STATE OF THE U.S. CONSUMER

HIGHLIGHTS

The pandemic and its related economic consequences have had a meaningful impact on the trajectory of financial health for U.S. consumers.

During the pandemic, Americans saved more and benefited from low rates while they lasted. But high rates, inflation, and the resumption of student loan payments have largely reversed those trends, leading to broad concerns about the health of consumer balance sheets.

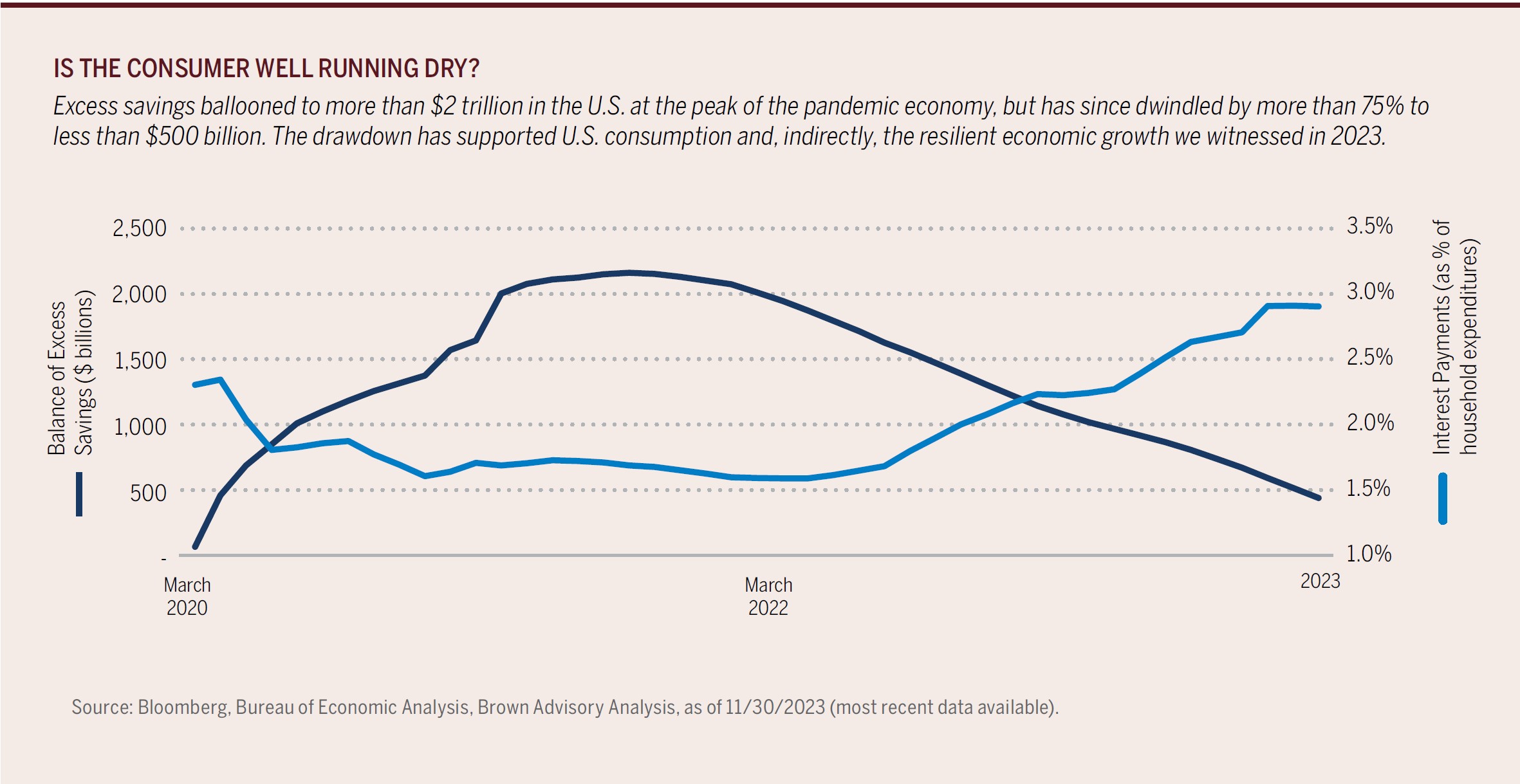

U.S. Consumer spending has been the foundation of post-pandemic economic growth and contributed to the economy’s surprising resilience in 2023. Household spending drives more than 60% of U.S. GDP, and nearly four years after COVID-19 appeared, that spending isn’t letting up. Pandemic stimulus and lockdowns boosted the personal savings rate to 33% in 2020 and raised excess savings to a peak of $2.1 trillion; the purchasing power of households soared following these temporary incentives, partly mitigating the impact of higher interest rates. At the start of 2024, unemployment was historically low, wage growth was outpacing inflation, jobs were being added at twice the 100,000 monthly gains needed to keep the economy growing, and job openings still exceeded unemployed workers by a healthy margin.

Consumer staples stocks missed this wave and performed poorly relative to other S&P 500® Index sectors in 2023. Investors tend to view this dividend-heavy sector as a bond proxy, and as short-term yields rose to 5%, there was a rotation out of these rate-sensitive stocks into higher-yielding and risk-free U.S. Treasuries. On the other hand, consumer discretionary stocks performed quite well; traditionally, this sector performs well early in a cycle of economic improvement (and sector performance benefited greatly from the fact that Amazon and Tesla are both considered consumer companies in the Index).

When one throws in the increase in net worth for many consumers (thanks to rising equity valuations and real estate prices), the overall picture for U.S. consumers has been extremely healthy. However, headwinds are emerging; the typical consumer is now draining their pandemic savings with the resumption of student loan payments, higher mortgage and credit card rates, and higher prices across the board.

Depletion of excess savings: Excess savings in the U.S. fell from $2.1 trillion to $500 billion as the economy normalized from March 2020 through November 2023 (see chart below).

Higher rates: Rising mortgage rates are starting to take their toll on consumer confidence. Approximately 82% of outstanding U.S. mortgage debt is still financed at rates below 5%, but new 30-year loans are charging 7%, greatly dampening activity in consumer real estate as buyers and builders alike are deterred by higher rates.

Auto and credit card debt is also being impacted. Average credit card rates have climbed to 24%, and some measures of delinquency rates are at their highest level since 2012. According to TransUnion, average consumer use of available credit on their cards is in line with pre-pandemic levels but rising. We also note the somewhat shocking rise of “buy now, pay later” (BNPL) transactions—BNPL volumes grew 50% in 2023 vs. 2022. We are monitoring this development, given the very high interest rates at times for BNPL loans (PayPal’s solution charged a 35% interest rate at time of publication) and the ability for consumers to “loan stack” as they take loans from multiple stores.

Resumption of payments: Student loan payments in the U.S. resumed in October 2023 after a three-year break during and after the pandemic. This is a massive consumer debt category, representing about 1% of annual consumer spending; about 17% of consumers have student loan debt. Although a small impact overall, this is a greater headwind for middle-income consumers (and relevant consumer categories).

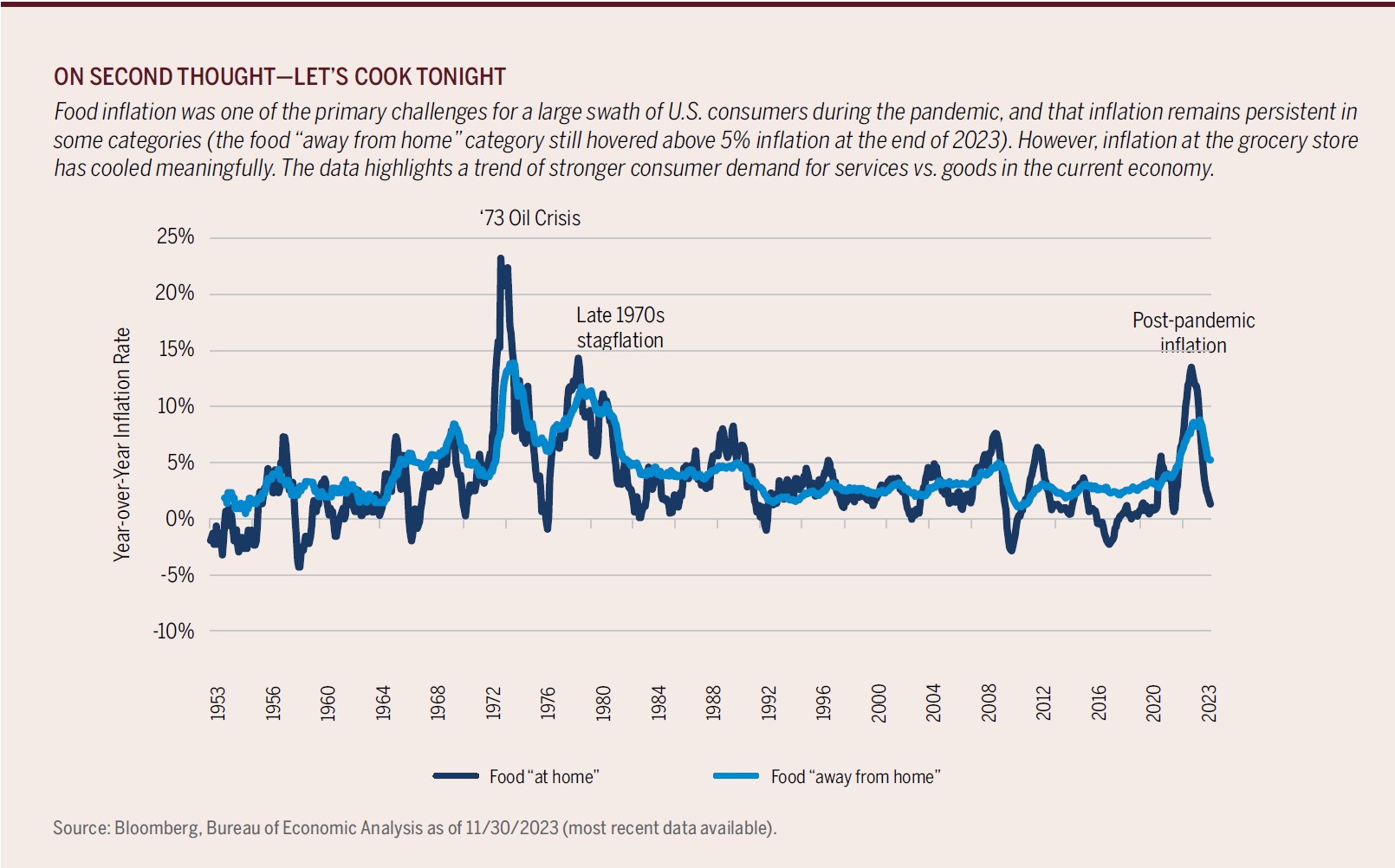

Inflation: Lastly, inflation remains elevated in essential categories such as housing and food “away from home” (see chart above), a fact that may dampen discretionary spending in other categories. A welcome exception has been gasoline prices, which have come down notably from their 2022 peak levels. Food “at home” prices cooled down in 2023, providing some relief to household budgets.

Shifting Spending Patterns

As the economy has transitioned from its “pandemic footing” to become more normalized, consumer behavior has unsurprisingly been in flux. We moved through a period of “revenge spending” on discretionary items by consumers angry about their lives being constrained, and, more recently, we are seeing consumers trade some of this spending on goods, in favor of spending on experiences such as restaurants, travel and leisure (Royal Caribbean and DraftKings each had terrific years in 2023). Meanwhile, consumers are increasingly opting for cheaper, “private label” products in essential categories (staple foods, cleaning supplies, etc.) as they choose price over brand loyalty. Private label products have also improved greatly in recent years, making them more competitive with established brands that can carry prices from 15% to 30% higher.

Bottom Line on the Consumer

Higher interest rates and inflation historically temper consumer spending, but the impact has been less significant during this cycle. Consumers remain confident about their employment, still have some excess savings, and are willing to spend large portions of their income. Mortgages, which make up 70% of consumer debt, are locked in at low interest rates, even as other forms of debt have seen rates adjust more quickly.

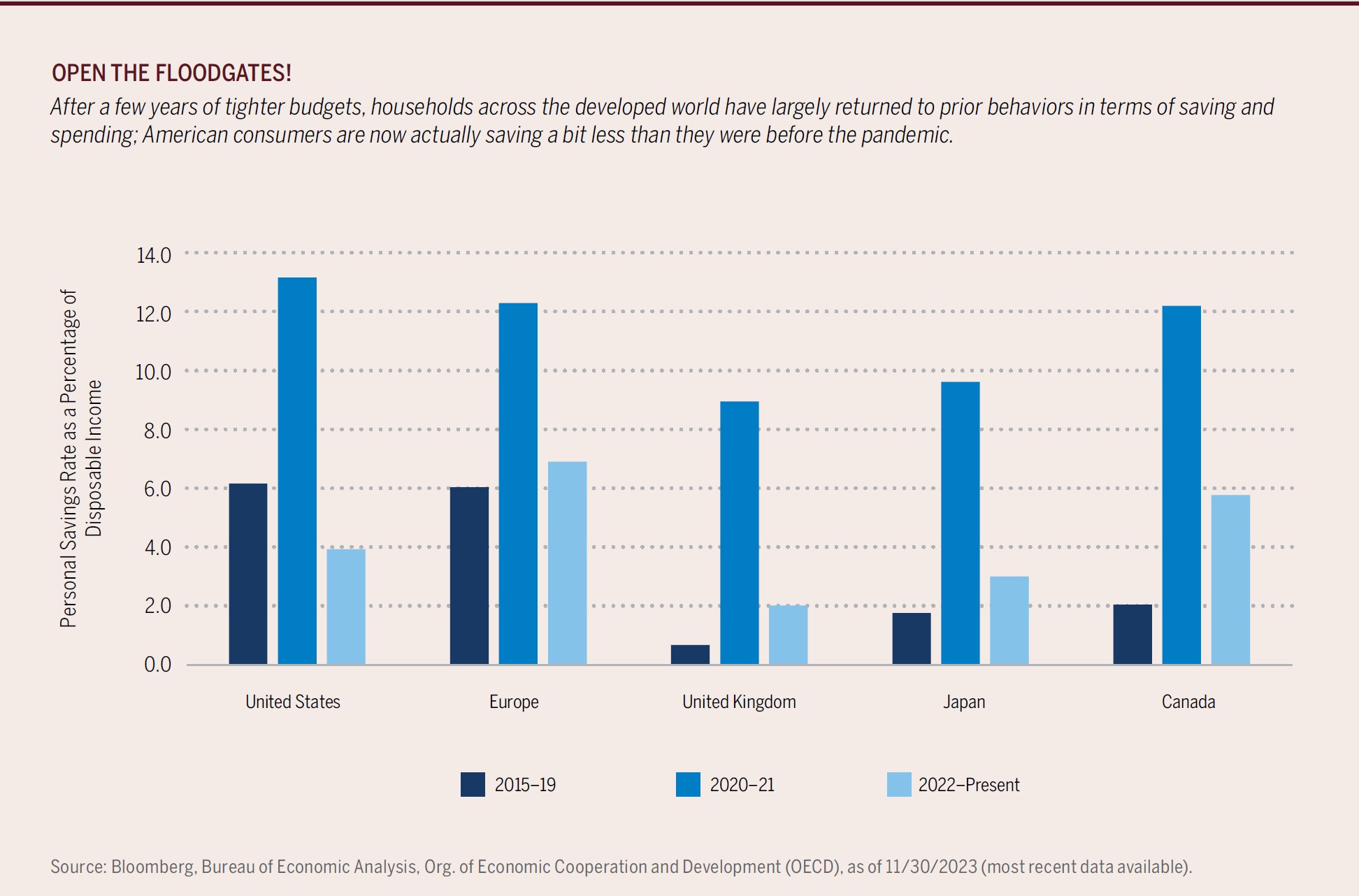

But warning signs are appearing, such as those mentioned above. Interest payments are rising as a percentage of personal income; further, personal savings rates have largely reverted to pre-pandemic levels—slightly lower in the U.S., slightly higher in the U.K. and Canada (see chart below). In 2024, we expect softer consumer spending and disposable income growth, and further expect that lower-income households will feel the greatest pinch from inflation and higher rates.

Note: All commentary sourced from Brown Advisory as of 12/31/23 unless otherwise noted. Alternative Investments may be available for Qualified Purchasers or Accredited Investors only. Click here for important disclosures, and for a complete list of terms and definitions.