, we enforce a rule on ourselves when a position drops in value beyond a certain percentage: we either invest additional capital, as a confirmation of our confidence in our investment thesis, or exit the investment.

Dillon: Lastly I’d just add that Brown Advisory has always strived to create a collaborative environment for all colleagues where the views of each individual can be heard, and this is especially true of the way our investment team interacts. As we embark on the next five years of our strategy, we are thankful to be working alongside phenomenal colleagues in such a collaborative and supportive environment that keeps our clients’ goals at the heart of what we do.

Further reading on this subject: Q1 2017 Investment Letter and Q1 2018 Investment Letter.

How do you think about sustainability within the portfolio?

Thomson: To us, corporate sustainability is primarily good business sense that goes hand-in-hand with value creation. As such, ESG research is an essential part of our Global Leaders investment strategy. It helps us to make intelligent choices about investments and to engage with company management teams on a wide variety of important topics that may affect their long-term prospects.

Dillon: As we discussed, our investment process centres on finding “win-win” relationships between the customer and the company, whereby the customer gets something special from the company and the company is rewarded with outstanding economics. Embedding ESG considerations into our investment analysis not only helps to shield our clients from business risks, but also helps us invest in companies where we see the potential for a triple win—for the customer, the company and society or the environment.

“Sustainable investing is more than a fad—it is a welcome recalibration of perspective, from a short-term fixation on profits to a long-term view of value creation.”

Microsoft is an oft-cited example, but we also like the way Indonesia’s Bank Rakyat—likely a less familiar name to many than Microsoft—has found innovative ways to tap into non-traditional growth drivers. Founded in 1896, PT Bank Rakyat Indonesia (BRI) has been partially governmentowned since Indonesia’s independence in 1950 and has played a critical role in promoting the government’s social agenda by advancing subsidized credit for rural enterprises. At the end of 2018, BRI had approximately $20 billion in loans outstanding to more than 10 million microborrowers in Indonesia. A decade ago, only one in five Indonesians had a bank account, and today, more than half of the country is “banked.” BRI also serves Indonesians who have no bank account, through its network of BRILink agents throughout the country. The number of BRILink agents grew by 230% between 2016 and 2019.

BRI is a crucial lender to the informal economy in these rural regions and leads the Indonesian microfinance market. Through this important role, the company has been rewarded with approximately a 18% return on equity over the past five calendar years (2015-2019). Its rural credit infrastructure, combined with a community-based approach to lending, has created a difficult-to-replicate formula with low levels (2%) of nonperforming loans that in our view has led to a wide competitive moat.1 We believe that these are clear wins for society, the customer and the business and we believe that Bank Rakyat is well positioned to produce long-term growth for our clients.

1All company data sourced from PT Bank Rakyat Indonesia

Further reading on this subject: Global Leaders Sustainable Perspectives and Q3 2017 Investment Letter.

What has been the biggest challenge or most painful loss over the last five years?

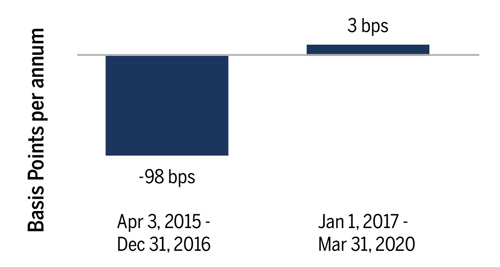

In 2016 we initiated a position in Novozymes, a high-quality franchise that dominates its industry by providing high-quality biodegradable solutions to customers in a diverse set of end markets ranging from bioethanol to household care. We used market weakness stemming from concerns about near-term growth when starting an investment in Novozymes. However, the company continued to underperform and in the fourth quarter of 2016 it cut guidance for the third time in just over a year as buyers became more price conscious. A supply-side change with increasing market aggression from DuPont, the U.S. chemicals firm, impacted Novozymes’s growth and research and development (R&D) monetization ability. On the basis of a broken thesis, we exited the position before the end of 2016, but with hindsight, we should have sold our investment as soon as we realised the thesis was broken. This investment played on our minds as a clear manifestation of the consequence of loss aversion. We have spent time analysing our selling behaviour over the years and have implemented a rule which gives us a week to exit a position following our decision to sell due to a broken thesis. Managers often lose alpha when selling and so did we until we implemented this rule in January 2017. In the almost two years prior to this we calculate that we lost nearly 1% a year to poor selling. In the three plus years after the implementation of this rule, our selling strategy has actually produced a positive return (see chart below).

Selling Strategy: Exit Decisively

As of 03/31/2020 Cumulative Loss From First Sale to Exit (basis points per annum) Global Leaders Representative Account

Source: Brown Advisory calculations. Past performance is not indicative of future results. The loss is calculated based on the price return of each stock from initial sell to exit date. The portfolio information provided is based on a representative Brown Advisory Global Leaders account and is provided as supplemental information. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold aparticular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned.

How are you different from other quality global fund managers?

Dillon: There are some fantastic investors out there, including a number of high-profile global equity managers that we respect. Our style is a little different and in fact we believe it can often complement other managers. We believe our philosophy and process set us apart in ways we have highlighted in this interview. In terms of our portfolio positioning, we often see differences in our sector weightings compared to our peers, which for us is an outcome of our bottom-up stock selection process. In a concentrated portfolio of around 30 positions, we focus on conviction in our very best ideas to enable us to achieve alpha for our clients, and we are not afraid of looking different from the benchmark.

Thomson: Some managers have found success in owning consumer staples and defensive health care, but we find more attractive business models that fit our investment criteria in sectors such as technology, financials and industrials, which is where the bulk of our outperformance vs. our benchmark has come from over the last five years. We also expand our global reach to include emerging markets, not just developed markets, globally. Having said all this, we’re certainly not trying to be all things to all people, and the global equity market is vast, plenty big enough for varying—and often complementary—styles.

Dillon: One thing I would add is that we think it’s very important to eat our own cooking and we are heavily invested in this strategy alongside our clients. Ultimately, the fact that Brown Advisory is private and independent also helps to ensure that our goals are aligned with those of our clients.

Finally, as avid readers, can you give us some recommendations?

Almost impossible to narrow down but for our five-year anniversary we give you our top six!

- Valuation: Measuring and Managing the Value of Companies by McKinsey & Company (7th edition coming out soon)

- The Influential Mind: What the Brain Reveals About Our Power to Change Others by Tali Sharot

- Margin of Safety: Risk Averse Value Investing Strategies for the Thoughtful Investor by Seth A. Klarman

- Influence: The Psychology of Persuasion by Robert B. Cialdini

- The Most Important Thing: Uncommon Sense for the Thoughtful Investor by Howard Marks

- The Art of Execution: How the World’s Best Investors Get it Wrong and Still Make Millions by Lee Freeman-Shor

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.