INNOVATION IN AI AND GLP-1 MARKETS

HIGHLIGHTS

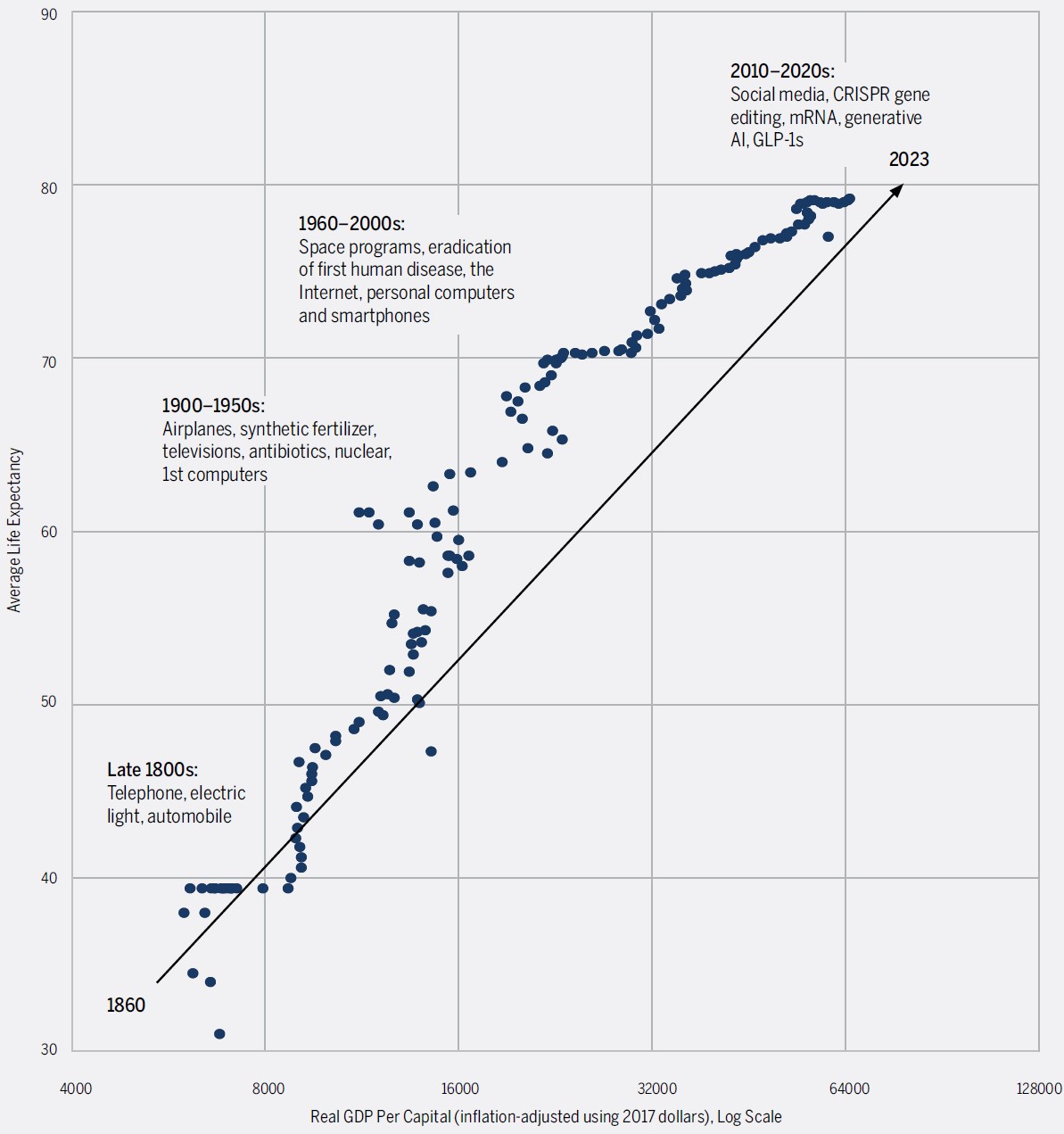

Technology innovation has provided a near-constant boost to economic productivity, especially over the past 100-150 years. Since 1860, lifespans have roughly doubled in the U.S., while economic productivity (GDP per capita) has grown elevenfold during that period (even after adjusting for inflation!).

We are in the early stages of two potential “gamechanger” innovations right now—generative AI, and GLP-1 drug treatments for obesity. We have sought to establish investment exposure in both markets, in such a way that we can participate in upside without taking on the binary risk of more speculative opportunities.

Nothing captures the attention of investors like the promise of a new technology. Companies at the forefront of technology can rapidly take over markets and/or invent entirely new industries, while laggards and those directly threatened by disruption can find themselves wiped out more quickly than they ever could have imagined.

Over the past year, equity markets were heavily influenced by technology innovation—specifically, the emergence of generative AI technology and the rise of glucagon-like peptide drugs (GLP-1s)—and we are just starting to see the impacts play out across various sectors of the market.

Generative AI

The launch of ChatGPT in late 2022 opened a floodgate of investor interest in generative AI. From an investment perspective, NVIDIA has thus far been deemed the winner of the early rounds of AI innovation; its shares appreciated by 239% in 2023, on the heels of heavy demand for its GPUs by customers seeking to train AI applications. But the big challenge for investors is to figure out where value will accrue within the AI tech stack going forward: Hardware or software? Learning model or application?

One can think about the opportunity and impact of AI across four broad categories:

- End-user applications: Companies like Adobe, Wolters Kluwer and Intuit offer applications directly to consumers or businesses that could benefit enormously from embedded AI (and in some cases, they already are).

- Foundation models, including large language models (LLMs): This includes the development and deployment of advanced AI models, including large language models such as ChatGPT, as well as proprietary or use-specific datasets such as those owned by London Stock Exchange Group.

- Cloud compute: Major cloud service providers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud play a significant role in AI infrastructure.

- Technical infrastructure: This category covers GPUs, networking, memory and related value chains, including semiconductor equipment. Constituents include companies such as Marvell Technology, Taiwan Semiconductor, ASML and NVIDIA.

These four groups face fairly different opportunities and risks. Currently, we are most enthusiastic about the technical infrastructure and cloud computing opportunities. NVIDIA has been a clear winner so far, and currently its GPUs are best-in-breed solutions for anyone seeking to run AI applications and infrastructure. Taiwan Semiconductor and ASML represent the “picks and shovels” that NVIDIA relies on to manufacture those GPUs. Training and running AI models will require high-powered hardware for the foreseeable future, which should be a boon to cutting-edge semiconductor companies. Within cloud compute, Microsoft, Alphabet and Amazon have demonstrated that scale and resources matter in AI. The three tech behemoths are pouring resources into their respective cloud infrastructures, all to support additional AI workloads. Our investments across both of these hardware-centric categories added meaningfully to performance in 2023.

Moving up the tech stack, we expect competition to be fierce among AI foundation models—the core engines that drive AI-powered applications. Our research team has noted that these models are becoming easier to create and scale and thus face the risk of becoming commoditized going forward. OpenAI’s GPT-4 LLM, which powers ChatGPT, has so far captured the most mindshare among consumers and developers, but developers can build applications on other competing models, such as LLaMa (Meta’s open-source LLM), Gemini (Alphabet’s latest LLM) or Claude2 (developed by Anthropic, a private company and competitor to OpenAI that has recently received investments from Alphabet and Amazon).

Finally, application software companies like Intuit or Adobe may have current advantages, but they will likely need to be proactive about infusing AI into their applications to stay ahead of competitors. Throughout 2023, we saw software-as-a-service (SaaS) companies taking steps to add AI functionality; for example, Intuit incorporated a new AI Assist platform across its personal finance solutions. Of course, companies will need to invest more resources into these products, which may impact margins if customers aren’t willing to pay extra for new features. We expect more companies to announce new AI-enabled products, but given a more constrained economic environment, we also expect investors to put a premium on situations where AI truly leads to better customer outcomes.

In these early innings of AI, we’ve benefited from both public and private AI-related investments:

- Public markets: Our investments in cloud computing and technical infrastructure have already produced strong results, and we believe that companies like NVIDIA, Microsoft and Alphabet have the resources and scale to maintain their competitive positioning. Key questions going forward: How long will we see such elevated demand for these products (especially for NVIDIA’s GPUs)? Further, will margins be squeezed in the future, by price competition or “cap ex competition” among the key industry players?

- Private markets: Private market volumes and valuations are down broadly, but activity tied to AI has been robust. One recent example is Hugging Face, an AI company that recently raised $235 million in a series D financing round, at a post-money valuation of $4.5 billion according to Pitchbook— nearly 100x recurring revenue. Several of our private fund managers hold attractive stakes in promising AI companies, which should be a boon going forward, but we note that it may be more challenging to find good value in the space now, given the recent runup in AI-related valuations.

Everything discussed above about AI technology is mostly focused on the intermediate term—how AI investments might pay off over the next five-to-seven years. Over the long term, the key question investors should consider in the coming years is how AI will change the world—and specifically, whether it will radically change productivity in the way that major technology advancements have in the past (see chart below). Global growth faces several challenges, from an aging populations to heavy sovereign debt to geopolitical disruptions, but AI and its promise of significant productivity gains could offset some of these headwinds.

TECHNOLOGICAL ADVANCES AND THEIR IMPACT ON PRODUCTIVITY AND GENERAL WELFARE (1860–2023)

Throughout history, technological innovations have tended to be powerful drivers of productivity (measured in this chart by the U.S. GDP per capita statistic over time) and general welfare (measured here by average U.S. life expectancy). The dot plot diverges far above the trendline during multiple historical periods marked by the advent of major transportation, communication, healthcare and other achievements. (Note that productivity gains are shown on a logarithmic scale.) Each dot on the chart below denotes a calendar year spanning from 1860-2023.

Source: Gap Minder, as of 12/31/2023.

GLP-1s

In 2023, the “glucagon-like peptide” (“GLP-1”) drug market exploded. For several sleepy decades, these drugs were used to treat diabetes, but newer GLP-1s can now successfully treat obesity and lower the risk of heart disease. Growth so far has happened outside of insurance reimbursement, and if insurers are eventually persuaded to cover these drugs for obesity, it would expand the market greatly (the drugs currently cost patients about $1,000 per month out of pocket).

GLP-1 leaders Novo Nordisk and Eli Lilly were among the best-performing healthcare names of 2023, on expectations about the future earnings impact of their respective drugs. Conversely, the market punished those potentially threatened over the long term by these emerging GLP-1 options, such as Intuitive Surgical and Edwards Lifesciences (GLP-1s may reduce overall demand for heart surgery), Dexcom and Insulet (GLP-1s may prevent many cases of diabetes in the future) and ResMed (maker of CPAP machines for sleep apnea).

These drugs have led many to speculate more broadly about a future where obesity is meaningfully reduced, and how other sectors of the economy and society may be affected. Here are a few of the many potential shifts we are considering:

- Orthopedics: A less obese population would likely exhibit different patterns of injury over time, forcing the health care industry to adapt. Populations may require fewer joint replacements if carrying less weight; on the other hand, people may become much more active, which could drastically increase the incidence of sports injuries and sports-related surgeries.

- Clothing/retail: A GLP-1 saturated world may produce hundreds of thousands of consumers every year who need to purchase an entire new wardrobe of clothing; in the current economic cycle, that could reaccelerate growth for some apparel companies.

- Online dating: If a few million people in the U.S. lose a ton of weight over the next year, it seems fairly likely that many of those people would feel newly confident and better prepared for the dating scene.

- Airlines: Fuel accounts for nearly a quarter of airline operating expenses; given the thin margins at which airlines operate, even a small reduction in passenger weight could translate into a significant boost to profitability.

- Restaurants and snack foods: To what extent will mass adoption of GLP-1s reduce demand for snack foods? To what extent will the “high calorie, high price” model followed by so many casual restaurants need to change in the future?

Market size is a key question in measuring the potential impact of GLP-1s. According to the National Health and Nutrition Examination Survey, as of Dec. 31, 2023, roughly 200 million U.S. adults are overweight, obese, or morbidly obese. What is the “steady state” market for GLP-1s—50 million of those adults? 10 million? All 200 million? The answer will determine how all of the aforementioned industries are impacted, but it will take time for our teams and other investors and analysts to get a better sense of the market’s scale.

Note: All commentary sourced from Brown Advisory as of 12/31/23 unless otherwise noted. Alternative Investments may be available for Qualified Purchasers or Accredited Investors only. Click here for important disclosures, and for a complete list of terms and definitions.